Register today for OSC Dialogue 2024: Inviting, thriving and secure capital markets

Amendments: NI - 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer

Amendments: NI - 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer

AMENDMENTS TO NATIONAL INSTRUMENT 54-101

COMMUNICATION WITH BENEFICIAL OWNERS

OF SECURITIES OF A REPORTING ISSUER

PART ONE -- AMENDMENTS

1.1

(a) The definition of "legal proxy" in section 1.1 of National Instrument 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer (the National Instrument) is repealed and the following substituted:

"legal proxy" means a voting power of attorney, in the form of Form 54-101F8, granted to a beneficial owner or to a person designated by the beneficial owner by either an intermediary or a reporting issuer under a written request of the beneficial owner;

(b) The definition of "routine business" in section 1.1 of the National Instrument is repealed;

(c) Section 1.1 of the National Instrument is amended by adding the following definitions:

"special resolution" for a meeting,

(a) has the same meaning given to the term "special resolution" under corporate law, or

(b) if no such term exists under corporate law, means a resolution that is required to be passed by at least two-thirds of the votes cast.

"special meeting" means a meeting at which a special resolution is being submitted to the securityholders of a reporting issuer;

1.2

(a) Paragraph 2.2(2)(h) of the National Instrument is repealed and the following substituted:

(h) whether the meeting is a special meeting.

(b) Section 2.20 of the National Instrument is amended by inserting "2.1(b)," in between the words "subsections" and "2.2(1)".

1.3

(a) Paragraph 3.2(b)(iii) of the National Instrument is amended by inserting the words "if applicable," before the word "enquire" at the beginning of the paragraph.

(b) Section 3.3 of the National Instrument is repealed and the following substituted:

3.3 Transitional -- Instructions from Existing Clients -- An intermediary that holds securities on behalf of a client in an account that was opened before the coming into force of this Instrument

(a) may seek new instructions from its client in relation to the matters to which the client response form pertains; and

(b) in the absence of new instructions from the client, shall rely on the instructions previously given or deemed to have been given by the client under NP41 in respect of that account, on the following basis:

(i) If the client chose to permit the intermediary to disclose the client's name and security holdings to the issuer of the security or other sender of material, the client is a NOBO under this Instrument;

(ii) If the client was deemed to have permitted the intermediary to disclose the client's name and security holdings to the issuer of the security or other sender of material, the intermediary may choose to treat the client as a NOBO under this Instrument;

(iii) If the client chose not to permit the intermediary to disclose the client's name and security holdings to the issuer of the security or other sender of material, the client is an OBO under this Instrument;

(iv) If the client chose not to receive material relating to annual or special meetings of securityholders or audited financial statements, the client is considered to have declined under this Instrument to receive:

(A) proxy-related materials that are sent in connection with a securityholder meeting;

(B) financial statements and annual reports that are not part of proxy-related materials; and

(C) materials sent to securityholders that are not required by corporate or securities law to be sent to registered securityholders.

(v) If the intermediary was permitted not to provide material relating to annual meetings of securityholders or audited financial statements, the client is considered to have declined under this Instrument to receive:

(A) proxy-related materials that are sent in connection with a securityholder meeting that is not a special meeting;

(B) financial statements and annual reports that are not part of proxy-related materials; and

(C) materials sent to securityholders that are not required by corporate or securities law to be sent to registered securityholders.

(vi) If the client chose to receive material relating to annual or special meetings of securityholders and audited financial statements, the client is considered to have chosen under this Instrument to receive all securityholder materials sent to beneficial owners of securities.

(vii) The client is considered to have chosen under this Instrument as the client's preferred language of communication the language that has been customarily used by the intermediary to communicate with the client.

1.4 Part 4 of the National Instrument is amended by adding the following section 4.8:

4.8 Fees from Persons or Companies other than Reporting Issuers

A proximate intermediary that receives securityholder materials from a person or company that is not a reporting issuer for sending to beneficial owners is not required to send the securityholder materials to any beneficial owners or intermediaries that are clients of the proximate intermediaries unless the proximate intermediary receives reasonable assurance of payment for the delivery of the securityholder materials.

1.5

(a) Subsection 6.2(1) of the National Instrument is repealed and the following substituted:

(1) A person or company may take any action permitted under this Instrument to be taken by a reporting issuer and, in so doing, has all the rights, and is subject to all of the obligations, of a reporting issuer in connection with that action, unless this Instrument specifies a different right or obligation.

(b) Subsection 6.2(3) of the National Instrument is amended by deleting the words "section 2.18" and substituting the words "paragraphs 2.12(1)(a) and 2.12(1)(b), sections 2.14 and 2.18".

(c) Section 6.2 of the National Instrument is amended by adding the following subsection 6.2(6):

(6) A person or company other than a reporting issuer to which the request relates that sends materials indirectly to beneficial owners shall pay to the proximate intermediary a fee for sending the securityholder materials to the beneficial owners.

1.6 Part 7 of the National Instrument is repealed and the following substituted:

Part 7 USE OF NOBO LIST AND INDIRECT SENDING OF MATERIALS

7.1 Use of NOBO List -- No reporting issuer or other person or company shall use a NOBO list or a report prepared under section 5.3 relating to the reporting issuer and obtained under this Instrument, except in connection with:

(a) sending securityholder materials to NOBOs in accordance with this Instrument;

(b) an effort to influence the voting of securityholders of the reporting issuer;

(c) an offer to acquire securities of the reporting issuer; or

(d) any other matter relating to the affairs of the reporting issuer.

7.2 Indirect Sending of Materials --No person or company other than the reporting issuer shall send any materials indirectly to beneficial owners of a reporting issuer under section 2.12 of this Instrument except in connection with:

(a) an effort to influence the voting of securityholders of the reporting issuer;

(b) an offer to acquire securities of the reporting issuer; or

(c) any other matter relating to the affairs of the reporting issuer.

1.7

(a) The "Explanation to Clients" portion of Form 54-101F1 is amended by deleting the second and third paragraphs under the heading "Disclosure of Beneficial Ownership Information" and substituting the following:

If you DO NOT OBJECT to the disclosure of your beneficial ownership information, please mark the first box on Part 1 of the form. In those circumstances, you will not be charged with any costs associated with sending securityholder materials to you.

If you OBJECT to the disclosure of your beneficial ownership information by us, please mark the second box in Part 1 of the form. If you do this, all materials to be delivered to you as a beneficial owner of securities will be delivered by us. [Instruction: Disclose particulars of any fees or charges that the intermediary may require an objecting beneficial owner to pay in connection with the sending of securityholder materials.]

(b) The "Explanation to Clients" portion of Form 54-101F1 is amended by deleting the third paragraph under the heading "Receiving Securityholder Materials" and substituting the following:

Securities law permits you to decline to receive securityholder materials. The three types of material that you may decline to receive are:

(a) proxy-related materials, including annual reports and financial statements, that are sent in connection with a securityholder meeting.

(b) annual reports and financial statements that are not part of proxy-related materials; and

(c) materials that a reporting issuer or other person or company sends to securityholders that are not required by corporate or securities law to be sent to registered holders.

(c) The "Explanation to Clients" portion of Form 54-101F1 is amended by deleting the Instruction in the first paragraph under the heading "Electronic Delivery of Documents" and substituting the following:

[Instruction: If applicable, either state (1) if the client wishes to receive documents by electronic delivery from the intermediary, the client should complete, sign and return an enclosed consent form with the client response form or (2) inform the client that electronic delivery of documents by the intermediary may be available upon his or her consent, and provide information as to how the client may provide that consent.]

(d) The "Client Response Form" portion of Form 54-101F1 is amended by deleting the text under the heading "Part 2 -- Receiving Securityholder Materials" and substituting the following:

Please mark the corresponding box to show what materials you want to receive. Securityholder materials sent to beneficial owners of securities consist of the following materials: (a) proxy-related materials for annual and special meetings; (b) annual reports and financial statements that are not part of proxy-related materials; and (c) materials sent to securityholders that are not required by corporate or securities law to be sent.

(Important note: These instructions do not apply to any specific request you give or may have given to a reporting issuer concerning the sending of interim financial statements of the reporting issuer. In addition, in some circumstances, the instructions you give in this client response form will not apply to annual reports or financial statements of an investment fund that are not part of proxy-related materials. An investment fund is entitled to obtain specific instructions from you on whether you wish to receive its annual report or financial statements.)

1.8

(a) Item 7.5(a) of Part 1 of Form 54-101F2 is deleted and the following substituted:

(a) the type of meeting (annual, special or annual and special);

(b) Item 9.3(a) of Part 1 of Form 54-101F2 is deleted and the following substituted:

(a) the type of meeting (annual, special or annual and special);

1.9 Form 54-101F8 is amended by deleting the fourth paragraph beginning "By voting..." and the following substituted:

By voting the securities represented by this legal proxy, you will be acknowledging that you are the beneficial owner of such securities or a person designated by the beneficial owner to vote such securities, and that you are entitled to vote such securities.

PART TWO -- EFFECTIVE DATE

2.1 These amendments come into effect on [*, 2004].

AMENDMENTS TO COMPANION POLICY 54-101CP

PART ONE - AMENDMENTS

1.1

(a) Subsection 2.1(1) of the Companion Policy 54-101CP (the Companion Policy) is amended by deleting from the final sentence the words "; an example of these types of materials would be corporate communications containing product information."

(b) Subsection 2.2(1) of the Companion Policy is amended by adding the following sentence to the end of the subsection:

Subsection 2.12(3) does not require a reporting issuer to send proxy-related materials to all beneficial owners outside Canada. A reporting issuer need only send proxy-related materials to beneficial owners who hold through proximate intermediaries that are either participants in a recognized depository, or intermediaries on the depository's intermediary master list.

(c) Subsection 2.4(2) of the Companion Policy is repealed and the following substituted:

(2) For the purposes of the Instrument, if an intermediary that holds securities has discretionary voting authority over the securities, it will be the beneficial owner of those securities for purposes of providing instructions in a client response form, and would not also be an "intermediary" with respect to those securities.

1.2 Part 4 of the Companion Policy is amended by adding the following section 4.8:

4.8 Instructions from Existing Clients -- A client deemed to be a NOBO under NP41 can continue to be treated as a NOBO under paragraph 3.3(b)(ii) of this Instrument. However, intermediaries are responsible for ensuring that they comply with their obligations under privacy legislation with respect to their clients' personal information. Intermediaries may find that, notwithstanding paragraph 3.3(b)(ii), privacy legislation requires that they take measures to obtain their clients' consent before they disclose their clients' names and security holdings to a reporting issuer or other sender of material.

1.3 Subsection 5.4(4) of the Companion Policy is amended by deleting the first sentence of that subsection and substituting the following:

Section 3.2 of the Instrument requires intermediaries that hold securities on behalf of a client in an account to obtain the electronic mail address of the client, if available, and if applicable, to enquire whether the client wishes to consent to electronic delivery of documents by the intermediary to the client.

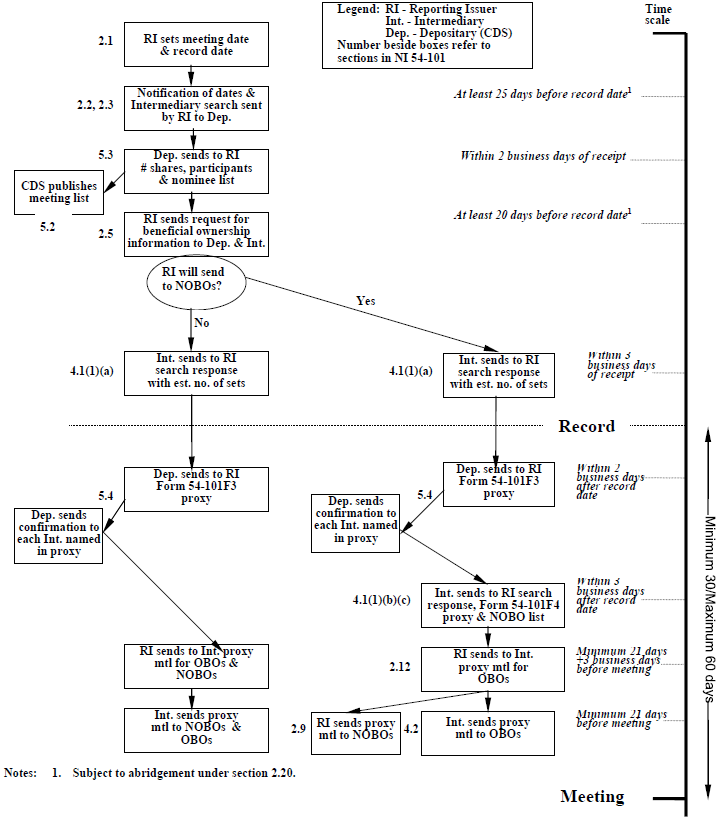

1.4 Appendix A of the Companion Policy is deleted in its entirety and the following substituted:

PART TWO -- EFFECTIVE DATE

2.1 These amendments come into effect on [*, 2004].