Register today for OSC Dialogue 2024: Inviting, thriving and secure capital markets

DWM Securities Inc. and Dundee Private Investors Inc.

Headnote

Under paragraph 4.1(1)(b) of National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations, a registered firm must not permit an individual to act as a dealing, advising or associate advising representative of the registered firm if the individual is registered as a dealing, advising or associate advising representative of another registered firm. The Filers are affiliated entities and have valid business reasons for the individuals to be registered with both firms. The Filers have policies in place to handle potential conflicts of interest. The Filers are exempted from the prohibition for current and future dealing representatives, based on the representations set out in the decision, for purposes of optimizing the supervision and oversight of: (i) the sub-branches and the dealing representatives located at such sub-branches and (ii) the registerable trading activities rendered by the producing supervisors and branch managers.

Applicable Legislative Provisions

Multilateral Instrument 11-102 Passport System, s. 4.7.

National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations, ss. 4.1, 15.1.

November 7, 2012

IN THE MATTER OF

THE SECURITIES LEGISLATION OF

ONTARIO

(the JURISDICTION)

AND

IN THE MATTER OF

THE PROCESS FOR EXEMPTIVE RELIEF

APPLICATIONS IN MULTIPLE JURISDICTIONS

AND

IN THE MATTER OF

DWM SECURITIES INC. (DWM) and

DUNDEE PRIVATE INVESTORS INC. (DPII)

(COLLECTIVELY, THE FILERS)

DECISION

Background

The principal regulator in the Jurisdiction has received an application from the Filers for a decision under the securities legislation of the Jurisdiction of the principal regulator (the Legislation) for an exemption from the requirement under paragraph 4.1(1)(b) of National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations (NI 31-103) to permit current and future dealing representatives of one Filer to be dually-registered as a dealing representative with the other Filer for purposes of optimizing the supervision and oversight of: (i) the Sub-Branches (as defined below) and the dealing representatives located at such Sub-Branches; and (ii) the registerable trading activities rendered by the Producing Supervisors/BMs (as defined below) (the Exemption Sought).

Under the Process for Exemptive Relief Applications in Multiple Jurisdictions (for a passport application):

a) the Ontario Securities Commission is the principal regulator for this application; and

b) the Filers have provided notice that subsection 4.7(1) of Multilateral Instrument 11-102 Passport System (MI 11-102) is intended to be relied upon by the Filers in all other provinces and territories in Canada.

Interpretation

Terms defined in National Instrument 14-101 Definitions and MI 11-102 have the same meaning in this decision unless otherwise defined. In addition, the following terms shall have the meaning ascribed to them:

• IIROC Rules shall mean the rules, policies, notices and bulletins governing members of the Investment Industry Regulatory Organization of Canada (IIROC) as promulgated by IIROC.

• MFDA Rules shall mean the rules, by-laws, policies, notices and bulletins governing members of the Mutual Fund Dealers Association of Canada (MFDA) as promulgated by the MFDA.

Representations

This decision is based on the following facts represented by the Filers:

DWM

1. DWM is a member of IIROC and is registered under NI 31-103 as an (i) investment dealer in all provinces and territories in Canada; (ii) investment fund manager in Ontario; and (iii) derivatives dealer in Quebec.

2. The head office of DWM is located in Toronto, Ontario.

3. DWM is not, to the best of its knowledge, in default of securities legislation of any jurisdiction in Canada.

DPII

4. DPII is a member of the MFDA and is registered under NI 31-103 as a mutual fund dealer and exempt market dealer in all provinces and territories of Canada and as a restricted dealer and scholarship plan dealer in Quebec.

5. The head office of DPII is located in Toronto, Ontario.

6. DPII is not, to the best of its knowledge, in default of securities legislation of any jurisdiction in Canada.

Affiliates

7. Each Filer is wholly-owned (indirectly) and controlled by The Bank of Nova Scotia and, as a consequence, are affiliates for purposes of the Legislation.

Conducting Securities Related Business -- Independent Agent Model

8. As permitted by IIROC Rules, individual dealing representatives who conduct registerable investment dealer activities on behalf of DWM do so as an agent of DWM and not as an employee. DWM (as principal) sponsors approximately 462 "independent" dealing representatives under its investment dealer registration that operate out of approximately 201 branches offices across Canada.

9. As permitted by MFDA Rules, individual dealing representatives who conduct registerable mutual fund dealer activities on behalf of DPII do so as an agent of DPII and not as an employee. DPII (as principal) sponsors approximately 445 "independent" dealing representatives under its mutual fund dealer registration that operate out of approximately 231 branches offices across Canada.

Supervision and Oversight

10. IIROC Rules require its members to designate an individual qualified and approved as a supervisor ("Supervisor") to supervise the activities of each of its dealing representatives (both registered representatives and investment representatives) to ensure that the member and its dealing representatives located at each branch office comply with IIROC Rules and applicable securities legislation.

11. MFDA Rules require its members to designate an individual qualified and approved as a branch manager ("Branch Manager") for each of its branch offices for purposes of ensuring that the member and its dealing representatives located at that branch office comply with MFDA Rules and applicable securities legislation.

DWM Sub-Branches and DPII Sub-Branches

12. There are approximately 154 branch offices of DWM that do not have a Supervisor that is physically present on a day-to-day basis (each a "DWM Sub-Branch").

13. DWM Sub-Branches are widely-dispersed across Canada and it would be extremely costly and operationally inefficient to dedicate and devote a Supervisor to be physically present at each DWM Sub-Branch on a day-to-day basis.

14. There are approximately 166 branch offices of DPII that do not have a Branch Manager that is physically present on a day-to-day basis (each a "DPII Sub-Branch").

15. DPII Sub-Branches are widely-dispersed across Canada and it would be extremely costly and operationally inefficient to dedicate and devote a Branch Manager to be physically present at each DPII Sub-Branch on a day-to-day basis.

"Producing" Supervisors and "Producing" Branch Managers

16. There are approximately 55 branch offices of DWM where the designated Supervisor is responsible for servicing an active and on-going "book" of clients (each a "Producing Supervisor") in addition to being responsible for discharging their designated supervisory responsibilities in respect of that branch office and its dealing representatives.

17. Generally speaking, Producing Supervisors are physically present at their DWM branch office on a day-to-day basis and the registerable trading activities they render for clients is supervised by compliance staff at the DWM head office level.

18. There are approximately 90 branch offices of DPII where the designated Branch Manager is responsible for servicing an active and on-going "book" of clients (each a "Producing Branch Manager") in addition to being responsible for discharging their designated supervisory responsibilities in respect of that branch office and its dealing representatives.

19. Generally speaking, Producing Branch Managers are physically present at their DPII branch office on a day-to-day basis and the registerable trading activities they render for clients is supervised by compliance staff at the DPII head office level.

Dually-Registered Representatives and the Filers' Compliance Structure

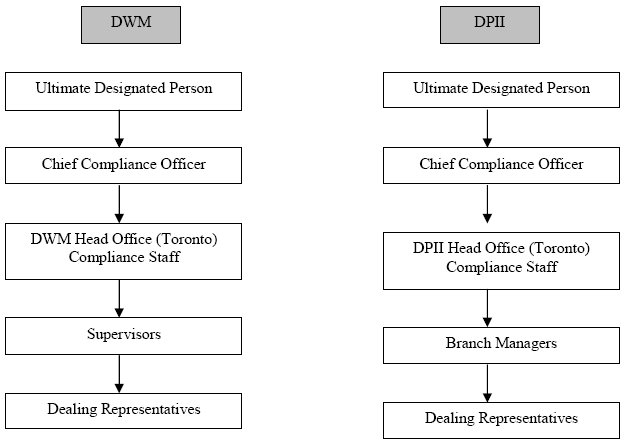

20. In order to effectively and efficiently discharge their supervisory and oversight obligations over branch offices and dealing representatives, the Filers have adopted a centralized corporate (head office) compliance structure:

21. For purposes of optimizing the supervision and oversight of (i) DWM Sub-Branches and DPII Sub-Branches (collectively the "Sub-Branches") and the dealing representatives located at such Sub-Branches; and (ii) the registerable trading activities rendered by Producing Supervisors and Producing Branch Managers (collectively the "Producing Supervisors/BMs") for clients, the Filers have jointly assigned to certain designated employees (each a "Dually-Registered Representative") the responsibility for:

a) discharging the duties and obligations of a Supervisor (as contemplated under IIROC Rules) in respect of one or more DWM Sub-Branches;

b) discharging the duties and obligations of a Branch Manager (as contemplated under MFDA Rules) in respect of one or more DPII Sub-Branches; and

c) overseeing the registerable trading activities of one or more Producing Supervisors/BMs.

22. In order to fulfill this role and meet applicable regulatory requirements, each Dually-Registered Representative is:

a) dually-employed with the Filers;

b) approved by IIROC to be a Supervisor (and to engage in outside business activities with DPII);

c) approved by the MFDA to be a Branch Manager (and to engage in outside business activities with DWM); and

d) registered as a dealing representative with two registered firms (DWM and DPII) by the applicable securities commissions.

23. For purposes of minimizing any potential conflicts of interest that could arise with respect to utilizing Dually-Registered Representatives to supervise and oversee Sub-Branches and registerable trading activities rendered by Producing Supervisors/BMs, each Dually-Registered Representative is designated as a "non-producing" dealing representative under the terms of their employment with the Filers. Accordingly, each Dually-Registered Representative:

a) is prohibited from having or servicing an active "book" of clients or generally acting in a sales capacity (except as noted below);

b) is generally required to devote 100% of their time to supervisory and compliance functions in respect of their designated Sub-Branches and registerable trading activities rendered by their designated Producing Supervisors/BMs;

c) is regarded as an employee (not an agent) by each Filer and compensated on the basis of meeting their respective supervisory and compliance objectives (not on a sales commission basis); and

d) reports directly to the Head Office (Toronto) Compliance Staff of DWM and DPII, as the case may be.

24. Each Dually-Registered Representative may be required to engage in registerable dealing activities in limited circumstances in which it is necessary and incidental to the performance of their supervisory role. This could occur, for example, in circumstances where a dealing representative at a small Sub-Branch is absent due to sickness or a vacation and a client of that dealing representative seeks to execute an unsolicited trade order.

25. To support the role of the Dually-Registered Representative within the Filers' centralized corporate supervisory structure, the Filers have implemented considerable and sophisticated technological and infrastructure measures in order to supervise and oversee branch office operations by compliance personnel that are not physically present at the branch location.

26. Currently, the Filers employ ten (10) Dually-Registered Representatives (each of whom obtained registration as a dealing representative with two sponsoring firms (DWM and DPII) prior to the implementation of section 4.1(1)(b) of NI 31-103 in July 2011) who supervise Sub-Branches and/or registerable trading activities rendered by Producing Supervisors/BMs on the same basis as represented above.

27. The Filers are seeking to employ additional Dually-Registered Representatives, as based on their experience to date and from a business reasons perspective, the Filers submit that the use of Dually-Registered Representatives within their centralized corporate supervisory structure has proven to be a highly effective and cost efficient tool for purposes of assisting in the discharge of their regulatory supervisory and oversight obligations.

28. Furthermore, the Filers submit that because Dually-Registered Representatives are not permitted to service an active "book" of clients or earn commission revenue tied to trading activities:

(a) the risk of client confusion is non-existent (especially considering the Filers engage in separate and distinct businesses in the securities industry);

(b) the conflicts of interest that typically arise when a dealing representative acts for two sponsoring firms are not present; and

(c) each Dually-Registered Representative has sufficient time to discharge their assigned supervisory and compliance functions owed to each Filer.

29. In absence of the Exemption Sought, the Filers would be prohibited under section 4.1(1)(b) of NI 31-103 from adding additional Dually-Registered Representatives to its corporate compliance structure for purposes of supervising Sub-Branches and registerable trading activities rendered by Producing Supervisors/BMs.

Decision

The principal regulator is satisfied that the decision meets the test set out in the Legislation for the principal regulator to make the decision.

The decision of the principal regulator under the Legislation is that the Exemption Sought is granted provided that with respect to any future Dually-Registered Representatives, the facts represented in paragraphs 3, 6, 20, 21, 22, 23, 24 and 25 of the decision apply in those circumstances.