Register today for OSC Dialogue 2024: Inviting, thriving and secure capital markets

CSA Notice of Amendments to NI 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer and Companion Policy 54-101CP Communication with Beneficial Owners of Securities of a Reporting Issuer and Companion Policy 54-101CP

CSA Notice of Amendments to NI 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer and Companion Policy 54-101CP Communication with Beneficial Owners of Securities of a Reporting Issuer and Companion Policy 54-101CP

CSA Notice of

Amendments to National Instrument 54-101

Communication with Beneficial Owners of Securities

of a Reporting Issuer

and Companion Policy 54-101CP

Communication with Beneficial Owners of Securities

of a Reporting Issuer

and

Amendments to

National Instrument 51-102 Continuous Disclosure Obligations and

Companion Policy 51-102CP Continuous Disclosure Obligations

November 29, 2012

Introduction

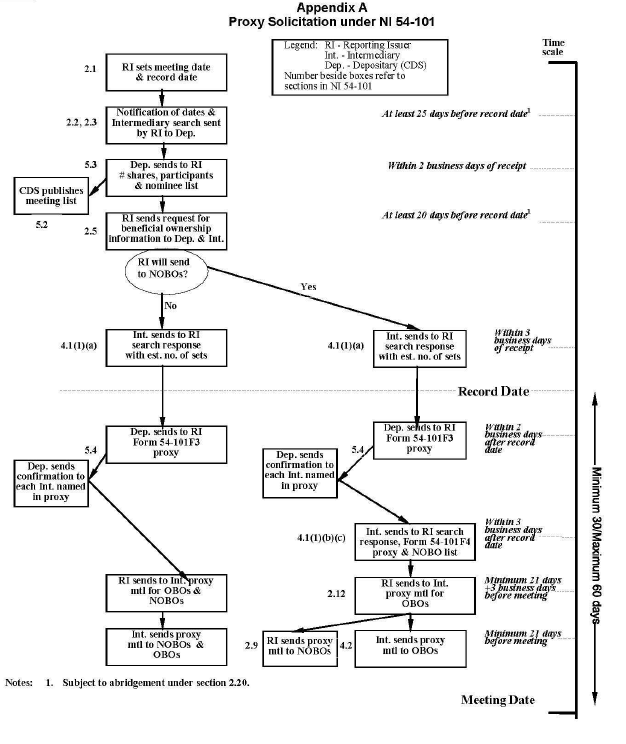

We, the members of the Canadian Securities Administrators (CSA), are adopting amendments (the Amendments) intended to improve the process by which reporting issuers send proxy-related materials to and solicit proxies and voting instructions from registered holders and beneficial owners of their securities (the Shareholder Voting Communication Process).

The Amendments are set out in the following materials (the Materials) included in the relevant Annexes to this notice:

• an amendment instrument to National Instrument 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer (NI 54-101), including the enactment of a new Form 54-101F10 Undertaking, and the following forms:

• Form 54-101F2 Request for Beneficial Ownership Information;

• Form 54-101F5 Electronic Format for NOBO List;

• Form 54-101 F6 Request for Voting Instructions Made by Reporting Issuer;

• Form 54-101F7 Request for Voting Instructions Made by Intermediary;

• Form 54-101F9 Undertaking (Annex B);

• an amendment instrument to National Instrument 51-102 Continuous Disclosure Obligations (NI 51-102) and Form 51-102F5 Information Circular (Annex C); and

• changes to:

• Companion Policy 54-101CP Communication with Beneficial Owners of Securities of a Reporting Issuer (54-101CP) (Annex D); and

• Companion Policy 51-102CP Continuous Disclosure Obligations (51-102CP) (Annex E).

The Materials are also available on the websites of CSA members, including the following:

• www.bcsc.bc.ca

• www.albertasecurities.com

• www.osc.gov.on.ca

• www.lautorite.qc.ca

• www.msc.gov.mb.ca

• www.nbsc-cvmnb.ca

• www.gov.ns.ca/nssc

• www.sfsc.gov.sk.ca

In some jurisdictions, ministerial approvals are required for the implementation of the Amendments. Provided all necessary ministerial approvals are obtained, the Amendments will come into force on February 11, 2013. However, please refer to Effective Dates for an explanation of the dates on which specific provisions of the Amendments will take effect.

Substance and Purpose

The most significant features of the Amendments are as follows:

• providing reporting issuers with a new notice-and-access mechanism to send proxy-related materials to registered holders and beneficial owners of securities (collectively, shareholders);

• simplifying the process by which beneficial owners are appointed as proxy holders in order to attend and vote at shareholder meetings; and

• requiring reporting issuers to provide enhanced disclosure regarding the beneficial owner voting process.

Background

We published proposed versions of the Amendments on April 9, 2010 and again on June 17, 2011 (the 2011 Proposal). For additional background and the summary of comments received during the first and second publication periods, please refer to the notices we published on April 9, 2010 and June 17, 2011.

Summary of Written Comments Received by the CSA

During the last comment period, we received submissions from eight commenters. We have considered the comments received and thank all of the commenters for their input. The names of commenters are contained in Annex A of this notice as well as a summary of their comments, together with our responses.

Summary of Changes to the Proposed Instrument/Policy

The following outlines the main changes from the 2011 Proposal. As these changes are not material, we are not republishing the Amendments for a further comment period.

1. Notice-and-access (sections 2.7.1 to 2.7.8 of NI 54-101; sections 9.1.1 to 9.1.4 of NI 51-102)

Under notice-and-access, a reporting issuer can deliver proxy-related materials by:

• posting the relevant information circular (and if applicable, other proxy-related materials) on a website that is not SEDAR; and

• sending a notice informing beneficial owners that the proxy-related materials have been posted, and explaining how to access them.

We have made the following changes to the notice-and-access provisions.

(a) Record date for notice

In order to use notice-and-access, a reporting issuer must set the record date for notice of the meeting date to be at least 40 days before the meeting. The 2011 Proposal would have permitted the record date to be set between 30 to 60 days before the meeting. The change to at least 40 days is intended to provide sufficient time for the website posting and delivery requirements under notice-and-access. See Annex A, Comment 1(g) for a further discussion of this issue.

(b) Notice in advance of first use of notice-and-access

A reporting issuer must file a notification of meeting and record dates containing information about the meeting and its use of notice-and-access on SEDAR. Where the issuer is using notice-and-access for the first time, the notification must be filed at least 25 days before the record date for notice (i.e., at least 65 days before the date of the meeting). This requirement replaces the proposed advance notice mechanism in the 2011 Proposal, which would require that a reporting issuer provide advance notice via a news release and a website posting 3 to 6 months before the expected date of the meeting. We believe this provides sufficient advance notice to shareholders. See Annex A, Comment 1(c) for a further discussion of this issue.

For meetings subsequent to the first meeting for which an issuer uses notice-and-access, the issuer can abridge the timeline for filing the notification of meeting and record dates to 3 business days before the record date for notice.

(c) Contents of notice package

Under notice-and-access, an issuer will send to shareholders a notice package that contains a notice and the relevant voting document (a form of proxy or voting instruction form as applicable).

(i) Notice

The notice must:

• contain basic information about the meeting and the matters to be voted on;

• explain how to obtain a paper copy of the information circular (and if applicable, annual financial statements and annual management discussion and analysis (MD&A)); and

• explain in plain language the notice-and-access process.

The 2011 Proposal as drafted contemplated that the notice-and-access explanation would be a separate document from the notice. The present requirement provides that the explanation will form part of the Notice. Note, however, that s.1.3 of NI 54-101 also is being amended to give issuers the flexibility to combine or substitute any form or document required by NI 54-101 with another form or document, provided the information required by NI 54-101 is included.{1}

We have also made changes to the information that must be included in the notice-and-access explanation:

• The explanation need only state an estimated date and time by which an issuer should receive a request for paper copies. The 2011 Proposal required a firm date and time to be specified.

• The explanation need only state the sections of the information circular where disclosure regarding each matter or group of related matters identified in the notice can be found. The 2011 Proposal required page numbers to be specified.

(ii) Additional material

An issuer generally is prohibited from including material in the notice package other than the notice and the relevant voting document. However, an issuer can include financial statements which are to be approved at the meeting and MD&A related to such financial statements, which documents may be part of an annual report. Sections 2.7.1(2)(b) of NI 54-101 and 9.1.1(2)(b) of NI 51-102) have been modified from the 2011 Proposal to make this concept clearer.

(d) Sending of annual financial statements and MD&A as part of proxy-related materials

In the Notice accompanying the 2011 Proposal, we asked questions about how notice-and-access should interact with the sending of annual financial statements and annual MD&A. Having considered the issue, we think that an issuer should be able to use notice-and-access to send annual financial statements and annual MD&A pursuant to s. 4.6(5) of NI 51-102. Notice-and-access is consistent with the principles for electronic sending set out in National Policy 11-201 Delivery of Documents by Electronic Means. We therefore provide new policy guidance in 51-102CP to that effect. The net effect is that an issuer can choose between:

• sending annual financial statements and annual MD&A pursuant to the annual request mechanism set out in s. 4.6(1) of NI 51-102; or

• sending annual financial statements and annual MD&A under s. 4.6(5) of NI 51-102, for which notice-and-access is an acceptable delivery method.

An issuer who chooses the second option and uses notice-and-access must modify the information in the notice required by s. 2.7.1(1) of NI 54-101 and s. 9.1.1(1) of NI 51-102 to refer to the annual financial statements and annual MD&A.

(e) Other significant features of notice-and-access

(i) Methods of sending notice package

A notice package can be sent by mail or, if prior consent has been obtained, electronically. In addition, if a service provider offers an e-delivery method (e.g., an email is sent with hyperlinks to all the proxy-related materials) that is distinct from notice-and-access and that is otherwise compliant with securities legislation, such delivery method can continue to be used in conjunction with notice-and-access.

(ii) Website posting

There are a number of requirements relating to the posting of proxy-related materials on the non-SEDAR website and these generally remain unchanged from the 2011 Proposal. One change is that proxy-related materials need only be posted for one year from the date of posting. This harmonizes the posting period with the period for which a reporting issuer has an obligation to fulfill requests for paper copies of proxy-related materials in s. 2.7.1(1)(f)(ii) of NI 54-101.

(f) Use of notice-and-access for non-management solicitations

We have added a new s. 2.7.7 that is intended to clarify that notice-and-access can be used to deliver proxy-related materials to beneficial owners of a reporting issuer's securities in connection with a proxy solicitation that is not a solicitation by management of the reporting issuer.{2}

2. Simplification of beneficial owner proxy appointment process (sections 2.18 and 4.5 of NI 54-101)

An intermediary or management of a reporting issuer, as applicable, who has voting authority over the securities owned by a beneficial owner, must appoint the beneficial owner or its nominee as a proxy holder with authority to vote on any matters that come before the meeting. We have modified the 2011 Proposal to clarify that the required grant of authority is subject to any prohibitions under corporate law. We also have removed the provision that a beneficial owner can instruct the intermediary or reporting issuer management, as applicable, to limit the voting authority. See Annex A, Comment 5 for a further discussion of these changes.

3. Enhanced disclosure of voting process (s. 2.16 of NI 54-101 and Item 4.3 of Form 51-102F5)

Issuers must provide enhanced disclosure of the voting process in the information circular. We have modified the 2011 Proposal so that where the reporting issuer does not intend to pay for intermediaries to deliver proxy-related materials to OBOs, the information circular must include a statement that the OBO may not receive proxy-related materials unless the OBO's intermediary assumes the costs of delivery.

4. NOBO list

A reporting issuer or other person may request a NOBO list without using a transfer agent. We have modified the 2011 Proposal to add a self-certification process, whereby the requester certifies in the Form 54-101F9 Undertaking that accompanies the request for a NOBO list that it has the technological capacity to receive the list.

5. Other changes

We have made additional changes to several Forms that were not part of the 2011 Proposal.

(a) Form 54-101F2 Request for Beneficial Ownership Information

The following changes are intended to improve the process for obtaining beneficial ownership information:

• adding the reporting issuer's French name, if applicable (Item 1);

• adding a contact person at the reporting issuer to deal with invoices, if different from the person who making the request (Item 2);

• having the reporting issuer explicitly state whether it wants securityholder materials to be sent electronically where consent has been obtained from beneficial owners (Items 6.7, 7.9, 8.5 and 9.7);

• having the reporting issuer explicitly state whether securityholder materials are to be sent to all beneficial owners of securities (including beneficial owners that have declined to receive them), only beneficial owners who have requested to receive all securityholder materials, or only beneficial owners who have requested to receive all securityholder materials or special meeting materials (Items 6.9, 7.11, 8.6 and 9.8); and

• where the reporting issuer wishes to use stratification, clarifying that a reporting issuer should discuss with the relevant intermediary what criteria the intermediary is able to apply (Items 7.12 and 9.9).

(b) Form 54-101F5 Electronic Format for NOBO List

We are replacing the existing form with a new one that includes a new field for stratification instructions (to the extent those have been obtained) under notice-and-access.

Effective Dates

The Amendments will come into force on February 11, 2013, subject to the following implementation dates:

• notice-and-access can only be used in respect of meetings that occur on or after March 1, 2013;

• a reporting issuer may request beneficial ownership information without using a transfer agent for the sole purpose of obtaining a NOBO list only on or after February 15, 2013;

• a person or company need only provide the new Form 54-101F10 Undertaking for a request to send materials indirectly to beneficial owners made on or after February 15, 2013;

• the new Part 7 of NI 54-101 only applies to NOBO lists requested on or after February 15, 2013 and requests to send materials indirectly to beneficial owners made on or after February 15, 2013; and

• a reporting issuer may rely on the exemptions in sections 9.1.1 of National Instrument 54-101 and 9.1.5 of NI 51-102 only in respect of a meeting that takes place on or after February 15, 2013.

Local Matters

Annex F is being published in any local jurisdiction that is making related changes to local securities laws, including local notices or other policy instruments in that jurisdiction. It also includes any additional information that is relevant to that jurisdiction only.

Questions

If you have any questions, please refer them to any of the following:

{1} The original s. 1.3 only applied to forms required by NI 54-101, and not documents generally.

{2} The notice-and-access provisions in NI 51-102 contain an equivalent concept.

ANNEX A

SUMMARY OF COMMENTS AND RESPONSES ON NOTICE AND REQUEST FOR COMMENT

Amendments to

National Instrument 54-101

Communication with Beneficial Owners of Securities of a Reporting Issuer and Companion Policy 54-101CP

Communication with Beneficial Owners of Securities of a Reporting Issuer

Amendments to

National Instrument 51-102 Continuous Disclosure Obligations and

Companion Policy 51-102CP Continuous Disclosure Obligations

This annex summarizes the written public comments we received on the 2011 Proposal. It also sets out our responses to those comments.

List of Parties Commenting on the 2011 Proposal

• Broadridge Financial Solutions, Inc.

• Canadian Bankers Association

• Computershare Trust Company of Canada, Computershare Investor Services Inc. and Georgeson Shareholder Communications (joint comment letter)

• Investment Industry Association of Canada

• Mouvement d'éducation et de défense des actionnaires

• National Bank of Canada

• Osler, Hoskin & Harcourt LLP

• Securities Transfer Association of Canada

1. Notice-and-access

(a) General comments on notice-and-access

We received a comment that notice-and-access should not be introduced without further study of the familiarity of shareholders with websites and appropriate regulations to facilitate their access and review of information circulars.

Response: Our view is that the notice-and-access provisions strike an appropriate balance between shareholder access to materials and a more streamlined delivery process. We will monitor the implementation of notice-and-access to assess the impact on shareholders.

We also received several comment letters recommending that investment funds be permitted to use notice-and-access.

Response: We are not prepared at this time to extend notice-and-access to investment funds without further study. We will consider this issue at a later date.

(b) Notice and permitted information in the notice package

We received a number of detailed comments on proposed s. 2.7.1 to 2.7.6 of NI 54-101, which set out the notice-and-access process. The main comments comprised the following recommendations:

• allowing or requiring all the requisite information to be provided in a single notice document, rather than a notice and a separate document explaining notice-and-access;

• removing the requirement to reference page numbers in the information circular;

• requiring a factual description of matters to be voted on only if the matter to be voted on is not otherwise fully described in the voting instruction form or proxy;

• removing the requirement to specify a date and time by which a request for a paper copy of the information circular must be received;

• removing the requirement for the reporting issuer to explain its reason for using notice-and-access;

• requiring the reporting issuer to disclose whether it is paying for intermediaries to forward proxy-related materials to OBOs.

Response: We generally have accepted most of the recommendations specified above, although in some cases we have made modifications to the specific alternatives proposed. We have, among other changes, amended s. 1.3 of NI 54-101 to clarify that any required document (and not just forms) that a person or company is required to send can be substituted for another form or document or combined with another form or document, so long as the form or document used requests or includes the same information contemplated by the required form or document.

However, we are not adopting the recommendation regarding disclosure of whether the reporting issuer is paying for intermediaries to forward proxy-related materials to OBOs. We do not think this information needs to be included in the notice, as it is already provided in the notification of meeting and record dates which is filed on SEDAR. We strongly encourage all market participants to work together to develop industry best practices and standards for the notice to make it as user-friendly and consistent for investors as possible.

(c) Notice in advance of first use of notice-and-access

We received several comments that questioned the utility of the requirement in proposed s. 2.7.2 that a reporting issuer provide advance notice not more than 6 months and not less than 3 months before the first meeting for which notice-and-access would be used. Several alternatives were suggested, including that the notification of meeting and record dates required by s. 2.2 of NI 54-101 filed on SEDAR would be adequate. It was noted by one commenter that shareholders would be unlikely to act upon three months advance notice to educate themselves on notice-and-access; that the need for advance notice for a reporting issuer adopting notice-and-access for the first time would diminish as shareholders became increasing familiar with the process; and that the concept of an "expected date" for the meeting is an unworkable standard.

Response: We have adopted this recommendation. A reporting issuer that uses notice-and-access for the first time must file the notification of meeting and record dates, which includes information on whether the issuer will use notice-and-access, on SEDAR at least 25 days before the record date for notice, which in turn must be at least 40 days before the meeting. We think that this greater lead time will enable issuers using notice-and-access for the first time to more smoothly implement notice-and-access. We strongly encourage all market participants to work together to develop industry best practices and standards as notice-and-access is introduced for the first time.

(d) Consent to other delivery methods/Electronic delivery of notice package

We received several comments and questions regarding how notice-and-access will interact with the delivery of proxy-related materials, including annual financial statements and related MD&A.

Response: We have made a number of changes to address these comments. In particular, please see new s. 3.5(2) of 51-102CP, which clarifies that annual financial statements and related MD&A can be sent for purposes of s. 4.6(5) using notice-and-access.

Our understanding is that currently, the primary service provider for intermediaries has a separate e-delivery platform for delivering proxy-related materials which is intended to be distinct from the notice-and-access platform. The guidance clarifies that this type of separate e-delivery platform can be used in conjunction with notice-and-access. In addition, the notice package can also be delivered electronically (subject to obtaining the beneficial owner's consent) if this delivery option is available.

(e) Standing instructions to receive paper copies of information circulars and/or annual financial statements and related MD&A

We received a comment proposing that changes be made to Form 54-101F1 Client Response Form to accommodate standing instructions, and requiring the provision of information on standing instructions in the explanation of notice-and-access required to be sent under s. 2.7.1. Another commenter also noted that some dealers expressed concern around implementation and management of a standing instruction database and that dealers wished to have the opportunity to consider and discuss the changes with regulators and service providers before stating a view.

We also received a comment that a reporting issuer should give effect to standing instructions it receives from registered shareholders whether or not it has taken steps to obtain standing instructions.

Response: The intent of the provisions relating to standing instructions and intermediaries is to permit but not require intermediaries to obtain standing instructions on the inclusion of paper copies of the information circular and/or annual financial statements and related MD&A. It is ultimately the intermediaries' decision (in consultation with service providers) whether to implement operational procedures to obtain standing instructions, and whether, as a result, intermediaries will need to give additional information to clients in Form 54-101F1 Client Response Formregarding provision of standing instructions.

We have not adopted the recommendation that a reporting issuer give effect to standing instructions whether or not it has taken steps to obtain them. To require this would effectively require reporting issuers to implement and manage a database of standing instructions, and we do not think that this measure is warranted at this time.

(f) Stratification

One commenter cautioned that it may be necessary or advisable to limit the criteria applied to stratification and asked for clarification as to what other criteria for stratification it foresees as being acceptable.

Response: The intent of the provisions relating to stratification is to permit but not require stratification to be used by, or available as an option to, reporting issuers and intermediaries. It is ultimately for reporting issuers and intermediaries (in consultation with the various service providers) to decide whether stratification is an appropriate and feasible feature for notice-and-access, subject to the guidance we have provided on the appropriate objectives for stratification. We do not propose to mandate specific permitted stratification criteria, although we will continue to monitor this issue. We strongly encourage market participants to develop best practices for stratification criteria should stratification be introduced as a feature of notice-and-access in the Canadian context. We note that stratification has been a feature of US notice-and-access for several years, and this experience may be helpful to market participants in developing stratification options and best practices.

(g) Record date for notice

A commenter noted that if the record date for notice was set at 30 days before the meeting date as currently permitted in s. 2.1 of NI 54-101, there would be operational challenges for all parties in the process to verify the record date information and send the requisite materials no more than 30 days before the meeting. The commenter requested that s. 2.1 be modified so that the record date for notice under notice-and-access leaves sufficient time for compliance with the posting and delivery requirements.

Response: We have adopted this recommendation.

(h) Collection of information on websites

One commenter noted that there may be some significant practical problems associated with permitting the collection of information on some securityholders (i.e. registered holders) and not others (i.e., beneficial owners) on the website to which proxy-related materials are posted.

Response: It is up to the reporting issuer using notice-and-access, in conjunction with relevant service providers, to determine how to comply with the restrictions on collecting information in a cost-effective manner.

(i) Availability of exemption to use US notice-and-access

A commenter submitted that any issuer that is mandatorily subject to Rule 14a-16 should be able to use US notice-and-access exclusively, and not have to comply with the Canadian notice-and-access requirements. Alternatively, it proposed that any disqualifying criteria from accessing the exemption should be tied solely to the trading volume of the issuer's securities in Canada relative to its trading volume in the United States. Finally, it also proposed that an SEC issuer that voluntarily complies with Rule 14a-16 despite being an exempt "foreign private issuer" under the SEC's rules should also be entitled to rely on the Canadian notice-and-access requirements exemption, subject to whatever disqualification test based on connections to Canada is ultimately adopted.

Response: We are not adopting this recommendation at this time. Although the Shareholder Voting Communication Process in the United States and Canada are broadly similar, there are important differences. These include differences in the mechanisms by which a beneficial owner obtains authority to attend and vote at a meeting and differences in what documents are required to be sent as part of proxy-related materials. The Canadian notice-and-access procedures have been formulated to take these and other specific features of the Canadian Shareholder Voting Communication Process into account. We note that there are a number of exemptions from Canadian securities legislation that also apply to "SEC issuers".

(j) Use of notice-and-access by third parties

A commenter requested clarification on the obligations and restrictions applicable to third parties in using notice-and-access, particularly in light of s. 6.2 of NI 54-101. For example, how would the restriction in s. 2.7.1(2) (requiring the reporting issuer to send a paper copy of the information circular if the notice-and-access package includes any particulars of any matter submitted to the meeting that go beyond what is permitted in s. 2.7.1) apply to third parties?

Response: We have added s. 2.7.7 to address this point. We note that notice-and-access is a delivery mechanism for proxy-related materials, and does not modify any existing legal obligations of third parties such as dissident shareholders in the Shareholder Voting Communication Process.

(k) Miscellaneous comments

We received a number of other detailed drafting and technical comments and have adopted a number of them.

2. Sending "notice only" package when reporting issuer decides not to pay for delivery to OBOs

A commenter asked that we mandate that a reporting issuer who chooses not to pay for an intermediary to forward proxy-related materials to OBOs pay for the forwarding of a "notice only" package, defined as a package without a paper copy of an information circular.

Response: We are not adopting this suggestion at this time, and will consider this issue separately. We note that we would have no concerns if, where a reporting issuer chose not to pay, an intermediary voluntarily sent the "notice only" package to its beneficial owner clients.

3. Indirect sending of securityholder materials by reporting issuer

A commenter took the view that removing the present s. 2.12(2) of NI 54-101 and instead providing guidance in 54-101CP effectively permits an issuer to choose to deliver materials for forwarding to beneficial owners to any office of an intermediary, rather than to the designated agent of that intermediary. The commenter noted that this would impede timely delivery of materials to investors, add costs and reduce the overall efficiency of the delivery process. The commenter also requested that s. 2.12 be amended to clearly require that reporting issuers pay for delivery of material to intermediaries for forwarding.

Response: Our view is that the present s. 2.12(2)'s use of the word "may" can be interpreted as permitting, but not requiring a reporting issuer to deliver materials to the intermediary's agent. This was not the intent of the provision, which was to clarify that a reporting issuer would not have failed to comply with its obligations to send securityholder materials because it followed an intermediary's instruction to send the materials to the intermediary's third-party agent. We have added language to s. 2.7 of 54-101CP to further clarify that we expect reporting issuers to send materials to the agent designated by the intermediary unless alternate arrangements have been made with that intermediary.

We think the wording of s. 2.12 (as amended) clearly states the reporting issuer's obligation to send a proximate intermediary the requisite number of sets of materials specified by the proximate intermediary. A reporting issuer that refuses to send these materials to a proximate intermediary is not complying with its obligations under this section. We have modified the guidance in s. 3.4.1(3) of 54-101CP to further clarify this point.

The same commenter took the view that an issuer should be obligated to deliver materials to all intermediaries in a foreign jurisdiction for forwarding to beneficial owners in that jurisdiction.

Response: NI 54-101 effectively only requires reporting issuers to send proxy-related materials to beneficial owners who hold their securities through intermediaries that are covered by the request for beneficial ownership information. Section 2.5(1) specifies that the request only applies to each proximate intermediary that is:

(a) identified by a depository (currently only CDS) as a participant in the depository holding securities that entitle the holder to receive notice of the meeting or to vote at the meeting; or

(b) listed as an intermediary on the intermediary master list provided by a depository where the intermediary, or a nominee of the intermediary that is identified on the intermediary master list, is a registered holder of securities that entitle the holder to receive notice of the meeting or to vote at the meeting.

We are not adopting this recommendation at this time and will consider this issue separately. In the meantime, we strongly encourage reporting issuers to send proxy-related materials to any intermediary in a foreign jurisdiction who requests them on behalf of beneficial owners.

4. Requests for NOBO lists

A commenter raised a concern that proposed s. 2.5(4) requires an intermediary to make an assessment about whether a person or company requesting a NOBO list has the technological capacity to receive the list. The commenter also noted concerns on the part of dealers about their ability to assess the technological capacities of a wide variety of reporting issuers and third parties, and also about issues that could arise should an intermediary determine not to provide the list. The commenter proposed an alternative self-certification process, whereby the requester certifies as to its technological capacity to receive the list.

Response: We have adopted this recommendation and made changes to the undertaking in Form 54-101F9.

Another commenter recommended that s. 2.5 be amended to not require any request for beneficial ownership information to come through a transfer agent, regardless of whether the request is only for the limited purpose of requesting a NOBO list.

Response: We are not adopting this recommendation.

5. Appointing beneficial owner as proxy holder

A commenter was concerned that requiring a beneficial owner or its nominee appointed under s. 2.18(2) or s. 4.5(2) be given authority to attend, vote and otherwise act for and on behalf of management of the reporting issuer or intermediary (as applicable) could conflict with the laws applicable to certain, largely foreign companies which only permit proxyholders to vote on items set out in the information circular. The commenter also was concerned that requiring that this authority be limited if expressly instructed by a beneficial owner would be difficult to implement.

Response: We have modified the relevant sections to clarify that the required grant of authority is subject to any prohibitions under corporate law. We have removed the reference to express limitations on voting authority by beneficial owner. In our view, a beneficial owner that wishes to provide more limited voting authority can make appropriate arrangements with its appointee without necessarily involving management of the reporting issuer or the intermediary (as applicable).

A commenter requested that proposed s. 2.18 be amended to permit management of the reporting issuer to use the power of substitution in the proxy they hold on behalf of NOBOs (where the reporting issuer is sending proxy-related materials directly to NOBOs) to send proxies instead of VIFs to NOBOs. Conversely, another commenter requested that s. 3.6 of 54-101CP be amended to expressly state that sending proxies instead of VIFs is not permitted.

Response: We are not adopting either recommendation at this time. We will consider this issue at a later date. While we support in principle measures to simplify the voting process of all beneficial owners, we believe the process described above needs to be studied further in the context of the larger Shareholder Voting Communication Process before determining whether it is appropriate to codify it in NI 54-101.

6. Use of alternate forms

A commenter requested that s. 1.3 of NI 54-101 be expanded to a more general provision that allows participants to use forms and documents that are acceptable for the purposes of corporate statutes and for achieving the purpose of NI 54-101. The objective would be to prevent technical non-compliance with the Instrument from being a factor that could potentially invalidate the vote for the meeting under corporate statutes, if otherwise acceptable documentation exists to allow non-registered holders to exercise their rights to vote.

Response: We are not adopting this recommendation at this time. We will consider this issue at a later date. We believe the issue described above is an important one, but that it needs to be studied further in the context of the larger Shareholder Voting Communication Process before determining whether it is appropriate to make the requested changes to NI 54-101.

7. Reconciliation of positions

A commenter called for NI 54-101 to explicitly require intermediaries to:

• Reconcile the files of beneficial ownership data with their registered, depository and nominee positions;

• Give clear direction to the tabulator regarding through which depository, nominee or intermediary securities being voted are held;

• Ensure that any omnibus proxy required from an intermediary or depository through whom they hold shares is being filed; and

• Ensure that a restricted proxy is not issued by the intermediary without verifying that a position has not been voted.

Response: We are not adopting this recommendation at this time. We will consider this issue at a later date. We believe the issue of reconciliation of voting positions is an important one and needs to be studied further in the context of the larger Shareholder Voting Communication Process before determining whether it is appropriate to codify provisions affecting this issue in NI 54-101 and the form those provisions should take.

ANNEX B

AMENDMENTS TO

NATIONAL INSTRUMENT 54-101

COMMUNICATION WITH BENEFICIAL OWNERS

OF SECURITIES OF A REPORTING ISSUER

1. National Instrument 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer is amended by this Instrument.

2. Section 1.1 is amended by

(a) repealing the definition of "legal proxy",

(b) adding the following definition:

"notice-and-access" means

(a) in respect of registered holders of voting securities of a reporting issuer, the delivery procedures referred to in section 9.1.1 of National Instrument 51-102 Continuous Disclosure Obligations, or

(b) in respect of beneficial owners of securities of a reporting issuer, the delivery procedures referred to in section 2.7.1;,

(c) in the definition of "proxy-related materials", adding "or beneficial owners" between "registered holders" and "of the securities",

(d) repealing the definition of "request for voting instructions",

(e) adding the following definition:

"SEC issuer" means an issuer that

(a) has a class of securities registered under section 12 of the 1934 Act or is required to file reports under section 15(d) of the 1934 Act, and

(b) is not registered or required to be registered as an investment company under the Investment Company Act of 1940 of the United States of America, as amended;,

(f) in the definition of "securityholder materials", adding "or beneficial owners" between "registered holders" and "of securities", and

(g) adding the following definition:

"stratification", in relation to a reporting issuer using notice-and-access, means procedures whereby a paper copy of the information circular and, if applicable, the documents in paragraph 2.7.1(2)(b), are included with either or both of the following:

(a) the documents required to be sent to registered holders under subsection 9.1(1) of National Instrument 51-102 Continuous Disclosure Obligations;

(b) the documents required to be sent to beneficial owners under subsection 2.7.1(1);.

3. Subsection 1.3(1) is replaced with the following:

1.3 Use of required forms -- (1) A person or company required to send or use a required form or document under a provision of this Instrument may substitute for that form or document another form or document, or combine the required form or document with another form or document, if the substituted or combined form or document requests or includes the same information contemplated by the form or document that is otherwise required..

4. Paragraphs 2.2(2)(g) and (h) are replaced with the following:

(g) the classes or series of securities that entitle the holder to vote at the meeting;

(h) whether the meeting is a special meeting;.

5. Subsection 2.2(2) is amended by adding the following paragraphs:

(i) whether the reporting issuer is sending proxy-related materials to registered holders or beneficial owners using notice-and-access and, if stratification will be used, the types of registered holders or beneficial owners who will receive paper copies of the information circular or other proxy-related materials;

(j) whether the reporting issuer is sending the proxy-related materials directly to NOBOs; and

(k) whether the reporting issuer intends to pay for a proximate intermediary to send the proxy-related materials to OBOs..

6. Subsection 2.5(4) is replaced with the following:

(4) A reporting issuer that requests beneficial ownership information under this section must do so through a transfer agent..

7. Section 2.5 is amended by adding the following subsection:

(5) Despite subsection (4), a reporting issuer may request beneficial ownership information without using a transfer agent for the sole purpose of obtaining a NOBO list if the reporting issuer has provided an undertaking using Form 54-101F9..

8. The Instrument is amended by adding the following sections:

2.7.1 Notice-and-Access --

(1) A reporting issuer that is not an investment fund may use notice-and-access to send proxy-related materials relating to a meeting to a beneficial owner of its securities if all of the following apply:

(a) the beneficial owner is sent a notice that contains the following information and no other information:

(i) the date, time and location of the meeting for which the proxy-related materials are being sent;

(ii) a description of each matter or group of related matters identified in the form of proxy to be voted on, unless that information is already included in a Form 54-101F6 or Form 54-101F7 as applicable, that is being sent to the beneficial owner under paragraph (b);

(iii) the website addresses for SEDAR and the non-SEDAR website where the proxy-related materials are posted;

(iv) a reminder to review the information circular before voting;

(v) an explanation of how to obtain a paper copy of the information circular and, if applicable, the documents in paragraph (2)(b) from the reporting issuer;

(vi) a plain-language explanation of notice-and-access that includes the following information:

(A) if the reporting issuer is using stratification, a list of the types of registered holders or beneficial owners who will receive paper copies of the information circular, and if applicable, the documents in paragraph (2)(b);

(B) the estimated date and time by which a request for a paper copy of the information circular and, if applicable, the documents in paragraph (2)(b), is to be received in order for the requester to receive the paper copy in advance of any deadline for the submission of voting instructions and the date of the meeting;

(C) an explanation of how the beneficial owner is to return voting instructions, including any deadline for return of those instructions;

(D) the sections of the information circular where disclosure regarding each matter or group of related matters identified in the notice can be found;

(E) a toll-free telephone number the beneficial owner can call to get information about notice-and-access;

(b) using the procedures referred to in section 2.9 or 2.12, as applicable, the beneficial owner is sent, by prepaid mail, courier or the equivalent, the notice required by paragraph (a) and a Form 54-101F6 or Form 54-101F7, as applicable;

(c) the reporting issuer files on SEDAR the notification of meeting and record dates on the same date that it sends the notification under subsection 2.2(1);

(d) public electronic access to the information circular and the notice in paragraph (a) is provided on or before the date that the reporting issuer sends the notice in paragraph (a) to beneficial owners, in the following manner:

(i) the documents are filed on SEDAR;

(ii) the documents are posted until the date that is one year from the date that the documents are posted, on a website other than the website for SEDAR;

(e) a toll-free telephone number is provided for use by the beneficial owner to request a paper copy of the information circular and, if applicable, the documents in paragraph (2)(b), at any time from the date that the reporting issuer sends the notice in paragraph (a) to the beneficial owner up to and including the date of the meeting, including any adjournment;

(f) if a request for a paper copy of the information circular and, if applicable, the documents in paragraph (2)(b), is received at the toll-free telephone number provided under paragraph (e) or by any other means, a paper copy of any such document requested is sent free of charge by the reporting issuer to the requester at the address specified in the request in the following manner:

(i) in the case of a request received prior to the date of the meeting, within 3 business days after receiving the request, by first class mail, courier or the equivalent;

(ii) in the case of a request received on or after the date of the meeting, and within one year of the information circular being filed, within 10 calendar days after receiving the request, by prepaid mail, courier or the equivalent.

(2) Unless an information circular is included with the proxy-related materials, a reporting issuer that sends proxy-related materials to a beneficial owner of its securities using notice-and-access must not include with the proxy-related materials any information or document that relates to the particulars of any matter to be submitted to the meeting, except for the following:

(a) the information required to be included in the notice under paragraph (1)(a);

(b) financial statements of the reporting issuer to be approved at the meeting, and MD&A related to those financial statements, which may be part of an annual report.

2.7.2 Notice in advance of first use of notice-and-access -- Despite paragraph 2.7.1(1)(c) and subsection 2.20(a.1), the first time that a reporting issuer uses notice-and-access to send proxy-related materials to a beneficial owner of its securities, the reporting issuer must file on SEDAR the notification of meeting and record dates at least 25 days before the record date for notice.

2.7.3 Restrictions on information gathering --

(1) A reporting issuer that receives a request for a paper copy of the information circular or other documents referred to in paragraph 2.7.1(1)(e) using the toll-free telephone number or by any other means must not do any of the following:

(a) ask for any information about the requester, other than the name and address to which the information circular and, if applicable, the documents in paragraph 2.7.1(2)(b), are to be sent;

(b) disclose or use the name or address of the requester for any purpose other than sending the information circular and, if applicable, the documents in paragraph 2.7.1(2)(b).

(2) A reporting issuer that posts proxy-related materials pursuant to subparagraph 2.7.1(1)(d)(ii) must not collect information that can be used to identify a person or company who has accessed the website address where the proxy-related materials are posted.

2.7.4 Posting materials on non-SEDAR website --

(1) A reporting issuer that posts proxy-related materials in the manner referred to in subparagraph 2.7.1(1)(d)(ii) must also post on the website the following documents:

(a) any disclosure material regarding the meeting that the reporting issuer has sent to registered holders or beneficial owners of its securities;

(b) any written communications the reporting issuer has made available to the public regarding each matter or group of matters to be voted on at the meeting, whether or not they were sent to registered holders or beneficial owners of its securities.

(2) Proxy-related materials that are posted under subparagraph 2.7.1(1)(d)(ii) must be posted in a manner and be in a format that permit an individual with a reasonable level of computer skill and knowledge to do all of the following easily:

(a) access, read and search the documents on the website;

(b) download and print the documents.

2.7.5 Consent to other delivery methods -- For greater certainty, section 2.7.1 does not

(a) prevent a beneficial owner from consenting to a reporting issuer, an intermediary or another person or company's use of other delivery methods to send proxy-related materials,

(b) terminate or modify a consent that a beneficial owner of voting securities previously gave to a reporting issuer, an intermediary or another person or company regarding the use of other delivery methods to send proxy-related materials, or

(c) prevent a reporting issuer, an intermediary or another person or company from sending proxy-related materials using a delivery method to which a beneficial owner has consented prior to February 11, 2013.

2.7.6 Instructions to receive paper copies --

(1) Despite section 2.7.1, an intermediary may obtain standing instructions from a beneficial owner that is a client of the intermediary that a paper copy of the information circular and, if applicable, the documents in paragraph 2.7.1(2)(b), be sent to the beneficial owner in all cases when a reporting issuer uses notice-and-access.

(2) If an intermediary has obtained standing instructions from a beneficial owner under subsection (1), the intermediary must do all of the following:

(a) if the reporting issuer is sending proxy-related materials directly under section 2.9, indicate in the NOBO list provided to the reporting issuer those NOBOs who have provided standing instructions under subsection (1) as at the date the NOBO list is generated;

(b) if the intermediary is sending proxy-related materials to a beneficial owner on behalf of a reporting issuer using notice-and-access, request appropriate quantities of paper copies of the information circular and, if applicable, the documents in paragraph 2.7.1(2)(b), from the reporting issuer for forwarding to beneficial owners who have provided standing instructions to be sent paper copies;

(c) include with the proxy-related materials a description, or otherwise inform the beneficial owner of, the means by which the beneficial owner may revoke the beneficial owner's standing instructions.

2.7.7 Application to non-management solicitations --

(1) A person or company other than management of a reporting issuer that is required by law to send materials to registered holders or beneficial owners of securities in connection with a meeting may use notice-and-access to send the materials.

(2) Section 2.7.1, other than paragraph (1)(c), and sections 2.7.3, 2.7.4 and 2.7.5 apply to a person or company in subsection (1) as if the person or company were a reporting issuer.

(3) Paragraph 2.7.1(1)(c) and section 2.7.8 apply to a person or company referred to in subsection (1) only if the person or company has requisitioned a meeting.

2.7.8 Record date for notice -- Despite subsection 2.1(b), a reporting issuer that uses notice-and-access must set a record date for notice that is no fewer than 40 days before the date of the meeting..

9. Section 2.9 is replaced with the following:

2.9 Direct sending of proxy-related materials to NOBOs by a reporting issuer --

(1) A reporting issuer that has stated in its request for beneficial ownership information sent in connection with a meeting, that it will send proxy-related materials to, and seek voting instructions from, NOBOs must send at its own expense the proxy-related materials for the meeting directly to the NOBOs on the NOBO lists received in response to the request.

(2) A reporting issuer that sends by prepaid mail, courier or the equivalent, paper copies of proxy-related materials directly to a NOBO must send the proxy-related materials at least 21 days before the date of the meeting.

(3) A reporting issuer that sends proxy-related materials directly to a NOBO using notice-and-access must send the notice required by paragraph 2.7.1(1)(a) and, if applicable, any paper copies of information circulars and documents in paragraph 2.7.1(2)(b), at least 30 days before the date of the meeting..

10. Section 2.10 is amended by inserting "and despite subsection 2.9(1)," after "Except as required by securities legislation,".

11. Section 2.12 is replaced with the following:

2.12 Indirect sending of securityholder materials by a reporting issuer --

(1) A reporting issuer sending securityholder materials indirectly to beneficial owners must send to each proximate intermediary that responded to the applicable request for beneficial ownership information the number of sets of those materials specified by that proximate intermediary for sending to beneficial owners.

(2) A reporting issuer that sends proxy-related materials indirectly to a beneficial owner by having the proximate intermediary send the proxy-related materials by prepaid mail must send the proxy-related materials to the proximate intermediary

(a) at least 3 business days before the 21st day before the date of the meeting, in the case of proxy-related materials that are to be sent on by the proximate intermediary by first class mail, courier or the equivalent, or

(b) at least 4 business days before the 21st day before the date of the meeting, in the case of proxy-related materials that are to be sent using any other type of prepaid mail.

(3) A reporting issuer that sends proxy-related materials indirectly to a beneficial owner using notice-and-access must send the notice required by paragraph 2.7.1(1)(a) and, if applicable, any paper copies of information circulars and documents in paragraph 2.7.1(2)(b), to the proximate intermediary

(a) at least 3 business days before the 30th day before the date of the meeting, in the case of proxy-related materials that are to be sent on by the proximate intermediary by first class mail, courier or the equivalent, or

(b) at least 4 business days before the 30th day before the date of the meeting, in the case of proxy-related materials that are to be sent using any other type of prepaid mail.

(4) A reporting issuer that sends securityholder materials that are not proxy-related materials indirectly to beneficial owners must send the securityholder materials to the intermediary on the date specified in the request for beneficial ownership information.

(5) Despite section 2.9, a reporting issuer must not send securityholder materials directly to a NOBO if a proximate intermediary in a foreign jurisdiction holds securities on behalf of the NOBO and one or both of the following applies:

(a) the law of the foreign jurisdiction does not permit the reporting issuer to send securityholder materials directly to NOBOs;

(b) the proximate intermediary has stated in a response to a request for beneficial ownership information that the law in the foreign jurisdiction requires the proximate intermediary to deliver securityholder materials to beneficial owners..

12. Section 2.16 is replaced with the following:

2.16 Explanation of voting rights --

(1) If a reporting issuer sends proxy-related materials for a meeting to a beneficial owner of its securities, the materials must explain, in plain language, how the beneficial owner can exercise voting rights attached to the securities, including an explanation of how to attend and vote the securities directly at the meeting.

(2) Management of a reporting issuer must provide the following disclosure in the information circular:

(a) whether the reporting issuer is sending proxy-related materials to registered holders or beneficial owners using notice-and-access, and if stratification will be used, the types of registered holders or beneficial owners who will receive paper copies of the information circular and, if applicable, the documents in paragraph 2.7.1(2)(b);

(b) whether the reporting issuer is sending proxy-related materials directly to NOBOs;

(c) whether the reporting issuer intends to pay for an intermediary to deliver to OBOs the proxy-related materials and Form 54-101F7, and if the reporting issuer does not intend to pay for such delivery, a statement that OBOs will not receive the materials unless their intermediary assumes the costs of delivery..

13. Section 2.17 is replaced with the following:

2.17 Voting instruction form (Form 54-101F6) -- A reporting issuer that sends proxy-related materials directly to a NOBO that solicit votes or voting instructions from securityholders must include with the proxy-related materials a Form 54-101F6..

14. Section 2.18 is replaced with the following:

2.18 Appointing beneficial owner as proxy holder --

(1) A reporting issuer whose management holds a proxy in respect of securities beneficially owned by a NOBO must arrange, without expense to the NOBO, to appoint the NOBO or a nominee of the NOBO as a proxy holder in respect of those securities if the NOBO has instructed the reporting issuer to do so using either of the following methods:

(a) the NOBO filled in and submitted the Form 54-101F6 previously sent to the NOBO by the reporting issuer;

(b) the NOBO submitted any other document in writing that requests that the NOBO or a nominee of the NOBO be appointed as a proxyholder.

(2) If management appoints a NOBO or a nominee of the NOBO as a proxy holder under subsection (1), the NOBO or nominee of the NOBO, as applicable, must be given authority to attend, vote and otherwise act for and on behalf of management of the reporting issuer in respect of all matters that may come before the applicable meeting and at any adjournment or continuance, unless corporate law prohibits the giving of that authority.

(3) A reporting issuer who appoints a NOBO as a proxy holder pursuant to subsection (1) must deposit the proxy within any time specified for the deposit in the information circular if the reporting issuer obtains the instructions under subsection (1) at least one business day before the termination of that time.

(4) If corporate law requires an intermediary or depository to appoint the NOBO or nominee of the NOBO as a proxy holder in respect of securities beneficially owned by the NOBO in accordance with any written voting instructions received from the NOBO, and the intermediary has received the written voting instructions, the reporting issuer must provide, upon request by the intermediary, confirmation of both of the following:

(a) management of the reporting issuer will comply with subsections 2.18(1) and (2);

(b) management of the reporting issuer is acting on behalf of the intermediary or depository to the extent it appoints the NOBO or nominee of the NOBO as proxy holder in respect of the securities of the reporting issuer beneficially owned by the NOBO.

(5) A confirmation provided under subsection (4) must identify the specific meeting to which the confirmation applies, but is not required to specify each proxy appointment that management of the reporting issuer has made..

15. Subsection 2.20(a) is replaced with the following:

(a) arranges to have proxy-related materials for the meeting sent in compliance with the applicable timing requirements in sections 2.9 and 2.12;.

16. Section 2.20 is amended by adding the following subsection:

(a.1) if the reporting issuer uses notice-and-access, fixes the record date for notice to be at least 40 days before the date of the meeting and sends the notification of meeting and record dates under section 2.2 at least 3 business days before the record date for notice;.

17. Subsection 4.1(1) is amended by replacing "through the transfer agent of the reporting issuer that sent the request" with "through the transfer agent, or in the case of a NOBO list, a person or company described in subsection 2.5(5) that sent the request".

18. Section 4.4 is replaced with the following:

4.4 Voting instruction form (Form 54-101F7) -- An intermediary that forwards proxy-related materials to a beneficial owner that solicit votes or voting instructions from securityholders must include with the proxy-related materials a Form 54-101F7..

19. Section 4.5 is replaced with the following:

4.5 Appointing beneficial owner as proxy holder --

(1) An intermediary who is the registered holder of, or holds a proxy in respect of, securities owned by a beneficial owner must arrange, without expense to the beneficial owner, to appoint the beneficial owner or a nominee of the beneficial owner as a proxy holder in respect of those securities if the beneficial owner has instructed the intermediary to do so using either of the following methods:

(a) the beneficial owner filled in and submitted the Form 54-101F7 previously sent to the beneficial owner by the intermediary;

(b) the beneficial owner submitted any other document in writing that requests that the beneficial owner or a nominee of the beneficial owner be appointed as a proxy holder.

(2) If an intermediary appoints a beneficial owner or a nominee of the beneficial owner as a proxy holder under subsection (1), the beneficial owner or nominee of the beneficial owner, as applicable, must be given authority to attend, vote and otherwise act for and on behalf of the intermediary in respect of all matters that may come before the applicable meeting and at any adjournment or continuance, unless corporate law does not permit the giving of that authority.

(3) An intermediary who appoints a beneficial owner as proxy holder pursuant to subsection (1) must deposit the proxy within any time specified for deposit in the information circular if the intermediary obtains the instructions under subsection (1) at least one business day before the termination of that time..

20. Section 5.4 is amended by adding the following subsections:

(3) If corporate law requires a depository to appoint a beneficial owner or nominee of the beneficial owner as a proxy holder in respect of securities beneficially owned by the beneficial owner in accordance with any written voting instructions received from the beneficial owner, and the depository has received the written voting instructions, any participant described in subsection (1) must provide, upon request by the depository, confirmation of all of the following:

(a) the participant will comply with subsections 4.5(1) and (2);

(b) the participant is acting on behalf of the depository to the extent it appoints a beneficial owner or nominee of a beneficial owner as proxy holder in respect of the securities of the reporting issuer beneficially owned by the beneficial owner;

(c) if the participant is required to execute an omnibus proxy under section 4.1, that the participant will take reasonable steps to request the confirmation set out in subsection 2.18(4).

(4) A confirmation provided under subsection (3) must identify the specific securityholder meeting to which the confirmation applies, but is not required to specify each proxy appointment that the participant has made..

21. Subsection 6.2(6) is replaced with the following:

(6) A person or company, other than the reporting issuer to which the request relates, that sends materials indirectly to beneficial owners must comply with the following:

(a) the person or company must pay to the proximate intermediary a fee for sending the securityholder materials to the beneficial owners;

(b) the person or company must provide an undertaking to the proximate intermediary in the form of Form 54-101F10..

22. Part 7 is replaced with the following:

PART 7 -- USE OF NOBO LIST AND INDIRECT

SENDING OF MATERIALS

7.1 Use of NOBO list --

(1) A reporting issuer may use a NOBO list, or a report prepared under section 5.3 relating to the reporting issuer and obtained under this Instrument, in connection with any matter relating to the affairs of the reporting issuer.

(2) A person or company that is not the reporting issuer must not use a NOBO list, or a report prepared under section 5.3 relating to the reporting issuer and obtained under this Instrument, in any manner other than any of the following:

(a) for sending securityholder materials directly to NOBOs in accordance with this Instrument;

(b) in respect of an effort to influence the voting of securityholders of the reporting issuer;

(c) in respect of an offer to acquire securities of the reporting issuer.

7.2 Sending of Materials --

(1) A reporting issuer may send securityholder materials indirectly to beneficial owners of securities of the reporting issuer using the procedures in section 2.12, or directly to NOBOs of the reporting issuer using a NOBO list, in connection with any matter relating to the affairs of the reporting issuer.

(2) A person or company that is not the reporting issuer may send securityholder materials indirectly to beneficial owners of securities of the reporting issuer using the procedures in section 2.12, or directly to NOBOs of the reporting issuer using a NOBO list, only in connection with one or both of the following:

(a) an effort to influence the voting of securityholders of the reporting issuer;

(b) an offer to acquire securities of the reporting issuer..

23. The Instrument is amended by adding the following section:

9.1.1 Compliance with SEC Notice-and-Access Rules --

(1) Despite section 2.7, a reporting issuer that is an SEC issuer can send proxy-related materials to beneficial owners using a delivery method permitted under U.S. federal securities law, if all of the following apply:

(a) the SEC issuer is subject to, and complies with Rule 14a-16 under the 1934 Act;

(b) the SEC issuer has arranged with each intermediary through whom the beneficial owner holds its interest in the reporting issuer's securities to have each intermediary send the proxy-related materials to the beneficial owner by implementing the procedures under Rule 14b-1 or Rule 14b-2 of the 1934 Act that relate to the procedures in Rule 14a-16 under the 1934 Act;

(c) residents of Canada do not own, directly or indirectly, outstanding voting securities of the issuer carrying more than 50% of the votes for the election of directors, and none of the following apply:

(i) the majority of the executive officers or directors of the issuer are residents of Canada;

(ii) more than 50% of the consolidated assets of the issuer are located in Canada;

(iii) the business of the issuer is administered principally in Canada.

(2) Part 4 does not apply to an intermediary with whom a reporting issuer has made arrangements under paragraph (1)(b) if the intermediary implements the procedures under Rule 14b-1 or Rule 14b-2 of the 1934 Act that relate to the procedures in Rule 14a-16 under the 1934 Act..

24. Form 54-101F2 Request for Beneficial Ownership Information is amended by

(a) in Item 1, adding "in English and, if applicable, French" after "reporting issuer";

(b) replacing Item 2 with the following:

Item 2 -- Contact person(s)

State the name, address, telephone number, facsimile number and email address of the contact person(s) of the reporting issuer, and of the reporting issuer's agent, if applicable, with whom the intermediary should deal. If different from the foregoing, also state the name, address, telephone number, facsimile number and email address of the contact person(s) of the reporting issuer responsible for dealing with invoices.;

(c) in Item 6.7, adding "State whether the reporting issuer would like materials to be sent electronically when consent has been obtained from the beneficial owner of securities." after "National Instrument.";

(d) in Item 6.9, replacing "If the securityholder materials are to be sent to all beneficial owners of securities, including beneficial owners that have declined to receive them, so state." with "State if securityholder materials are to be sent to (a) all beneficial owners of securities (including beneficial owners that have declined to receive them), (b) only those beneficial owners who have requested to receive all securityholder materials, or (c) only those beneficial owners who have requested to receive all securityholder materials or special meeting materials.";

(e) in Item 7.9, adding "State whether the reporting issuer would like materials to be sent electronically when consent has been obtained from the beneficial owner of securities." after "National Instrument.";

(f) in Item 7.11, replacing "If the securityholder materials are to be sent to all beneficial owners of securities, including beneficial owners that have declined to receive them, so state." with "State if securityholder materials are to be sent to (a) all beneficial owners of securities (including beneficial owners that have declined to receive them), (b) only those beneficial owners who have requested to receive all securityholder materials, or (c) only those beneficial owners who have requested to receive all securityholder materials or special meeting materials.";

(g) adding the following Item:

7.12 State whether the reporting issuer is using notice-and-access, and any stratification criteria to be used. [Before completing this item, the reporting issuer should discuss with the intermediary what stratification criteria the intermediary is able to apply.];

(h) in Item 8.5, adding "State whether the reporting issuer would like materials to be sent electronically when consent has been obtained from the beneficial owner of securities." after "National Instrument.";

(i) in Item 8.6, replacing "If the securityholder materials are to be sent to all beneficial owners of securities, including beneficial owners that have declined to receive them, so state." with "State if securityholder materials are to be sent to (a) all beneficial owners of securities (including beneficial owners that have declined to receive them), (b) only those beneficial owners who have requested to receive all securityholder materials, or (c) only those beneficial owners who have requested to receive all securityholder materials or special meeting materials.";

(j) in Item 9.7, adding "State whether the reporting issuer would like materials to be sent electronically when consent has been obtained from the beneficial owner of securities." after "National Instrument.";

(k) in Item 9.8, replacing "If the securityholder materials are to be sent to all beneficial owners of securities, including beneficial owners that have declined to receive them, so state." with "State if securityholder materials are to be sent to (a) all beneficial owners of securities (including beneficial owners that have declined to receive them), (b) only those beneficial owners who have requested to receive all securityholder materials, or (c) only those beneficial owners who have requested to receive all securityholder materials or special meeting materials.";

(l) adding the following Item:

9.9 State whether the reporting issuer is using notice-and-access, and any stratification criteria to be used. [Before completing this item, the reporting issuer should discuss with the intermediary what stratification criteria the intermediary is able to apply.]; and

(m) replacing "National Policy 11-201 and, in Québec, Staff Notice 11-201" with "National Policy 11-201 Electronic Delivery of Documents" wherever the expression occurs.

25. Form 54-101F5 Electronic Format for NOBO List is repealed and replaced with the following:

FORM 54-101F5

ELECTRONIC FORMAT FOR NOBO LIST

HEADER RECORD DESCRIPTION

TYPE

LENGTH

POSITION

COMMENTS

RECORD TYPE

A

1

1

Header record = A

FINS NUMBER

A

4

2-5

Prefix T,M,V or C

ISIN

A

12

6-17

FILLER

X

3

18-20

Blank

SECURITY DESC.

A

32

21-52

Security Description

RECORD DATE

N

8

53-60

Format YYYYMMDD

CREATION DATE

N

8

61-68

Format YYYYMMDD

FILLER

X

250

69-318

Blank

DETAIL RECORD DESCRIPTION

TYPE

LENGTH

POSITION

COMMENTS

RECORD TYPE

A

1

1

Detail Record = B

FINS NUMBER

A

4

2-5

Same as in Header record

ISIN

A

12

6-17

FILLER

X

3

18-20

Blank

FILLER

X

20

21-40

Blank

NAME

A

32

41-72

Holder Name

ADDRESS

A

32 x 6

73- 264

Occurs 6 times

FILLER

X

32

265- 296

Blank

POSTAL CODE

A

9

297- 305

POSTAL REGION

A

1

306

C=Canada; U=USA; F=Foreign; (other than USA); H=Hand Deliver

NOTICE AND ACCESS

A

1

307

Y=Full Package; N=Notice Only

FILLER

X

1

308

Blank

E-MAIL ADDRESS

A

32

309- 340

LANGUAGE CODE

A

1

341

E=English; F=French

NUMBER OF SHARES

N

9

342- 350

Shareholder Position

RECEIVE ALL MATERIAL

A

1

351

A -- ALL Material, S -- Material for SPECIAL Meetings only, D -- DECLINE to receive Materials

AGREE TO ELECTRONIC DELIVERY BY INTERMEDIARY

A

1

352

Y/N

TRAILER RECORD DESCRIPTION

TYPE

LENGTH

POSITION

COMMENTS

RECORD TYPE

A

1

1

Trailer record = C

FINS NUMBER

A

4

2-5

Same as in Header Record

ISIN

A

12

6-17

FILLER

X

3

18-20

TOTAL SHAREHOLDERS

N

7

21-27

Number of "B" type records

TOTAL SHARES

N

11

27-38

Total Shares on "B" type records

FILLER

X

280

39-318

Blank

26. Form 54-101F6 Request for Voting Instructions Made by Reporting Issuer is amended by replacing the paragraph that begins "Should you wish to attend the meeting and vote in person..." with the following:

If you want to attend the meeting and vote in person, write your name in the place provided for that purpose in this form. You can also write the name of someone else whom you wish to attend the meeting and vote on your behalf. Unless prohibited by law, the person whose name is written in the space provided will have full authority to present matters to the meeting and vote on all matters that are presented at the meeting, even if those matters are not set out in this form or the information circular. Consult a legal advisor if you wish to modify the authority of that person in any way. If you require help, contact [insert name]..

27. Form 54-101F7 Request for Voting Instructions Made by Intermediary is amended by replacing the paragraph that begins "Should you wish to attend the meeting and vote in person..." with the following:

If you want to attend the meeting and vote in person, write your name in the place provided for that purpose in this form. You can also write the name of someone else whom you wish to attend the meeting and vote on your behalf. Unless prohibited by law, the person whose name is written in the space provided will have full authority to present matters to the meeting and vote on all matters that are presented at the meeting, even if those matters are not set out in this form or the information circular. Consult a legal advisor if you wish to modify the authority of that person in any way. If you require help, contact [insert name]..

28. Form 54-101F8 Legal Proxy is repealed.

29. Form 54-101F9 Undertaking is amended by

(a) replacing paragraph 2 with the following:

<Option #1: use this alternative if the reporting issuer is providing the undertaking>

2. I undertake that the information set out on the NOBO list will be used only in connection with matters relating to the affairs of the reporting issuer.

<Option #2: use this alternative if a person or company other than the reporting issuer is providing the undertaking>

2. I undertake that the information set out on the NOBO list will be used only for one or more of the following purposes:

(a) sending securityholder materials directly to NOBOs in accordance with National Instrument 54-101;

(b) an effort to influence the voting of securityholders of the reporting issuer;

(c) an offer to acquire securities of the reporting issuer.;

(b) replacing paragraph 4 with the following:

4. I am aware that it is a contravention of the law to use a NOBO list for purposes other than in connection with one or more of the following:

(a) sending securityholder materials directly to NOBOs in accordance with National Instrument 54-101;

(b) an effort to influence the voting of securityholders of the reporting issuer;

(c) an offer to acquire securities of the reporting issuer.;

(c) adding the following paragraph:

5. I declare that I (or the person or company I am using to make this request) has the technological capacity to receive the NOBO list..

30. The Instrument is amended by adding the following form:

FORM 54-101F10

UNDERTAKING

Note: Terms used in this Form have the meaning given to them in National Instrument 54-101.

The use of this Form is referenced in section 6.2 of National Instrument 54-101.