Register today for OSC Dialogue 2024: Inviting, thriving and secure capital markets

CSA Notice of Amendments Relating to Rights Offerings to NI 45-106 Prospectus Exemptions, NI 41-101 General Prospectus Requirements, NI 44-101 Short Form Prospectus Distributions and NI 45-102 Resale of Securities, and Repeal of NI 45-101 Rights Offerings

CSA Notice of Amendments Relating to Rights Offerings to NI 45-106 Prospectus Exemptions, NI 41-101 General Prospectus Requirements, NI 44-101 Short Form Prospectus Distributions and NI 45-102 Resale of Securities, and Repeal of NI 45-101 Rights Offerings

CSA Notice of Amendments Relating to Rights Offerings to

National Instrument 45-106 Prospectus Exemptions,

National Instrument 41-101 General Prospectus Requirements, National

Instrument 44-101 Short Form Prospectus Distributions, and National

Instrument 45-102 Resale of Securities and Repeal of National Instrument

45-101 Rights Offerings

September 24, 2015

Introduction

We, the Canadian Securities Administrators (the CSA or we), are adopting the following amendments to the prospectus-exempt rights offering regime:

• amendments to:

• National Instrument 45-106 Prospectus Exemptions (NI 45-106),

• National Instrument 41-101 General Prospectus Requirements (NI 41-101),

• National Instrument 44-101 Short Form Prospectus Distributions (NI 44-101),

• National Instrument 45-102 Resale of Securities (NI 45-102),

• consequential amendments to:

• Multilateral Instrument 11-102 Passport System (MI 11-102),

• National Instrument 13-101 System for Electronic Document Analysis and Retrieval (SEDAR) (NI 13-101),

• Multilateral Instrument 13-102 System Fees for SEDAR and NRD (MI 13-102), and

• the repeal of National Instrument 45-101 Rights Offerings (NI 45-101) (collectively, the Amendments).

In addition, we are implementing changes to:

• Companion Policy 45-106CP to NI 45-106 (45-106CP), and

• Companion Policy 41-101CP to NI 41-101 (41-101CP).

We are also withdrawing Companion Policy 45-101CP to NI 45-101 (45-101CP).

The Amendments and policy changes have been made by each member of the CSA. Provided all necessary ministerial approvals are obtained, the Amendments and policy changes will come into force on December 8, 2015.

Substance and purpose

The Amendments and policy changes are intended to address CSA concerns that issuers seldom use prospectus-exempt rights offerings to raise capital because of the associated time and cost. At the same time, rights offerings can be one of the fairer ways for issuers to raise capital as they provide existing security holders with an opportunity to protect themselves from dilution. The Amendments are designed to make prospectus-exempt rights offerings more attractive to reporting issuers while maintaining investor protection.

The Amendments create a streamlined prospectus exemption (the Rights Offering Exemption) that is available only to reporting issuers, but not to investment funds subject to National Instrument 81-102 Investment Funds. The Rights Offering Exemption removes the current requirement for a regulatory review prior to use of the rights offering circular. Other key elements of the Rights Offering Exemption include:

• a new form of notice (Form 45-106F14 or the Rights Offering Notice) that reporting issuers will have to file and send to security holders informing security holders how to access the rights offering circular electronically,

• a new form of simplified rights offering circular (Form 45-106F15 or the Rights Offering Circular) in a question and answer format that is intended to be easier to prepare and more straightforward for investors to understand -- it will have to be filed but not sent to security holders,

• a dilution limit of 100%, instead of the current 25%, and

• the addition of statutory secondary market civil liability.

The Amendments create a new prospectus exemption for stand-by guarantors and modify certain conditions of the minimal connection exemption. The Amendments also update or revise some of the requirements for rights offerings by way of prospectus.

In addition, the Amendments remove the ability of non-reporting issuers to use the Rights Offering Exemption and repeal NI 45-101.

Background

Under the current rules, an issuer wanting to conduct a prospectus-exempt rights offering in Canada would use the prospectus exemption in section 2.1 of NI 45-106 which requires compliance with NI 45-101 (the 45-101 Exemption) and also provides that:

• the securities regulatory authority must not object to the offering, which results in a review of the rights offering circular by CSA staff, and

• reporting issuers are restricted from issuing more than 25% of their securities under the exemption in any 12 month period.

Very few reporting issuers use the 45-101 Exemption. In 2013 and 2014, CSA staff conducted research, collected data and held informal consultations with market participants to identify issues and to consider changes to the 45-101 Exemption that would facilitate prospectus-exempt rights offerings.

Through this work, the CSA found that the overall time period to conduct a prospectus-exempt rights offering, including the CSA review period, was much longer than the time period when using other prospectus exemptions. Specifically, CSA staff looked at 93 rights offerings by reporting issuers over a seven year time period and found that the average length of time to complete a prospectus-exempt rights offering was 85 days and the average length of time between filing of the draft circular and notice of acceptance by the regulator was 40 days. CSA staff heard that the length of time to complete an offering results in lack of certainty of financing and increased costs.

Market participants also reported that the dilution limit was too low and greatly restricted the ability of issuers with small market capitalization to raise sufficient funds to make a prospectus-exempt rights offering worthwhile.

Between March 2014 and February 2015, all CSA jurisdictions adopted a prospectus exemption for the distribution of securities to existing security holders. Under that exemption, reporting issuers listed on a Canadian exchange are able to raise money directly from their security holders without having to prepare an offering document. However, the CSA believes that rights offerings remain an important tool for reporting issuers because, with a rights offering:

• all security holders receive notice of the offering,

• the offering must be done on a pro-rata basis,

• securities are only subject to a seasoning period (and therefore generally freely tradeable), and

• there are no investment limits other than the limit imposed by the pro rata requirement.

On November 27, 2014, we published a Notice and Request for Comment relating to the Amendments and policy changes (the November 2014 Publication) in which we proposed removing the 45-101 Exemption and adopting the Rights Offering Exemption to make prospectus-exempt rights offerings more attractive to reporting issuers while maintaining investor protection.

Summary of written comments received by the CSA

The comment period for the November 2014 Publication ended on February 25, 2015. We received submissions from 13 commenters. We considered the comments received and thank all of the commenters for their input. The names of commenters are contained in Annex B of this notice and a summary of their comments, together with our responses, is contained in Annex C of this notice.

Summary of changes to the November 2014 Publication

After considering the comments received on the November 2014 Publication, we have made some revisions to the Amendments as published for comment. Those revisions are reflected in the Amendments and policy changes that we are publishing concurrently with this notice. As these changes are not material, we are not republishing the Amendments and policy changes for a further comment period.

Annex A contains a summary of notable changes to the Amendments and policy changes since the November 2014 Publication.

Repeal and withdrawal of instruments and policies

We are repealing NI 45-101 and withdrawing 45-101CP, effective December 8, 2015.

As the 45-101 Exemption will no longer be available as of December 8, 2015, issuers that plan to conduct a rights offering using the 45-101 Exemption will need to complete the distribution before December 8, 2015.

Consequential amendments

We are making consequential amendments to MI 11-102 to reflect the repeal of NI 45-101. We are also making consequential amendments to NI 13-101 and MI 13-102 to reflect necessary changes to SEDAR as a result of the Amendments. The consequential amendments to MI 13-102 will be adopted in each of the jurisdictions either as an amendment to a rule or as an amendment to a regulation.

Local matters

Annex G is being published in any local jurisdiction that is making related changes to local securities laws, including local notices or other policy instruments in that jurisdiction. It also includes any additional information that is relevant to that jurisdiction only.

The Ontario Securities Commission and the Autorité des marchés financiers will also make a consequential amendment to Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions. The consequential amendment will replace the reference to NI 45-101 with a reference to NI 45-106. A more detailed explanation of this local amendment is available on the OSC and the AMF websites, respectively, www.osc.gov.on.ca and www.lautorite.qc.ca.

Contents of annexes

The following annexes form part of this CSA Notice:

Annex A

Summary of changes

Annex B

List of commenters

Annex C

Summary of comments and responses

Annex D1

Amendments to NI 45-106

Annex D2

Amendments to NI 41-101

Annex D3

Amendments to NI 44-101

Annex D4

Amendments to NI 45-102

Annex D5

Repeal of NI 45-101

Annex E1

Consequential amendments to MI 11-102

Annex E2

Consequential amendments to NI 13-101

Annex E3

Consequential amendments to MI 13-102

Annex F1

Changes to 45-106CP

Annex F2

Changes to 41-101CP

Annex G

Local matters

Questions

Please refer your questions to any of the following:

British Columbia Securities CommissionLarissa M. StreuSenior Legal Counsel, Corporate Finance604-899-6888 1-800-373-6393Anita CyrAssociate Chief Accountant, Corporate Finance604-899-6579 1-800-373-6393Alberta Securities CommissionAshlyn D'AoustSenior Legal Counsel, Corporate Finance403-355-4347 1-877-355-0585Manitoba Securities CommissionWayne BridgemanDeputy Director, Corporate Finance204-945-4905Ontario Securities CommissionRaymond HoAccountant, Corporate Finance416-593-8106 1-877-785-1555Aba StevensLegal Counsel, Corporate Finance416-263-3867 1-877-785-1555Autorité des marchés financiersAlexandra LeeSenior Regulatory Advisor, Corporate Finance514-395-0337 ext.44651-877-525-0337Nova Scotia Securities CommissionDonna M. GouthroSecurities Analyst902-424-7077

Annex A

Summary of changes

Stand-by commitment

In the November 2014 Publication, we proposed a prospectus exemption (in section 2.1.1 of NI 45-106) for securities distributed to a stand-by guarantor as part of a distribution under the Rights Offering Exemption (the Stand-by Exemption). We proposed that the Stand-by Exemption would have a restricted period on resale (that is, a four-month hold period). Stand -by guarantors who were already existing security holders would only be subject to a seasoning period on resale.

Upon considering the comments received, we have decided that stand-by guarantors should not be subject to different resale restrictions depending on whether or not they are existing security holders and that stand-by guarantors generally should not be subject to a four-month hold period on the securities they take up as part of the stand-by commitment. A restriction such as a hold period may limit a person's willingness to provide a stand-by commitment and increase the costs to the issuer of the stand-by commitment.

In the Amendments, the Stand-by Exemption now has a seasoning period instead of a restricted period on resale. As a result, the securities distributed under the stand-by commitment will generally have the same resale restrictions as securities distributed under the basic subscription privilege and the additional subscription privilege, except as noted below.

We added guidance to 45-106CP which clarifies that if a registered dealer acquires a security as part of a stand-by commitment, the dealer may use the Stand-by Exemption (and have a seasoning period on resale). However, we would have concerns if a dealer or other person uses the Stand-by Exemption in a situation where the dealer or other person (a) is acting as an underwriter with respect to the distribution, and (b) acquires the security with a view to distribution. In that situation, the dealer or other person should acquire the security under the exemption in section 2.33 of NI 45-106 as per the guidance in section 1.7 of 45-106CP. This approach is consistent with the approach to the use of other prospectus exemptions by dealers acting as underwriters.

Minimal connection exemption

In the November 2014 Publication, we proposed a prospectus exemption (in section 2.1.2 of NI 45-106) for issuers with a minimal connection to Canada (the Minimal Connection Exemption) that was consistent with Part 10 of NI 45-101. As described in the November 2014 Publication, the prospectus requirement would not apply to rights offerings in situations where the number of securities and beneficial security holders in Canada, and in the local jurisdiction, is minimal.

In the Amendments, we decided to remove the local jurisdiction aspect of this test. We did not believe issuers should be precluded from using the Minimal Connection Exemption to offer rights to security holders in a local jurisdiction solely because either 5% of the issuer's beneficial security holders reside in the local jurisdiction or 5% of the number of the issuer's securities are held by security holders that reside in the local jurisdiction. In addition, for reporting issuers that do not meet the local jurisdiction test but satisfy the Canada-wide test, we did not believe that the benefits of requiring the issuer to prepare the documents required under the Rights Offering Exemption outweighed the costs. As a result, both reporting and non-reporting issuers will be able to use the Minimal Connection Exemption so long as neither the number of beneficial security holders of the relevant class that are resident in Canada nor the number of securities beneficially held by security holders resident in Canada exceeds 10% of all security holders or securities, as the case may be.

We have also added guidance on the timing for the procedures that an issuer may rely upon to determine the number of beneficial security holders or the number of securities for the purposes of determining whether they can use the Minimal Connection Exemption.

Material facts

Upon considering the comments received, we have decided to include a requirement that the issuer must disclose in the Circular any material facts and material changes that have not yet been disclosed and include a statement that there are no undisclosed material facts or material changes. This approach is substantially similar to the existing security holder exemption where the issuer must represent to the investor that there is no material fact or material change related to the issuer which has not been generally disclosed.

Annex B

List of commenters

|

|

Commenter |

Date |

|

|

||

|

1. |

Gordon Keep |

February 12, 2015 |

|

|

||

|

2. |

Investment Industry Association of Canada (Susan Copland) |

February 24, 2015 |

|

|

||

|

3. |

The Canadian Advocacy Council for Canadian CFA Institute Societies (Cecilia Wong) |

February 24, 2015 |

|

|

||

|

4. |

Scorpeo UK Ltd. (Ian Davey) |

February 25, 2015 |

|

|

||

|

5. |

Osler, Hoskin & Harcourt LLP (Rob Lando) |

February 25, 2015 |

|

|

||

|

6. |

Simon A. Romano (Stikeman Elliott) |

February 25, 2015 |

|

|

||

|

7. |

TMX Group Limited (Ungad Chadda and John McCoach) |

February 25, 2015 |

|

|

||

|

8. |

DuMoulin Black LLP (Daniel McElroy) |

February 25, 2015 |

|

|

||

|

9. |

Canadian Foundation for Advancement of Investor Rights (Neil Gross) |

February 25, 2015 |

|

|

||

|

10. |

Association for Mineral Exploration British Columbia (Gavin Dirom) |

February 25, 2015 |

|

|

||

|

11. |

Burstall Winger Zammit LLP (Jason Mullins) |

February 26, 2015 |

|

|

||

|

12. |

Don Mosher |

February 25, 2015 |

|

|

||

|

13. |

Prospectors & Developers Association of Canada (Rodney Thomas) |

March 11, 2015 |

[Editor's Note: Annex C follows on separately numbered pages. Bulletin pagination resumes after Annex C.]

Annex C

Summary of comments and responses

CSA Notice and Request for Comment Proposed Amendments to National Instrument 45-106 Prospectus Exemptions, National Instrument 41-101 General Prospectus Requirements, National Instrument 44-101 Short Form Prospectus Distributions and National Instrument 45-102 Resale of Securities and Proposed Repeal of National Instrument 45-101 Rights Offerings

|

No. |

Subject |

Summarized Comment |

Response |

|

|

|

||||

|

General Comments |

||||

|

|

||||

|

1 |

General support for the proposals |

We received 13 comment letters. Ten commenters generally support the proposals. The other three commenters only commented on specific aspects of the proposals. |

We acknowledge the comments. |

|

|

|

||||

|

|

|

One commenter noted that they support the initiative to assist issuers by making the rights offering process more efficient and accessible for companies seeking to raise capital from existing shareholders. |

|

|

|

|

||||

|

|

|

One commenter supports efforts to improve the ease with which issuers can raise capital in Canada while balancing investor protection considerations. In addition, the commenter agrees that the proposed exemption should only be available to reporting issuers in Canada. Investors are generally familiar with the ability to access current information about issuers on SEDAR and current shareholders may also be receiving specified financial and other continuous disclosure information from the issuer directly. |

|

|

|

|

||||

|

|

|

One commenter is extremely supportive of the introduction of changes to the current rights offering regime, and are very appreciative of the significant work among the Canadian securities regulatory authorities that went into revisions to these rules. They are generally of the view that rights offerings are inherently fair to security holders and should therefore be supported by regulatory authorities. The commenter is committed to reviewing their policies in order to support the appeal of rights offerings and believes that the CSA's efforts to reduce the standard timetable and associated costs of completing a rights offering are key to increasing the viability of rights offerings as a useful way for listed issuers to access capital. |

|

|

|

|

||||

|

|

|

One commenter indicated that they are generally very supportive of the Proposed Amendments. |

|

|

|

|

||||

|

|

|

One commenter supports the Proposed Amendments as a method of facilitating rights offerings in Canada, and believes that they would increase the likelihood of reporting issuers raising capital via rights offerings. |

|

|

|

|

||||

|

|

|

One commenter, on behalf of close to 5,000 corporate and individual members, expresses full support of the proposed changes to the Rights Offering Regime. As proposed, the changes should reduce costs and improve timeliness. And importantly, the changes should enable BC and Canada to compete more competitively with jurisdictions such as Australia. The commenter also supports retaining as much flexibility as possible on the use of funds raised. The commenter supports the overall goal of making the process of raising capital more streamlined and efficient. It is imperative that this goal actually be achieved. |

|

|

|

|

||||

|

|

|

One commenter supports regulatory efforts to improve the ability of reporting issuers to raise capital in a cost efficient manner that, at the same time, provides adequate protection to investors. The commenter supports efforts to examine why some prospectus exemptions, such as rights offerings, have been rarely used in the various jurisdictions in Canada whilst they are commonly used in other jurisdictions (such as the United Kingdom, Hong Kong, and Australia) in order to make changes so such prospectus exemption are utilized more often. The Notice indicates that CSA Staff have conducted research, collected data and held informal consultations with market participants to identify issues and consider changes. This has resulted in the Proposed Amendments. The commenter welcomes such steps. |

|

|

|

|

||||

|

|

|

One commenter noted that overall, they are in favour of the implementation of the Proposed Amendments. They welcome the initiative to amend rights offerings so that they will become a viable and more attractive financing method for issuers. Historically, the commenter's clients have viewed rights offerings as overwhelmingly negative and a financing "method of last resort" due to the length of and difficulty in predicting the overall timeline and the capital raising limits under the current regime. The commenter believes the Proposed Amendments substantially address the issues which made rights offerings an impractical and undesirable financing method (specifically the increase of permitted dilution in a 12-month period to 100% and removal of the requirement for advanced review and clearance of rights offering circulars by securities regulators). |

|

|

|

|

||||

|

|

|

One commenter stated that reducing costs and time for listed companies will allow more money to be spent on research, development and exploration regardless of sector. |

|

|

|

|

||||

|

|

|

One commenter views rights offerings as an important and useful means of raising capital in Canada, particularly for junior issuers in the mining industry. By permitting all security holders to participate on a pro rata basis, rights offerings are inherently fair to investors and therefore should be viewed as positive for Canada's capital markets. However, the ability of issuers to efficiently raise meaningful amounts of capital by way of a rights offering, on a prospectus-exempt basis, can be limited by the existing 25% market capitalization limit. |

|

|

|

|

||||

|

|

|

For those reasons, the commenter is generally supportive of the Proposed Amendments insofar as the amendments would reduce the cost of capital raising by: |

|

|

|

|

|

|

• simplifying and standardizing the offering documentation used to effect a rights offering |

|

|

|

|

|

• eliminating regulatory review of the rights offering circular; and |

|

|

|

|

|

• reducing the average period of time to complete a rights offering. |

|

|

|

||||

|

|

|

The commenter is also supportive of the proposal to increase the maximum dilution limit from 25% to 100% over a 12 month period, which, when combined with the other aspects of the Proposed Amendments, should enable issuers to more efficiently raise larger amounts of capital on a prospectus-exempt basis. |

|

|

|

|

||||

|

2 |

General comment on rights offering timeframe |

One commenter noted the length of time to complete a rights offer has been the subject of examination and regulatory reform in other jurisdictions. The UK made changes to its regime to shorten the length of time. The minimum rights issue offer period was reduced from 21 days to 10 business days (or 14 clear days when statutory pre-emption rights apply). Listed issuers are able to hold general meetings on 14 clear days' notice if certain conditions are complied with. |

We acknowledge the comments. |

|

|

|

||||

|

|

|

The UK Report that preceded changes to the rights offering in that jurisdiction notes that reducing the length of time would reduce the period when a company (and its reputation) is at risk and its share price open to potential abuse (some companies experienced changes in their financial position and prospects during the process and claims were made of short selling). The Report notes that "Efficient capital raising techniques are essential to enable companies to raise capital at least cost. Orderly capital raising not only helps reduce the cost of raising capital but also preserves the integrity of the market and the issuer's reputation. Improvements will therefore benefit the market, companies and shareholders." |

We note that the Canadian processes for communicating with beneficial owners of securities are unique; therefore, it is difficult to directly compare our timelines to those in other jurisdictions. |

|

|

|

||||

|

|

|

The commenter notes that the UK was able to significantly reduce the length of time without having to do away with a rights offering prospectus altogether -- rather it reduced disclosure requirements as compared to a full prospectus in order to lower the cost and administrative burden by omitting from a rights issue prospectus the information that is already available to the market through its ongoing disclosure obligations. |

|

|

|

|

||||

|

3 |

General comment on shareholder value |

One commenter notes that rights offerings are usually conducted by companies to raise cash for specific or general purposes including: to repay debt; to satisfy capital adequacy requirements (as applicable); to fund acquisitions; or to create working capital. |

We acknowledge the comments. Please also see the response to comment 2 above. |

|

|

|

||||

|

|

|

From the perspective of the retail investor, rights offerings may generally be viewed favourably (versus a private placement, for example) to the extent that they: (a) Offer existing shareholders shares in proportion to their existing holdings (the "right of pre-emption") and (b) Allow the existing shareholders to sell the right to subscribe for shares (the "right of compensation for non-subscribing shares"). |

|

|

|

|

||||

|

|

|

A rights offering should provide the retail investor with the following choices: |

|

|

|

|

|

|

-- Accept the offer and subscribe for the shares at the issue price (i.e. take up the rights); |

|

|

|

|

|

-- Sell the entitlement to their right of pre-emption (also known as a "nil-paid" entitlement) (i.e. sell their rights); |

|

|

|

|

|

-- Do nothing, in which case alternative subscribers will be sought at the end of the rights issue and any proceeds above the issue price, less expenses, will be passed to the shareholder (i.e. do nothing and receive the proceeds of a sale of the rights); or |

|

|

|

|

|

-- Do a combination of the above three options |

|

|

|

||||

|

|

|

In theory, the value that non-accepting shareholders receive in a rights issue can be the same regardless of which course of action they choose to take -- take up their rights, sell those rights or do nothing. However, in practice, there may be little or no value in the nil-paid right as the market may be illiquid and they are often underpriced. Nonetheless, shareholders prefer to have tradability of rights. |

|

|

|

|

||||

|

|

|

The commenter notes that corporate law, listing rules and securities law requirements must be reviewed in order to derive a rights offering framework that best improves shareholder value. The CSA Notice does not discuss the applicable corporate law or listing rules of the TSX or TSX-V or other exchanges and how they assist in creating an efficient and orderly rights offering regime that is in the interests of all market participants, including retail investors. This would have been helpful to include. |

|

|

|

|

||||

|

|

|

A recent paper entitled "Rights Offerings, Trading, and Regulation: A Global Perspective" examined the rights offering around the world using a sample of 8,238 rights offers in 69 countries and provides insight as to which rules may increase shareholder value. For example, in Hong Kong and the UK a company's ability to decide whether rights will be tradable is structured and regulated -- if the offerings are without tradable rights, they are called open offers and are subject to a separate set of regulations including a limit on the discount to the market price. In those jurisdictions, issuers do not have a free choice as to whether the rights are traded but rather it is subject to specific conditions if tradability is removed. |

|

|

|

|

||||

|

4 |

Results of CSA Research |

One commenter would have liked to see publicized in the Notice the results of the research undertaken especially any benchmarking of the key features of the rights offering regimes in those jurisdictions that commonly use it (notably Australia, Hong Kong and the UK). It would also be beneficial in the interests of transparency to provide some detail as to what categories of stakeholders were consulted -- were institutional shareholders consulted in addition to issuers, for example? Finally, it would be valuable to publish in the Notice any available information on the amount of capital raised in other jurisdictions through the exemption, and the percentage of total capital raised in other jurisdictions using the exemption as compared to other prospectus exemptions, if available. Making this information public would further the understanding of all stakeholders of capital raising in other jurisdictions and improve the quality of comments received in respect of the Proposed Amendments. |

We thank the commenter for their input. |

|

|

|

||||

|

|

|

|

|

With respect to benchmarking, we note that, in general, our policy making is informed by looking at the requirements in other jurisdictions to the extent appropriate having regard to the uniqueness of the Canadian market. |

|

|

||||

|

Question 1a: the Proposed Exemption -- the Exercise Period -- Do you agree that the exercise period should be a minimum of 21 days and a maximum of 90 days? |

||||

|

|

||||

|

5 |

Yes |

Two commenters believe that an exercise period of a minimum of 21 days is appropriate. |

We acknowledge the comments. We have maintained the requirement that the exercise period be a minimum of 21 days and a maximum of 90 days. |

|

|

|

||||

|

|

|

One commenter noted that while they do not have a view on the appropriate maximum number of days for the exercise period, they believe the minimum exercise period should be at least 21 business days, to ensure that the requisite materials have been mailed to all shareholders, including foreign shareholders. Issuers and their intermediaries should be given sufficient time to identify beneficial holders to whom the materials must be sent. The commenter agrees with market commentators who have indicated that institutional investors may require additional time for internal approvals prior to making a decision with respect to participation in a rights offering. All investors would benefit from a longer period of time in which to make a decision, particularly if they would be required to liquidate other investments to satisfy the exercise price. |

|

|

|

|

||||

|

|

|

Two commenters believe that a maximum of 90 days is appropriate. |

|

|

|

|

||||

|

6 |

No |

Five commenters did not agree with the proposed exercise period. |

We thank the commenters for their input. We have decided that a minimum exercise period of 21 days is appropriate considering the Canadian system for communicating with beneficial security holders. |

|

|

|

||||

|

Question 1b: the Proposed Exemption -- the Exercise Period -- If no, what are the most appropriate minimum and maximum exercise periods, and why? |

||||

|

|

||||

|

7 |

10-15 days |

One commenter thought the exercise period could be reduced to 10 to 15 days and still meet all requirements for sufficient time for shareholders to act. |

We thank the commenters for their input. As indicated above, we have decided that a minimum exercise period of 21 days is appropriate. |

|

|

|

||||

|

|

|

One commenter noted that one of the primary reasons the current exemption is not widely used is due to the extended time required to complete a rights offerings. The current minimum exercise period was implemented in a time when electronic distribution and access to documents was not widely available, and issuers and investors relied on the postal service for distribution. This process, which is no longer necessary, extends the process by weeks. Given the ability of issuers to communicate to security holders in real-time, we propose that the minimum exercise period by shortened to two business weeks (14 business days). The commenter does not believe that shortening this period will prejudice shareholders, and will allow issuers to access the market in a much more timely and efficient manner. |

Please also see the response to comment 2 above. |

|

|

|

||||

|

|

|

One commenter noted in other jurisdictions, the minimum exercise period is 14 days (UK); similarly maximum periods are often restricted to 70 days (10 week maximum). A two-week period should be more than sufficient for shareholders to be notified of a rights issue and act accordingly. The commenter would challenge why 3 weeks is necessary to reach beneficial security holders when in the UK 14 days is deemed sufficient and has become established without material problems. Similarly, a 10 week period seems unnecessarily long. Having the option as an issuer to close the rights offering within 14 days removes material timing uncertainty. The reduction in timing risk reduces the cost of any underwriting fees to be paid. |

|

|

|

|

||||

|

|

|

Should of course a corporate issuer wish to extend a rights issue, or if for example a change to the terms in favour of shareholders is proposed (such as a reduction in exercise price), the commenter would also suggest that an underwriter have the right to extend the period of exercise once for an additional 2 weeks, subject to the total subscription period being within the maximum timeframe. Again this would serve to protect the corporate issuer's shareholders, both in price paid and additionally reducing the possibility of otherwise having the underwriters own a large block of shares and creating a significant stock overhang. This capacity to extend in extremis would also reduce underwriting fees. |

|

|

|

|

||||

|

|

|

One commenter noted that it had submitted proposals to improve the efficiency of the rights offering regime in Canada in order to make rights offerings more attractive and viable financing options for issuers and their security holders, and believe the 21-day minimum period should be reduced to 10 business days. The commenter believes that issuers should be permitted to launch the rights offering by issuing a news release and electronically filing the Notice and Circular and should not be required to mail the Notice to security holders. Allowing electronic filing of the Notice and Circular will enable the minimum period to be reduced to 10 business days. The commenter further believes that 10 business days is sufficient because recipients of the rights are existing security holders who are already familiar with the listed issuer and, as a result, do not require 21 days to make an informed investment decision. Secondary market purchasers of rights are not prejudiced by a shortened exercise period as their investment decision is made at the time they purchase the rights and is not based on receipt of a disclosure document. These purchasers will instead rely on publicly available disclosure. |

|

|

|

|

||||

|

8 |

Other |

One commenter agrees with the concerns in respect of contacting beneficial security holders and allowing them sufficient time to consider participating in the rights offering. The commenter notes that the regime for contacting beneficial security holders in National Instrument 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer requires issuers to send meeting materials at least three business days before the 21st day before the meeting. The commenter thinks the minimum exercise period should be not less than this period, meaning that if the exercise period commenced on the date that the Notice is sent, the exercise period would be a minimum of 24 days. Another way to achieve the same end is if the exercise period is at least 21 days and commences at least three business days after the date of mailing of the Notice. |

We thank the commenter for their input. We note that the exercise period for rights offerings has always been a minimum of 21 days. If an issuer believes more time is needed to contact beneficial security holders, the issuer may increase the exercise period. |

|

|

|

||||

|

9 |

Related to trading |

One commenter suggested a possible metric that it needs to trade for a minimum of 10 days, so all market participants are aware and can buy and sell the rights. |

We thank the commenters for their input. We note that the rules and policies relating to the trading of rights are set by the exchanges. |

|

|

|

||||

|

|

|

One commenter suggests that the trading period of rights should cease at least 3 business days prior to the end of the exercise period, to allow settlement of rights in good form for delivery to the agent. |

|

|

|

|

||||

|

10 |

Reference to UK timing |

One commenter noted that the UK Report indicates that a long exercise period can be problematic for issuers and can lead to behaviours that impact the integrity of the market. The CSA should consider whether it can further reduce the minimum rights issue offer period from 21 days and should benchmark to other jurisdictions (including other aspects of their rights offering regime) as part of its determination. The UK also has a process whereby issuers can choose through a shareholder meeting to disapply the statutory pre-emption rights so that they do not have to offer the rights to certain overseas shareholders but the rights otherwise attributable to those shareholders are sold for their benefit. This shortens the exercise period and should be examined as an option. The timetable for a rights offering will also have to take into account corporate law requirements for a meeting for shareholder approval, and listing requirements of the applicable exchange so they need to be reviewed to see if they are still appropriate. |

We thank the commenter for their input. As indicated above, we have decided that a minimum exercise period of 21 days is appropriate. |

|

|

|

||||

|

|

|

|

|

As far as we are aware, there are no statutory pre-emption rights under corporate law in Canada. As a result, we do not believe there is a necessity for security holder approval of rights offerings. |

|

|

||||

|

Question 2: the Proposed Exemption -- the Notice -- Do you foresee any challenges with the requirement that the Notice be filed and sent before the exercise period begins, and that the Circular be filed concurrently with the Notice? |

||||

|

|

||||

|

11 |

No |

Seven commenters do not foresee challenges. |

We acknowledge the comments. |

|

|

|

||||

|

|

|

One commenter noted issuers are free to prepare the Notice and Circular in accordance with their own internal timing requirements. |

We note that issuers may be able to send the Notice electronically. For guidance on electronic delivery, issuers should review National Policy 11-201 Electronic Delivery of Documents. |

|

|

|

||||

|

|

|

One commenter suggested that the Notice be able to be distributed to shareholders electronically. |

As indicated above, we are not aware of any statutory pre-emption rights in Canada. As a result, we do not believe there is a necessity for security holder approval of rights offerings. |

|

|

|

||||

|

|

|

One commenter does not foresee challenges unless the exercise period were to commence three business days (or some other period of time) after the date of mailing of the Notice. In that case the Circular could be filed not later than the first day of the exercise period. . |

|

|

|

|

||||

|

|

|

One commenter noted that the exercise period (or offer period) may have to occur after the Notice is filed and sent and the Circular filed, and a shareholder meeting has also been held. The record date and the offer period may start subsequent to the announcement of the offering so that shareholders can sell or buy their holdings if they prefer not to participate. |

|

|

|

|

||||

|

12 |

Other |

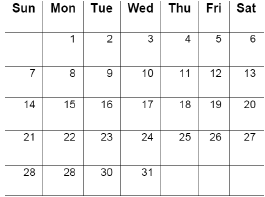

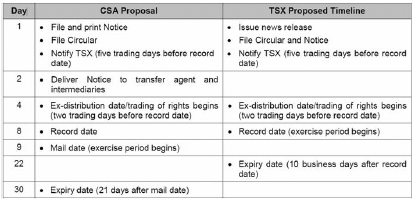

One commenter did not see an issue with requiring the Notice and Circular to be filed concurrently, before the exercise period begins. However, another timing consideration is the coordination of the record date, the ex-distribution date and the trading date. Currently, all requisite documentation must be filed with the relevant Exchange at least seven trading days prior to the record date. This seven-day period is designed to enable the Exchange to properly notify the market of the ex-distribution date and the record date and to list the rights two trading days prior to the record date. The Exchange will also issue a bulletin in respect of the rights offering that provides market participants with adequate notice of the rights offering and the key terms related to it. However, based on the review of Exchange procedures, the commenter believes that the Exchanges may (subject to regulatory approval) seek to reduce this seven-day period to five trading days without compromising the objective of providing adequate notice to market participants. These proposed measures, along with allowing electronic filing of both the Notice and Circular and a 10 business day minimum period, would reduce the time required to complete a rights offering in Canada, as illustrated in the chart below. The column entitled "CSA Proposal" outlines the approximately 30-day period required to complete a rights offering under the timeline in the Request for Comment, including a 21 day minimum period. The column entitled "TSX Proposed Timeline" demonstrates how the timeline for a rights offering may be reduced to approximately 22 days if issuers were permitted to launch the rights offering by issuing a news release and filing the Circular and Notice, and if the minimum period were reduced to 10 business days. The timelines in both columns assume the Exchanges have reduced the seven trading day period referred to above to five trading days. |

We thank the commenter for their input. |

|

|

|

||||

|

|

|

|

|

We appreciate the commenter's willingness to make their processes more efficient. |

|

|

||||

|

|

|

|

|

|

|

|

||||

|

Question 3a: The Proposed Exemption -- the Notice and Circular -- Do you foresee any challenges with requiring the issuer to send a paper copy of the Notice? |

||||

|

|

||||

|

13 |

Yes |

Four commenters saw some challenges with requiring the issuer to send a paper copy of the Notice. |

We thank the commenters for their input. The requirement is for the issuer to send the notice to its security holders. As noted above, issuers may be able to send the Notice electronically. The expectation is that beneficial security holders would receive the Notice. |

|

|

|

||||

|

|

|

One commenter noted electronic communication is now a widely accepted business practice, and as such, issuers should be permitted to communicate with shareholders in such a manner. By permitting electronic distribution of the Notice, the time required to undertake a rights offering could be shortened, resulting in a more efficient process. |

|

|

|

|

||||

|

|

|

One commenter believed that the requirement to send a notice of a proposed rights offering to "security holders" as a condition of availability of the exemption is unclear, if not problematic. The commenter asks if the reference to "security holders" is intended to mean registered holders, or is it intended to mean beneficial owners? If intended to mean registered holders, then the notice delivery requirement will not operate so as to ensure that all beneficial owners are made aware of the rights offering. If intended to mean beneficial owners, then a requirement to ensure delivery to all beneficial owners at a particular point in time may be difficult or impossible for the issuer to comply with, as the process for communication with beneficial owners that is contemplated by National Instrument 54-101 is currently limited to proxy-related materials, in addition to being time-consuming and costly. The commenter notes that currently, an issuer will distribute its rights offering circular or prospectus to all of its registered shareholders, together with any "rights offering certificates" or other related materials. Typically, The Canadian Depository for Securities Limited ("CDS") will be one of those registered shareholders, and will work with the issuer to distribute copies of those materials to beneficial owners through the network of CDS participants holding securities on behalf of those beneficial owners. While an issuer may be expected to use reasonable efforts to help facilitate distribution of those materials to beneficial owners by CDS and its participants, ensuring that they do in fact reach all beneficial owners is outside the issuer's control. The commenter recommends that the requirement to deliver the notice to security holders should be clearly limited only to registered shareholders, with the possible addition of a requirement that the issuer take certain reasonable steps to bring the rights offering to the attention of beneficial owners (such as, for example, a requirement to issue a press release containing some or all of the information prescribed by the notice). |

|

|

|

|

||||

|

|

|

One commenter noted that printing and mailing of a disclosure document to all security holders involves a significant amount of time and cost, and believed the CSA should allow issuers to file both the Notice and Circular electronically and issue a news release to provide notice of the proposed rights offering, rather than require the Notice to be mailed to security holders. This will reduce the time required to complete a rights offering. Beneficial holders are not sent a rights certificate, so the requirement to mail the Notice to all security holders will lead to additional time and expense. |

|

|

|

|

||||

|

|

|

In one commenter's view, the proposed requirement to send a copy of the Notice to security holder would add an unnecessary expense to the rights offering process. The commenter would propose that that requirement be removed and replaced with an obligation on the issuer to issue a press release containing the information set forth in the Notice, concurrently with the filing of the Notice on SEDAR. |

|

|

|

|

||||

|

|

|

The commenter's view is that any effort which results in a reduction in the cost to raise capital is welcomed by the commenter's members. In the commenter's view, the proposed requirement to deliver a paper copy of the Notice to security holders should not be necessary if the issuer issues a press release containing the information in the Notice, files the Notice on SEDAR and posts the Notice on the issuer's website. In any event, issuers whose securities have been issued and are maintained on a book-entry only basis should not be required to deliver a paper copy of the Notice if the issuer satisfies these conditions. |

|

|

|

|

||||

|

14 |

No |

Six commenters did not see challenges with requiring the issuer to send a paper copy of the notice. |

We acknowledge the comments. |

|

|

|

||||

|

|

|

One commenter does not see challenges with the Notice as it mostly goes to intermediaries. |

|

|

|

|

||||

|

|

|

One commenter did not see a challenge as there is other continuous disclosure documentation which must be made available to security holders in paper format. |

|

|

|

|

||||

|

|

|

One commenter noted that a reasonable attempt should be made to contact smaller shareholders. |

|

|

|

|

||||

|

|

|

One commenter does not foresee any significant challenges. A requirement to send the Notice to all security holders and make the Circular available on SEDAR is analogous to the use of "notice-and-access" in respect of security holders' meeting materials. The commenter thinks applying the same principles to rights offerings makes sense, up to a point. In respect of the argument that the issuer would be sending rights certificates in any event and therefore should also send the Notice, the commenter noted that rights certificates would only be sent to registered holders. As such, the commenter considers this argument to be only a partial justification for a requirement to send the Notice to beneficial holders as well. Given the importance of a notification of a rights offering, however, the commenter's view is that the requirement to send the Notice to all security holders is justified. |

|

|

|

|

||||

|

|

|

One commenter noted that the issuer should be able to provide delivery of the Notice by electronic means if the shareholder has accepted such method of delivery. If they have not then the Notice should be sent by mail. |

|

|

|

|

||||

|

|

|

One commenter views this change positively as it should greatly reduce the cost of an exempt rights offering without prejudicing investors. |

|

|

|

|

||||

|

15 |

Sending certificates |

One commenter noted that in a number of places in the notice of the Proposed Amendments, reference is made to the requirement to "send certificates" in the context of explaining why the requirement to send the proposed notice on Form 45-106F14 would not be additionally burdensome as certificates will be required to be sent. The commenter does not believe the assumption that is implied, that certificates would generally or broadly be required to be sent, is necessarily correct. Given the prevalence of beneficial owners holding their entitlements indirectly through brokers or other intermediaries, certificates would not broadly be sent as they would be sent only to registered holders. |

We acknowledge the comments. |

|

|

|

||||

|

Question 3b: The Proposed Exemption -- the Notice and Circular -- Do you foresee any challenges with the Circular only being available electronically? |

||||

|

|

||||

|

16 |

Yes |

One commenter strongly recommends that the Notice, if provided electronically, be required to have a specific link to the offering circular (as is required for delivery for the Fund Facts document). The commenter is concerned that retail investors will find it difficult to access the offering circular if it is simply made available on SEDAR. Many retail investors are unlikely to be familiar with SEDAR, which can be difficult to navigate. It is also clear that fewer retail investors will review the offering circular if it is not delivered to them but rather only made available (given what the commenter has learned from behaviour economics). If the issuer is unable to deliver to certain shareholders electronically, the Notice should be sent with clear instructions on how to access the offering circular electronically and also a telephone number should be provided for those who wish to obtain a hard copy of it (at no expense to the shareholder). |

We acknowledge the comments. |

|

|

|

||||

|

|

|

|

|

We have included in the Notice a clear statement directing security holders to where they can access or obtain a copy of the Rights Offering Circular. |

|

|

||||

|

17 |

No |

Five commenters did not see any challenges with the Circular only being available electronically. |

We acknowledge the comments. |

|

|

|

||||

|

|

|

One commenter did not see a challenge, as many Canadian investors are familiar and proficient with SEDAR. |

|

|

|

|

||||

|

|

|

One commenter did not see any challenges if a Notice is sent pointing shareholders to where it can be found electronically (company website or SEDAR, etc.). |

|

|

|

|

||||

|

18 |

Access to internet |

One commenter expects that a small minority of security holders may not have access to the internet, so there is the potential for prejudice to those persons. The commenter thinks it is outweighed by the benefit to issuers of being able to avoid the cost of printing and mailing hard copies of the Circular. |

We acknowledge the comments. |

|

|

|

||||

|

Question 4a: The Proposed Exemption -- the Circular -- Have we included the right information for issuers to address in their disclosure? |

||||

|

|

||||

|

19 |

Yes |

Five commenters indicated we included the right information. |

We acknowledge the comments. |

|

|

|

||||

|

|

|

One commenter thought the proposed changes cover the key areas. |

|

|

|

|

||||

|

|

|

One commenter noted that information about the business of the issuer will be readily available from other sources. Inclusion of additional information would unduly lengthen the Circular. |

|

|

|

|

||||

|

|

|

One commenter believes that the proposed prescribed information is sufficient. |

|

|

|

|

||||

|

20 |

No |

One commenter would add additional information that would reasonably be expected to impact the underlying share price throughout the rights offering, such as if quarterly results are due to be released during the rights offering or a dividend is due to go ex and details thereof, etc. |

We have added a requirement for the issuer to disclose any material facts and material changes that have not yet been disclosed and to include a statement that there are no undisclosed material facts or material changes. |

|

|

|

||||

|

|

|

One commenter noted that there is much required disclosure about issuers' future financial circumstances (e.g. at the top of Part 2 of the Proposed Amendment), and it strikes the commenter that it is far too definitive and needs to be softened to reflect the fact that there will be much uncertainty about future cash requirements, etc. (forward looking disclosure). |

We thank the commenter for their input on future financial circumstances. We note that the instructions to the Rights Offering Circular remind issuers disclosing forward-looking information in the Rights Offering Circular that they must comply with the disclosure requirements of Part 4A.3 of NI 51-102. |

|

|

|

||||

|

Question 4b: The Proposed Exemption -- the Circular -- Is there any other information that would be important to investors making an investment decision in the rights offering? |

||||

|

|

||||

|

21 |

Yes |

One commenter noted it may be advisable to include a "recent developments" section to allow for disclosure regarding any issues that the board of the issuer believes may be relevant to shareholders. |

We have added a requirement for the issuer to disclose any material facts and material changes that have not yet been disclosed and to include a statement that there are no undisclosed material facts or material changes. |

|

|

|

||||

|

|

|

As noted above, one commenter noted the Circular should also include any additional information that would reasonably be expected to impact the underlying share price. |

We acknowledge the comments about fractional rights. We have changed the question to "Will we issue fractional underlying securities on exercise of rights?". |

|

|

|

||||

|

|

|

One commenter noted question 35 in the Circular asks "Will we issue fractional rights?" The commenter thinks the issue will more frequently be whether fractional underlying securities will be issued on the exercise of rights, and suggests the question be amended accordingly. |

With respect to the comment on disclosure of underwriters and stand-by guarantors, we note that section 24 of Form 45-106F15 requires disclosure of stand-by guarantors including their fees and whether they are a related party. Sections 27 and 28 of Form 45-106F15 require disclosure of the managing dealers and soliciting dealers including disclosure of their fees and conflicts. We think the required disclosure is sufficient. |

|

|

|

||||

|

|

|

One commenter suggests that the lead underwriters or stand-by guarantors should be identified and any fees paid in respect of the stand-by fee and any/or any underwriting fee in the aggregate should be disclosed. The circumstances in which the underwriting or stand-by guarantee can be withdrawn also should be disclosed. |

|

|

|

|

|

The interests of persons involved in the offer and any conflicts of interest should be identified and avoided, and/or appropriately managed. |

|

|

|

|

||||

|

22 |

No |

Two commenters indicated that there is no other information that would be important to investors. |

We acknowledge the comments. |

|

|

|

||||

|

Question 5: The Proposed Exemption -- the Closing News Release -- Do you think that this disclosure will be unduly burdensome? If so, what disclosure would be more appropriate? |

||||

|

|

||||

|

23 |

No |

Five commenters did not think this disclosure would be burdensome. |

We acknowledge the comments. |

|

|

|

||||

|

|

|

One commenter thought the closing news release disclosure is appropriate. |

With respect to the comment about full disclosure of all details of the rights issue, we thank the commenter for their input. We think the disclosure requirements of the closing news release, including the requirement to separate out the securities distributed under both the basic subscription privilege and additional subscription privilege as between insiders and all other persons, as a group, are appropriate. |

|

|

|

||||

|

|

|

One commenter thought the proposed disclosure in a closing news release is appropriate, and that such information should be readily available to the issuer, and not burdensome to provide. |

We acknowledge the comment about information on insiders. We have revised the disclosure requirements in subparagraphs 2.1(5) (b)(i) and 2.1(5)(c)(i) of NI 45-106 so that disclosure is only required to the knowledge of the issuer after reasonable enquiry. |

|

|

|

||||

|

|

|

One commenter noted that issuers should have ready access to the requisite information. |

|

|

|

|

||||

|

|

|

One commenter did not think the disclosure would be unduly burdensome but also thought disclosure should include all statistics on the result of the rights offering. Full disclosure of all details of the rights issue, including information such as what percentage of subscribing shares requested the additional subscription privilege (and not just the number subsequently distributed), are essential in establishing a true picture of demand by shareholders. Partial disclosure could allow obfuscation by management of the true pattern of shareholder demand. |

|

|

|

|

||||

|

|

|

One commenter does not believe that the information required to be disclosed in the closing press release will be unduly burdensome. However, the commenter notes that the issuer may not necessarily know, at the time of closing, the number of shares issued to persons that were insiders prior to the rights offering or who become insiders as a result of the rights offering, in either case where the security holder is an insider solely as a result of holding 10% of share of the issuer's outstanding voting securities and disclosure of the holder's securities of the issuer is known only as a result of insider reports and/or early warning filings. The commenter would suggest that, in those circumstances, the issuer be entitled to rely on SEDAR filings for purposes of its closing press release disclosures or that the disclosure requirement be removed on the basis that the insider will have an obligation to make the disclosure as required by applicable securities laws. |

|

|

|

|

||||

|

Question 6a: The Proposed Exemption -- Trading of Rights -- Should we continue to allow rights to be traded? If so, why? |

||||

|

|

||||

|

24 |

Yes |

Six commenters said we should continue to allow rights to be traded. |

We acknowledge the comments. We agree that we should continue to allow rights to be traded. |

|

|

|

||||

|

|

|

One commenter thought that rights should trade to ensure that shareholders who can't exercise get some value for the discounted offering. |

|

|

|

|

||||

|

|

|

One commenter noted it is extremely important that rights should be allowed to be traded. The trading of rights improves the efficiency and effectiveness of the capital raising process, as it increases the likelihood of a fully subscribed offering, and also provides a much more fair process for all shareholders. Those shareholders that are not in a position to obtain or exercise their rights due to jurisdictional or other issues, are able to obtain the benefits of the rights offering by trading the rights. By making the process more fair and more likely to provide the issuer with a fully subscribed offering, the exemption will be more widely utilized. |

|

|

|

|

||||

|

|

|

One commenter believes that from an investor prospective, rights should continue to be traded as such trading permits investors to monetize their rights in the event they do not have access to sufficient liquid funds to satisfy the exercise price. Allowing rights to trade may also have the benefit of setting a tangible value to the rights in the event of a civil lawsuit for misrepresentation. Issuers can also benefit in these circumstances, because the capital raising objective of a rights offering may be defeated if the take up of the securities by existing security holders is low due to lack of funds. |

|

|

|

|

||||

|

|

|

One commenter strongly believes that the CSA should continue to allow rights to be traded. The commenter was generally of the view that rights offerings are inherently fair in that they afford all existing security holders the opportunity to maintain their pro rata position in the issuer. Permitting trading of rights also allows security holders who do not wish to, or are ineligible to, participate in the rights offering the ability to sell their rights to investors who wish to participate in the offering. This enables the issuer to raise capital and means security holders who are ineligible to participate in the rights offering are not diluted without compensation. |

|

|

|

|

||||

|

|

|

The commenter does not believe that the trading of rights adds complexity or cost to a rights offering. The Exchanges do not charge a listing fee to the issuer for the listing of rights. If the securities underlying the rights are of a listed class, the Exchanges will require notice of the offering at least five trading days prior to the record date, whether or not the rights will trade, in order to set the ex-distribution date and notify the market by issuing a bulletin as described in the response to question 2 above. Therefore, the commenter does not believe that permitting trading of the rights will add to the timeline for a rights offering, particularly if the minimum exercise period is reduced to 10 business days. The Exchanges are also considering amendments to their rules and policies to reduce the period of time between when the Exchange is provided with the required documentation and the record date. Under current TSX and TSX Venture rules, rights that have received all required regulatory approvals are automatically listed if the rights entitle security holders to purchase securities of a listed class. The commenter believes that the CSA should continue to allow rights to be traded. |

|

|

|

|

||||

|

|

|

One commenter agrees that the trading of rights can add complexity to the rights offering, but the commenter thinks the ability to make rights saleable is important. The commenter agrees with the arguments noted in the question with respect to monetization and the increased likelihood that saleable rights will be exercised. To expand on the argument in respect of foreign security holders, even if the sale generates little or no return for the foreign holders, it is still better than excluding them altogether and issuers should continue to be entitled to make that election. |

|

|

|

|

||||

|

|

|

One commenter believes that rights should be allowed to be listed and traded in order to permit shareholders to elect to monetize the rights (particularly non-resident investors); and to encourage greater levels of participation in the rights offering and therefore the amount of proceeds raised. |

|

|

|

|

||||

|

25 |

No |

One commenter did not think we should allow rights to trade. |

We thank the commenter for their input; however, we think that rights should be allowed to trade. |

|

|

|

||||

|

26 |

Research |

One commenter encouraged the CSA to carefully examine this issue, including any empirical evidence such as the research done by Insead, and consider how the individual countries' regulations impact on what are the costs and benefits to restricting tradability and what regime most improves shareholder value. In addition, the CSA needs to examine the impact of tradability or non-tradability (and other rules) on the ability of shareholders who are foreign to take up the rights; or Canadian shareholders ability to participate or be compensated in respect of a rights offering of a foreign issuer. |

We acknowledge the comment. We have considered the research to which the commenter refers. |

|

|

|

||||

|

|

|

The commenter noted that recent research has found that investors desire rights tradability and react better to rights offerings with tradable rights. There is a greater potential for shareholder abuse if rights are not tradable. The commenter suggests that the CSA should examine the existing research to determine what type of regime most enhances shareholder value. In particular, questions to be examined include: |

We think, in the Canadian context, that the benefits of allowing rights to trade outweigh any costs. |

|

|

|

|

|

-- Is shareholder value enhanced in those countries that allow for choice by issuers in tradability of rights versus mandating tradability? |

|

|

|

|

|

-- Is shareholder value enhanced by setting out conditions for trading restrictions? (in the UK and Hong Kong, offerings without tradable rights are called "open offers" and are subject to a separate set of regulations including discount limits (10% in the UK)). |

|

|

|

|

|

-- Do issuers perform better after offerings with tradable rights versus those with non-tradable rights? |

|

|

|

|

|

-- What are the reasons issuers make rights non-tradable? |

|

|

|

||||

|

Question 6b: The Proposed Exemption -- Trading of Rights -- What are the benefits of not allowing rights to be traded? |

||||

|

|

||||

|

27 |

Benefits |

One commenter thought the only advantage is if the issue could be closed quicker i.e. 10 days total, however the commenter thought they should trade for everyone to benefit. |

We thank the commenters for their input. We acknowledge there may be benefits of not allowing rights to be traded; however, we think that the costs of not allowing rights to be traded outweigh the benefits. |

|

|

|

||||

|

|

|

One commenter noted the benefits of not allowing rights to be traded are reducing cost to the issuing corporate / sponsoring bank. The proposed changes in timeline for rights exercise will have a materially larger impact than the 'few days' additional to the timeline required for trading. Potentially the cost of trading in proportion to the size of the capital to be raised in the rights issue could be estimated to set a minimum size rights above which trading of rights should be expected. |

|

|

|

|

||||

|

|

|

One commenter noted if the rights are not allowed to be traded the rights offering is less complex and only existing security holders are entitled to participate. |

|

|

|

|

||||

|

|

|

One commenter noted that by not allowing the rights to trade, issuers may be less vulnerable to unsolicited attempts to effect a change of control at a discount to the market, as aggregation of rights (and the underlying securities) would be more difficult. However, the commenter believes that the benefits of permitting trading in the rights generally outweigh any benefit of prohibiting trading. |

|

|

|

|

||||

|

28 |

No benefits |

Two commenters did not see any benefits of not allowing rights to be traded. |

We acknowledge the comments. |

|

|

|

||||

|

Question 6c: The Proposed Exemption -- Trading of Rights -- Should issuers have the option of not listing rights for trading? |

||||

|

|

||||

|

29 |

Yes |

Four commenters thought issuers should have the option of not listing rights for trading. |

We thank the commenters for their input. We have not seen evidence that the listing of rights for trading adds any significant cost or time to an offering. Accordingly, we think the benefits to the security holder of listing rights for trading outweigh the costs to the issuer. |

|

|

|

||||

|

|

|

One commenter stated that while listing rights will provide issuers with the ability to raise capital through a broader potential group of investors, they should be provided with the opportunity to decline a listing if it becomes cost prohibitive. |

|

|

|

|

||||

|

|

|

One commenter noted an option should be available if the cost of trading is prohibitive relative to capital to be raised. In any extent, the issuing company should ensure that the rights are transferable between entities to reduce settlement problems over ex. date. |

|

|

|

|

||||

|

|

|

One commenter noted that if, for example, an issuer has a very small foreign security holder base and the benefit to those persons would not justify the cost to the issuer of listing the rights, the issuer should have the option of not listing rights for trading. |

|

|

|

|

||||

|

|

|

One commenter believes that issuers should have the option of not listing rights for trading, as the cost of the listing may not be warranted in the circumstances. |

|

|

|

|

||||

|

30 |

No |

Two commenters thought issuers should not have the option of not listing rights for trading. |

We acknowledge the comments. |

|

|

|

||||

|

|

|

One commenter noted in order to provide a fair process to all security holders, they do not believe that issuers should have the option of not listing rights for trading. |

|

|

|

|

||||

|

Question 7a: The Proposed Exemption -- the Review Period -- Do you agree with our proposal to remove pre-offering review? |

||||

|

|

||||

|

31 |

Yes |

Six commenters agreed with removing pre-offering review. |

We acknowledge the comments. |

|

|

|

||||

|

|

|

One commenter indicated that removing pre-offering review for rights offerings by reporting issuers, which are already subject to continuous disclosure rules and the civil liability for secondary market disclosure regime should result in an increased use of the exemption. |

|

|

|

|

||||

|

|

|

One commenter supported the proposal to remove the pre-offering review. The commenter believes that reducing the standard timetable and associated costs of completing a rights offering are key to increasing the viability of rights offerings as a useful way for listed issuers to access capital. |

|

|

|

|

||||

|

|

|

In one commenter's experience, the regulatory review process is a disincentive to completing a rights offering and the benefits conferred by such process do not justify the cost to issuers and security holders of the inability to conduct rights offerings on a reasonable and predictable time frame. |

|

|

|

|

||||

|

|

|

One commenter agrees with the proposal to eliminate the pre-offering review of the Circular. In the commenter's view, this proposal should reduce offering costs and management resources, and enable issuers to complete a rights offering more quickly and efficiently. Concerns over the elimination of a regulatory review should be adequately addressed by the introduction of statutory liability for disclosure in the Circular. |

|

|

|

|

||||

|

32 |

No |