Scheduled outage for OSC Electronic Filing Portal on Thursday, April 25, 2024 from 6:00 to 11:00 pm (EST)

Notice of Amendments: NI - 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer

Notice of Amendments: NI - 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer

NOTICE OF AMENDMENTS TO

NATIONAL INSTRUMENT 54-101

COMMUNICATION WITH BENEFICIAL OWNERS OF

SECURITIES OF A REPORTING ISSUER

AND

COMPANION POLICY 54-101CP

Notice of Amendments

Each member of the Canadian Securities Administrators (the CSA) is amending National Instrument 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer (the Instrument) and Companion Policy 54-101CP (the Policy).

The amendments to the Instrument have been or are expected to be made by each member of the CSA, and will be implemented as

• a rule in each of British Columbia, Alberta, Manitoba, Ontario, Prince Edward Island, Nova Scotia and Newfoundland and Labrador;

• a commission regulation in Saskatchewan and Québec;

• a policy or code in New Brunswick, the Northwest Territories, Nunavut and the Yukon.

We also expect that the amendments to the Policy will be adopted in all jurisdictions.

In Ontario, the amendments to the Instrument and the other material required by the Act to be delivered to the Chair of the Management Board of Cabinet (the Minister) were delivered on November 26, 2004. If the Minister does not reject the amendments or return them to the Commission for further consideration, the amendments will come into force on February 9, 2005. The amendments to the Policy will come into force on the date that the amendments to the Instrument come into force.

In Québec, the Instrument is a regulation made under section 331.1 of the Act and must be approved, with or without amendment, by the Minister of Finance. The Instrument will come into force on the date of its publication in the Gazette officielle du Québec or on any later date specified in the regulation. It must also be published in the Bulletin.

Provided all necessary ministerial approvals are obtained, the amendments to the Instrument will come into force on February 9, 2005.

Substance and Purpose of the Amendments

The Instrument and Policy came into effect on July 1, 2002. The primary purpose of the Instrument is to ensure that beneficial owners of securities of a reporting issuer can receive proxy-related materials and provide instructions on how the securities they beneficially own are to be voted. To achieve this purpose, the Instrument sets out detailed procedures by which proxy-related materials are provided to the beneficial owner, and the beneficial owner provides voting instructions. The Instrument also imposes obligations on the reporting issuer, the depository and intermediaries who hold on behalf of the beneficial owner. We have been monitoring the Instrument and Policy since they came into effect. We have also published CSA Staff Notice 54-301 Frequently Asked Questions. The amendments are intended to make the Instrument and Policy clearer and also improve the regulatory regime set out in the Instrument.

Details of the proposed amendments were contained in a notice and request for comments published in October 2003.

Summary of Written Comments Received by the CSA

We published the amendments for comment in October 2003. The comment period expired January 2, 2004. During the comment period we received submissions from six commenters. We have considered the comments received and thank all the commenters. The names of the commenters and a summary of their comments, together with our responses, are contained in Appendices A and B to this notice.

After considering the comments, we have made some changes to the amendments as proposed in the notice published in October 2003. As these changes are not material, we are not republishing the amendments for a further comment period.

Summary of Changes to the Amendments

This section describes changes made to the amendments published for comment in October 2003 other than those changes that are of a minor nature, or those made only for the purposes of clarification or for drafting reasons.

• Client Response Form

We have amended the note to the client response form portion of Form 54-101F1 to make it clearer that in the case of investment funds, where specific instructions concerning receipt of the investment fund's annual report or financial statements have been provided to the investment fund, the instructions in the client response form with respect to financial statements will not apply.

• Companion Policy

Explanations of the interaction of the Instrument and National Instrument 51-102 Continuous Disclosure Obligations have been added.

• Transition

We have added a transition provision so that a reporting issuer that has filed a notice of a meeting and record date before the coming into force of these amendments is, with respect to that meeting, exempt from these amendments if the reporting issuer complies with the provisions of the Instrument as unamended.

Text of Amendments

The text of the amendments follows the Appendices.

Questions

Please refer your questions to any of:

November 26, 2004.

Appendix A

Summary of Comments and CSA Responses

Definition of Special Meeting

Two commenters supported the replacement of the references to "non routine" in the instrument with "special resolution".

One commenter said that the special meeting definition and concept may not strike the right balance between ensuring that beneficial owners are properly informed of significant issues and their desire not to receive materials. The commenter cited the following examples of matters that could be considered to be significant but which would be excluded from the special meeting definition:

• the election of directors, particularly if there is a contest as to board composition;

• non-proxy related materials, such as those relating to take-over bids, issuer bids, rights offerings, class actions or securityholder elections in non-proxy related matters;

• the corporate law concept of special meetings does not necessarily cover significant issues relating to mutual funds;

• certain shareholder proposals can be significant enough that they should fall into the significant category.

The commenter suggested that further consideration is required and that it would be preferable at this time to leave the definition of routine business in place. The commenter also suggested that any amendments to the routine business definition at this time would pose undue costs to intermediaries. The commenter also stated that the proposed amendments do not clearly address how beneficial owners who made elections under NP 41 or under the instrument prior to amendment should be treated.

Response: We have attempted to achieve the right balance between ensuring that beneficial owners are properly informed of significant issues and their desire not to receive materials by providing that beneficial owners may elect to receive only proxy-related materials that are sent in connection with a meeting at which a special resolution is being submitted to securityholders. We believe that the concept of special resolution is an improvement over the concept of non-routine business as it strikes a better balance. Using the concept of special resolution also results in greater certainty for issuers and beneficial owners than would a concept which attempted to encompass all matters that could be considered to be significant to beneficial owners.

Non-proxy related materials will continue to be sent to securityholders if required to be sent by corporate or securities law, as the client response form does not affect these. We believe that transition costs of the change from the non-routine business concept will be outweighed by the cost savings that will be realized from the reduction in material that will be required to be mailed. We have not amended the proposed amendments to the transitional provisions as an intermediary would not be prevented from seeking new instructions from the client after the amendments become effective.

Should beneficial owners be permitted to decline to receive all materials?

Two commenters suggested that, rather than provide beneficial owners with three choices (to decline to receive all materials, to choose to receive only proxy-related materials relating to special meetings, or to choose to receive all materials), beneficial owners should have two clear choices (to choose to receive all materials or to decline to receive all materials). This approach would eliminate the need of the CSA to attempt to determine which materials are deemed significant and would eliminate any concerns that beneficial owners would be left with a false sense that they will receive all materials related to significant matters. One of the commenters suggested that more consideration needs to be given to the question of whether beneficial owners should be entitled to determine whether they wish to receive materials related to significant issues before any amendments are made and suggested that any amendments at this time would pose undue costs to intermediaries and create added confusion for beneficial owners.

Response: We believe that three choices are appropriate, and permitting securityholders to choose to receive only proxy-related materials that are sent in connection with a meeting at which a special resolution is being submitted to securityholders strikes the right balance between ensuring that beneficial owners are properly informed of significant issues and their desire not to receive materials. The use of the concept of special resolution should lessen concerns that securityholders will have a false sense that they will receive all materials related to significant matters. The CSA believe that the proposed amendments will not pose undue costs to intermediaries or create confusion for beneficial owners, as the concept of special resolution provides a standard that is already used in corporate law.

Interaction of NI 54-101 with NI 51-102 Continuous Disclosure Obligations and NI 81-106 Investment Fund Continuous Disclosure

One commenter noted that there are duplicative and conflicting requirements in NI 54-101 and NI 51-102 that will lead to confusion:

• Beneficial owners who have given their intermediary a global, one-time-only instruction that they want to receive proxy materials and financial statements for all securities in their accounts, in accordance with NI 54-101, would receive annual solicitations from multiple issuers pursuant to NI 51-102 with respect to financial statements (but not proxy materials), which would lead to significant costs and require additional resources in the case of investment managers holding securities of large numbers of issuers for large numbers of clients.

• The global one-time-only instruction under NI 54-101 will relate to proxy materials and financial statements, but the annual solicitations from issuers under NI 51-102 will relate only to some of this material.

• Beneficial owners could selectively request financial statements of some issuers, but would not be able to make this choice in respect of proxy materials, which are typically distributed in the same envelope.

• It is not clear how beneficial owners would be advised that failing to request financial statements from issuers on an annual basis overrides their NI 54-101 instructions.

• The CSA suggest that the annual request form be delivered to beneficial owners as part of the proxy materials, but a beneficial owner might question why the request form refers to the financial statements and MD&A but excludes the proxy materials.

• As there is no deadline for responding to issuers' annual solicitations, and as beneficial owners may order financial statements under NI 51-102 for up to two years, issuers and intermediaries would be unable to accurately estimate the quantities of material to order.

Response: The requirement in NI 51-102 to send the request form only to those securityholders that have indicated they want to receive materials under NI 54-101 is appropriate. The basic principle behind the delivery requirement is that only those investors that want the financial statements should receive copies of them. The request form under NI 51-102 gives securityholders an opportunity to respond to each issuer individually and "customize" their instructions on an issuer-by-issuer basis.

The Companion Policy to NI 51-102 indicates that failing to request the financial statements and MD&A will override the instructions given under NI 54-101, to the extent those instructions relate to the financial statements and MD&A only. Failing to request the financial statements will not affect securityholders' right to receive other meeting materials in accordance with their instructions. We have also added this explanation to the Companion Policy to NI 54-101.

One commenter said that NI 51-102, NI 81-106 and NI 54-101 should fit together without gaps or inconsistencies, and suggested that the CSA consider providing guidance to all market participants on which instrument is paramount in the event of conflict.

Response: Although NI 51-102 and NI 54-101 provide for different requirements with respect to financial statements and proxy-related material, the CSA believe that these requirements are not conflicting and will not cause undue confusion. It was considered to be important that NI 51-102 include a requirement that securityholders receive a notice annually reminding them that they may request financial statements for specific issuers. The Companion Policy to NI 51-102 indicates that failing to request the financial statements and MD&A will override the instructions given under NI 54-101, to the extent those instructions relate to the financial statements and MD&A only. We have also added this explanation to the Companion Policy to NI 54-101.

One commenter suggested that beneficial owners who do not respond to issuers annually (which may be due to not realizing that failing to respond to the NI 51-102 request form will override the NI 54-101 instructions with respect to financial statements or a lack of resources to deal with multiple requests from issuers) could result in a beneficial owner wanting to vote but not being able to do so without the financial statements, or voting nonetheless, leading to a corporate governance deficiency and calling into question the integrity of the vote.

Response: Investors that want the financial statements will still have access to the statements. Once they request the statements, issuers must deliver a copy within 10 days of receiving the request, if the financial statements have already been filed. We do not agree that delivering the financial statements only on request will result in corporate governance deficiencies. The effect of NI 51-102 and NI 54-101 is to give securityholders choice as to what materials to receive.

One commenter suggested that because of the unique business and legal arrangements that apply to the mutual funds industry, mutual funds, mutual fund securities and mutual fund dealers should be explicitly carved out of the application of NI 54-101. The commenter stated that the requirement to obtain instructions from investors as to whether they object to their beneficial ownership information being disclosed is unnecessary and possibly misleading in the context of mutual funds since client information is provided by dealers to mutual fund managers because of tax reporting obligations that are fulfilled by fund managers on behalf of clients. The commenter also noted that the client response form election with respect to receiving financial statements and meeting materials will be unnecessary in relation to mutual funds as NI 81-106 will require mutual funds to identify which clients wish to receive financial statements, and according to industry practice mutual fund managers send meeting materials directly to all securityholders.

Response: The requirement to obtain instructions as to whether investors object to their beneficial ownership information being disclosed, and whether an exemption for mutual funds should be provided in NI 54-101 or NI 81-106, will require further consideration.

Proposed NI 81-106 provides that an investment fund that complies with the provisions of that instrument dealing with the delivery of financial statements and management reports is exempt from the financial statement delivery requirements of NI 54-101. The note to the client response form has been amended to make it clearer that where specific instructions concerning receipt of the investment fund's annual report or financial statements have been provided to an investment fund, the instructions in the client response form with respect to financial statements will not apply. We have retained the instructions in the client response form with respect to financial statements because investment funds that are not mutual funds may not have beneficial owner information and may want to use NI 54-101 to obtain that information. We believe the provisions of NI 54-101 with respect to mailings in connection with meetings can be relevant to investment funds, and we have not amended these provisions.

Costs

One commenter said that the activities and costs involved in implementing the proposed amendments would be significant, time consuming and expensive, although the benefits to be gained are unclear. The commenter suggested that further consideration be given to the issues.

Response: We believe that the proposed amendments make the instrument clearer and improve the regulatory regime. In particular, in our view, the amendment to permit beneficial owners to decline to receive all proxy-related materials and to permit beneficial owners to choose to receive only proxy-related materials relating to special meetings instead of non-routine business strikes the right balance between ensuring that beneficial owners can receive information on significant issues and their desire not to receive materials.

General Comments

Three commenters noted that the effective date should not fall during the peak proxy season in the first half of the year. Two commenters suggested that the instrument include a transition period in order that the necessary changes can be made to securityholder response forms and computer systems can be reprogrammed before the amendments to the instrument become effective. One commenter suggested that an effective date later than June 30, 2004 would interfere with the effective date for implementation of the second stage of NI 54-101.

Response: The effective date of February 9, 2005 will not interfere with the peak proxy season. We have also added a transition provision so that a reporting issuer that has filed a notice of a meeting and record date before the coming into force of these amendments is, with respect to that meeting, exempt from these amendments if the reporting issuer complies with the provisions of the Instrument as unamended.

One commenter asked that the CSA consider amending the provisions dealing with legal proxies to continue the process that was followed under NP 41, whereby beneficial owners could indicate on the voting instruction form that they or a third party appointee would attend the meeting in person and the intermediary would issue cumulative proxies to the transfer agent. The commenter suggested that the requirement under NI 54-101 that the beneficial owner make a separate request for a legal proxy which must be prepared and mailed by the intermediary to the beneficial owner has the following implications:

• It is inefficient and imposes higher processing costs, and where late requests are received, it is less likely the beneficial owner will receive the legal proxy in time to attend the meeting;

• Except under section 2.18, it is not clear who is to pay the processing costs;

• Sections 2.19 and 4.6 require reporting issuers and intermediaries to tabulate and execute voting instructions received, but does not deal with the situation where a legal proxy has been delivered; it is difficult to reconcile voting instructions with votes cast in person using a proxy. The commenter suggested that sections 2.19 and 4.6 be amended to exempt reporting issuers and intermediaries from the obligation to tabulate or execute voting instructions in these circumstances.

Response:

The CSA acknowledge that it may be difficult to reconcile voting instructions with votes cast in person using a proxy where a beneficial owner completes the voting instructions and also requests a legal proxy. This issue will require further consideration.

Two commenters said that the CSA should reconsider the issue of responsibility for the cost of delivery to OBOs. One of the commenters noted that where none of the issuer, the intermediary or the OBO agrees to pay for the costs of delivery, the OBO may not receive proxy-related materials. The commenters suggested that issuers should be responsible to pay for OBO delivery, as this would support efficiency, equitable and clearly defined obligations and similar treatment of all securityholders.

Response: These concerns were raised by a number of commenters when NI 54-101 was published for comment on three occasions in 1998 and 2000. The CSA decided to permit the market to determine how the costs of sending to OBOs would be borne where the matter is not addressed by local rule. As we have indicated in response to earlier comments, we believe it would be unfair to require the reporting issuer to pay for sending materials to beneficial securityholders who have chosen not to identify themselves to the reporting issuer. In addition, the amendments will permit OBOs, as well as NOBOs, to decline to receive all securityholder materials, so that OBOs will not be in a position of having to pay for delivery of materials they do not wish to receive.

Appendix B

List of Commenters

ADP Investor Communications

Computershare Trust Company of Canada

Investment Dealers Association of Canada

Investment Funds Institute of Canada

Pacific Corporate Trust Company

RBC Global Services

AMENDMENTS TO

NATIONAL INSTRUMENT 54-101

COMMUNICATION WITH BENEFICIAL OWNERS

OF SECURITIES OF A REPORTING ISSUER

PART ONE -- AMENDMENTS

1.1

(a) The definition of "legal proxy" in section 1.1 of National Instrument 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer (the National Instrument) is repealed and the following substituted:

"legal proxy" means a voting power of attorney, in the form of Form 54-101F8, granted to a beneficial owner or to a person designated by the beneficial owner, by either an intermediary or a reporting issuer under a written request of the beneficial owner;

(b) The definition of "routine business" in section 1.1 of the National Instrument is repealed;

(c) Section 1.1 of the National Instrument is amended by adding the following definitions:

"special resolution" for a meeting,

(a) has the same meaning given to the term "special resolution" under corporate law, or

(b) if no such term exists under corporate law, means a resolution that is required to be passed by at least two-thirds of the votes cast;

"special meeting" means a meeting at which a special resolution is being submitted to the securityholders of a reporting issuer;

1.2

(a) Paragraph 2.2(2)(h) of the National Instrument is repealed and the following substituted:

(h) whether the meeting is a special meeting.

(b) Section 2.20 of the National Instrument is amended by inserting "2.1(b)," in between the words "subsections" and "2.2(1)".

1.3

(a) Paragraph 3.2(b)(iii) of the National Instrument is amended by inserting the words "if applicable," before the word "enquire" at the beginning of the paragraph.

(b) Section 3.3 of the National Instrument is repealed and the following substituted:

3.3 Transitional -- Instructions from Existing Clients -- An intermediary that holds securities on behalf of a client in an account that was opened before the coming into force of this Instrument

(a) may seek new instructions from its client in relation to the matters to which the client response form pertains; and

(b) in the absence of new instructions from the client, shall rely on the instructions previously given or deemed to have been given by the client under NP41 in respect of that account, on the following basis:

(i) If the client chose to permit the intermediary to disclose the client's name and security holdings to the issuer of the security or other sender of material, the client is a NOBO under this Instrument;

(ii) If the client was deemed to have permitted the intermediary to disclose the client's name and security holdings to the issuer of the security or other sender of material, the intermediary may choose to treat the client as a NOBO under this Instrument;

(iii) If the client chose not to permit the intermediary to disclose the client's name and security holdings to the issuer of the security or other sender of material, the client is an OBO under this Instrument;

(iv) If the client chose not to receive material relating to annual or special meetings of securityholders or audited financial statements, the client is considered to have declined under this Instrument to receive:

(A) proxy-related materials that are sent in connection with a securityholder meeting;

(B) financial statements and annual reports that are not part of proxy-related materials; and

(C) materials sent to securityholders that are not required by corporate or securities law to be sent to registered securityholders;

(v) If the intermediary was permitted not to provide material relating to annual meetings of securityholders or audited financial statements, the client is considered to have declined under this Instrument to receive:

(A) proxy-related materials that are sent in connection with a securityholder meeting that is not a special meeting;

(B) financial statements and annual reports that are not part of proxy-related materials; and

(C) materials sent to securityholders that are not required by corporate or securities law to be sent to registered securityholders;

(vi) If the client chose to receive material relating to annual or special meetings of securityholders and audited financial statements, the client is considered to have chosen under this Instrument to receive all securityholder materials sent to beneficial owners of securities;

(vii) The client is considered to have chosen under this Instrument as the client's preferred language of communication the language that has been customarily used by the intermediary to communicate with the client.

1.4 Part 4 of the National Instrument is amended by adding the following section 4.8:

4.8 Fees from Persons or Companies other than Reporting Issuers

A proximate intermediary that receives securityholder materials from a person or company that is not a reporting issuer for sending to beneficial owners is not required to send the securityholder materials to any beneficial owners or intermediaries that are clients of the proximate intermediary unless the proximate intermediary receives reasonable assurance of payment for the delivery of the securityholder materials.

1.5

(a) Subsection 6.2(1) of the National Instrument is repealed and the following substituted:

(1) A person or company may take any action permitted under this Instrument to be taken by a reporting issuer and, in so doing, has all the rights, and is subject to all of the obligations, of a reporting issuer in connection with that action, unless this Instrument specifies a different right or obligation.

(b) Subsection 6.2(3) of the National Instrument is amended by deleting the words "section 2.18" and substituting the words "paragraphs 2.12(1)(a) and (b), sections 2.14 and 2.18".

(c) Section 6.2 of the National Instrument is amended by adding the following subsection 6.2(6):

(6) A person or company, other than a reporting issuer to which the request relates, that sends materials indirectly to beneficial owners shall pay to the proximate intermediary a fee for sending the securityholder materials to the beneficial owners.

1.6 Part 7 of the National Instrument is repealed and the following substituted:

Part 7 USE OF NOBO LIST AND INDIRECT SENDING OF MATERIALS

7.1 Use of NOBO List -- No reporting issuer or other person or company shall use a NOBO list or a report prepared under section 5.3 relating to the reporting issuer and obtained under this Instrument, except in connection with:

(a) sending securityholder materials to NOBOs in accordance with this Instrument;

(b) an effort to influence the voting of securityholders of the reporting issuer;

(c) an offer to acquire securities of the reporting issuer; or

(d) any other matter relating to the affairs of the reporting issuer.

7.2 Indirect Sending of Materials -- No person or company other than the reporting issuer shall send any materials indirectly to beneficial owners of a reporting issuer under section 2.12 of this Instrument except in connection with:

(a) an effort to influence the voting of securityholders of the reporting issuer;

(b) an offer to acquire securities of the reporting issuer; or

(c) any other matter relating to the affairs of the reporting issuer.

1.7

(a) The "Explanation to Clients" portion of Form 54-101F1 is amended by deleting the second and third paragraphs under the heading "Disclosure of Beneficial Ownership Information" and substituting the following:

If you DO NOT OBJECT to the disclosure of your beneficial ownership information, please mark the first box in Part 1 of the form. In those circumstances, you will not be charged with any costs associated with sending securityholder materials to you.

If you OBJECT to the disclosure of your beneficial ownership information by us, please mark the second box in Part 1 of the form. If you do this, all materials to be delivered to you as a beneficial owner of securities will be delivered by us. [Instruction: Disclose particulars of any fees or charges that the intermediary may require an objecting beneficial owner to pay in connection with the sending of securityholder materials.]

(b) The "Explanation to Clients" portion of Form 54-101F1 is amended by deleting the third paragraph under the heading "Receiving Securityholder Materials" and substituting the following:

Securities law permits you to decline to receive securityholder materials. The three types of materials that you may decline to receive are:

(a) proxy-related materials, including annual reports and financial statements, that are sent in connection with a securityholder meeting;

(b) annual reports and financial statements that are not part of proxy-related materials; and

(c) materials that a reporting issuer or other person or company sends to securityholders that are not required by corporate or securities law to be sent to registered holders.

(c) The "Explanation to Clients" portion of Form 54-101F1 is amended by deleting the Instruction in the first paragraph under the heading "Electronic Delivery of Documents" and substituting the following:

[Instruction: If applicable, either state (1) if the client wishes to receive documents by electronic delivery from the intermediary, the client should complete, sign and return an enclosed consent form with the client response form or (2) inform the client that electronic delivery of documents by the intermediary may be available upon his or her consent, and provide information as to how the client may provide that consent.]

(d) The "Client Response Form" portion of Form 54-101F1 is amended by deleting the text under the heading "Part 2 -- Receiving Securityholder Materials" and substituting the following:

Please mark the corresponding box to show what materials you want to receive. Securityholder materials sent to beneficial owners of securities consist of the following materials: (a) proxy-related materials for annual and special meetings; (b) annual reports and financial statements that are not part of proxy-related materials; and (c) materials sent to securityholders that are not required by corporate or securities law to be sent.

(Important note: These instructions do not apply to any specific request you give or may have given to a reporting issuer concerning the sending of interim financial statements of the reporting issuer. In addition, in some circumstances, the instructions you give in this client response form will not apply to annual reports or financial statements of an investment fund that are not part of proxy-related materials. An investment fund is also entitled to obtain specific instructions from you on whether you wish to receive its annual report or financial statements, and where you provide specific instructions, the instructions in this form with respect to financial statements will not apply.)

1.8

(a) Item 7.5(a) of Part 1 of Form 54-101F2 is deleted and the following substituted:

(a) the type of meeting (annual, special or annual and special);

(b) Item 9.3(a) of Part 1 of Form 54-101F2 is deleted and the following substituted:

(a) the type of meeting (annual, special or annual and special);

1.9 Form 54-101F8 is amended by deleting the fourth paragraph beginning "By voting..." and the following substituted:

By voting the securities represented by this legal proxy, you will be acknowledging that you are the beneficial owner of those securities or a person designated by the beneficial owner to vote such securities, and that you are entitled to vote such securities.

PART TWO -- EFFECTIVE DATE AND TRANSITION

2.1 Effective date of instrument - These amendments come into effect on February 9, 2005.

2.2 Transition -- A reporting issuer that has filed a notice of a meeting and record date with the securities regulatory authority in accordance with the provisions of the National Instrument before the coming into force of these amendments is, with respect to that meeting, exempt from these amendments if the reporting issuer complies with the provisions of the National Instrument in force on February 8, 2005.

AMENDMENTS TO

COMPANION POLICY 54-101CP

COMMUNICATION WITH BENEFICIAL OWNERS

OF SECURITIES OF A REPORTING ISSUER

PART ONE -- AMENDMENTS

1.1

(a) Subsection 2.1(1) of the Companion Policy 54-101CP (the Companion Policy) is amended by deleting from the final sentence the words "; an example of these types of materials would be corporate communications containing product information."

(b) Subsection 2.2(1) of the Companion Policy is amended by adding the following sentence to the end of the subsection:

Subsection 2.12(3) does not require a reporting issuer to send proxy-related materials to all beneficial owners outside Canada. A reporting issuer need only send proxy-related materials to beneficial owners who hold through proximate intermediaries that are either participants in a recognized depository, or intermediaries on the depository's intermediary master list.

(c) Subsection 2.4(2) of the Companion Policy is repealed and the following substituted:

(2) For the purposes of the Instrument, if an intermediary that holds securities has discretionary voting authority over the securities, it will be the beneficial owner of those securities for purposes of providing instructions in a client response form, and would not also be an "intermediary" with respect to those securities.

1.2

(a) Subsection 3.2(3) of the Companion Policy is repealed and the following substituted:

(3) New intermediary searches may have to be conducted if the nature of the business to be transacted at the meeting is materially changed. If the nature of the business is changed to add business that results in the meeting becoming a special meeting, it may be necessary to conduct new intermediary searches in order to ensure that beneficial owners that had elected to receive only proxy-related materials that are sent in connection with a special meeting receive proxy-related materials for the meeting.

1.3

(a) Section 4.1 of the Companion Policy is amended by adding the following sentence to the end of the section:

Section 4.6 of National Instrument 51-102 Continuous Disclosure Obligations requires reporting issuers to send annually a request form to the registered holders and beneficial holders of its securities that the holders may use to request a copy of the reporting issuer's financial statements and MD&A. Failing to return the request form or otherwise specifically request a copy of the financial statements or MD&A from the reporting issuer will override the beneficial owner's standing instructions under this Instrument in respect of the financial statements.

(b) Part 4 of the Companion Policy is amended by adding the following section 4.8:

4.8 Instructions from Existing Clients -- A client deemed to be a NOBO under NP41 can continue to be treated as a NOBO under paragraph 3.3(b)(ii) of this Instrument. However, intermediaries are responsible for ensuring that they comply with their obligations under privacy legislation with respect to their clients' personal information. Intermediaries may find that, notwithstanding paragraph 3.3(b)(ii), privacy legislation requires that they take measures to obtain their clients' consent before they disclose their clients' names and security holdings to a reporting issuer or other sender of material.

1.4 Subsection 5.4(4) of the Companion Policy is amended by deleting the first sentence of that subsection and substituting the following:

Section 3.2 of the Instrument requires intermediaries that hold securities on behalf of a client in an account to obtain the electronic mail address of the client, if available, and if applicable, to enquire whether the client wishes to consent to electronic delivery of documents by the intermediary to the client.

1.5 Appendix A of the Companion Policy is deleted in its entirety and the following substituted:

Appendix A

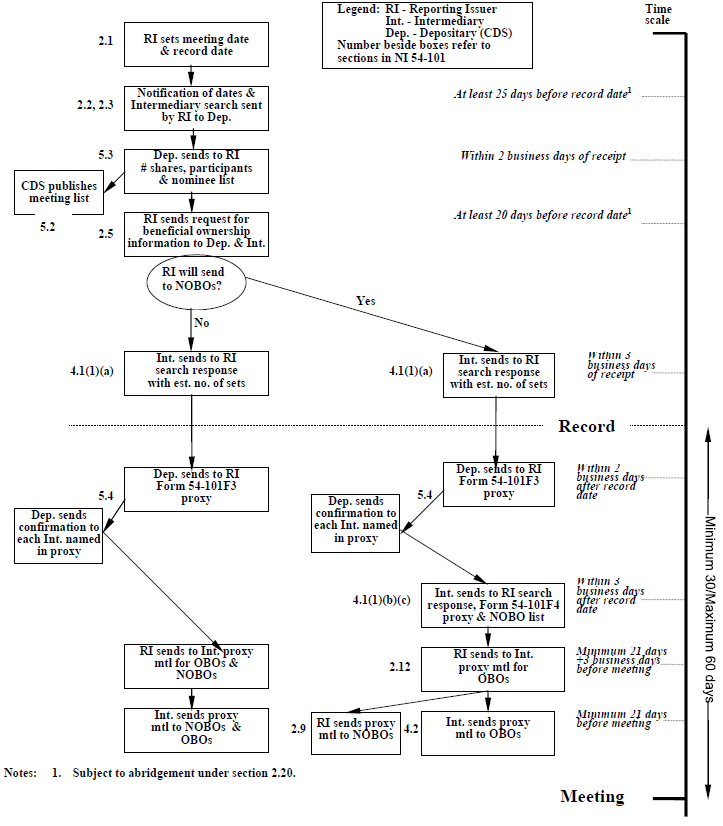

Proxy Solicitation under NI 54-101

PART TWO -- EFFECTIVE DATE

2.1 These amendments come into effect on February 9, 2005.