Scheduled outage for OSC Electronic Filing Portal on Thursday, April 25, 2024 from 6:00 to 11:00 pm (EST)

TSX Request for Comments - Security Holder Approval Requirements for Acquisitions - TSX Inc.

Toronto Stock Exchange ("TSX") is requesting comments on its security holder approval requirements for acquisitions (the "Request for Comments"). The Request for Comments is being published for a 60 day comment period. Comments should be in writing and delivered by December 12, 2007 to:

Deanna Dobrowsky

Legal Counsel, Market Policy and Structure

Toronto Stock Exchange

The Exchange Tower

130 King Street West

Toronto, Ontario M5X 1J2

Fax: (416) 947-4461

Email: [email protected]

A copy should also be provided to:

Cindy Petlock

Manager

Market Regulation

Ontario Securities Commission

20 Queen Street West

Toronto, Ontario M5H 3S8

Fax: (416) 595-8940

Email: [email protected]

Comments will be publicly available unless confidentiality is requested.

Following the comment period, TSX will determine whether to propose an amendment to its current security holder approval requirements for acquisitions, based on the comments it receives. Any proposed amendment will be published for comments, together with a summary of the comments received prior to implementation. In the event that TSX does not propose an amendment, TSX will publish a subsequent notice, together with a summary of the comments received.

Background

Prior to January 1, 2005, TSX practice for many years was to waive the requirement for security holder approval for acquisitions of public companies even where the number of securities issued or issuable in payment of the purchase price exceeded 25% of the issued and outstanding securities of the listed issuer. At that time, security holder approval was required where the number of securities issued or issuable exceeded 25% of the issued and outstanding securities of the listed issuer and were issued in exchange for assets, "particularly if the listed company proposes to issue securities in exchange for assets which are closely held" (formerly Section 624 prior to January 1, 2005). At that time, there was no explicit statement with respect to the waiver of security holder approval for acquisitions of public companies.

Currently, TSX requires security holder approval for the issue of securities as full or partial consideration for an acquisition where the number of securities issued or issuable in payment of the purchase price exceeds 25% of the issued and outstanding securities of the listed issuer (Subsection 611(c)). However, this requirement does not apply where the listed issuer is acquiring a public company (a reporting issuer or issuer of equivalent status having 50 or more beneficial security holders, excluding insiders and employees) (Subsection 611(d)). This exemption from security holder approval for acquisitions of public companies was formally incorporated in the TSX Company Manual (the "Manual") on January 1, 2005 in conjunction with a substantial number of other amendments to Parts V, VI and VII of the Manual. Comments were not explicitly sought on Subsection 611(d) as TSX believed that it was simply making the well established historical practice more explicit and transparent which was one of the key objectives of the amendments. The full text of Section 611 of the Manual is attached to this Request for Comments as Appendix A.

Some market participants have expressed the view that issuers should not be exempted from the requirement to obtain security holder approval for the issue of securities in an acquisition where the target is a public company and dilution for the acquiror shares exceeds 25%. TSX is therefore soliciting public comments as to whether security holder approval requirements for the acquisition of public companies through the issue of securities should be revised.

Questions

1. Should security holder approval be required for the issue of securities as full or partial consideration for the acquisition of a public company in a transaction negotiated at arm's length where insiders receive 10% or less of the securities issued? Why?

2. If you responded affirmatively to Question 1, please comment on whether approval should be required only if the issue exceeds a certain dilution level and, if so, what constitutes an appropriate dilution level. Should Subsection 611(d) (which provides for the security holder approval exemption) simply be eliminated? Is a level of dilution other than that set out in Subsection 611(c) (which provides that security holder approval is required where the number of securities issued in payment of the purchase price for an acquisition exceeds 25% of the number of outstanding securities of the issuer) more appropriate e.g. 35% or 50%? If so, why?

3. Should factors other than voting dilution, such as the relative premium to a target company's stock price or enterprise value, be taken into consideration in determining if security holder approval is required? If so, what are the appropriate factors and why?

4. Does imposing security holder approval requirements discourage acquisitions?

5. Does the requirement for security holder approval of the acquiror make transactions more difficult to complete, particularly where a premium is being paid for the securities of the target?

6. Is this an appropriate issue for security holder approval or should the decision to make an arm's length acquisition using securities be left to the business judgement of the board of directors of the acquiror?

7. What are the possible unintended consequences of requiring security holder approval of an acquiror in a share exchange bid? Will this favour cash bids over share exchange bids? Will this result in acquirors increasing their leverage to make cash bids so as to avoid the need for security holder approval or the need to provide disclosure about the acquiror's strategy that could benefit its competitors?

8. If security holder approval is required, is approval by a majority vote of security holders the right threshold?

9. Should issuers with a smaller market capitalization be exempted from the new proposal?

Policy Considerations

Where TSX listed issuers are acquiring public companies, securities are being widely distributed and prospectus level disclosure is publicly available for the target security holders about the acquiror. Accordingly, TSX has traditionally equated the distribution of securities in the context of an acquisition to a public offering by way of prospectus, for which security holder approval is generally not required.

While both public offerings and public acquisitions through the issue of securities widely distribute securities and afford market participants prospectus level disclosure of the offering issuer, a significant difference may arise in the manner in which the distributed securities are priced. Generally, securities issued under a prospectus are priced at a relatively small discount to the market price. Other than in respect of issuers in financial difficulty, TSX experience is that public offerings are generally priced at a 5% to 10% discount to the market price. TSX experience with public acquisitions paying share consideration is that transactions are effected at a 15% to 30% premium over the target's market price. Assuming that the offeror offers stock at a 20% premium to the target's market price and if the offeror and the target's stock trade at $10, the offeror would offer 1.2 of its shares for every target share. This would result in the offeror issuing shares at a 17% discount to its market price.

|

|

|

[Value of the target's share ($10)] |

|

|

Discount (17%) = |

1- |

[----------------------------------------------------------------------------- ] |

x 100 |

|

|

|

[Value of the offeror's shares ($10) x Exchange Ratio (1.2) ] |

|

However, the discounts may not be directly comparable to a prospectus offering as valuing the target may present a number of challenges.

Provided that an acquisition is negotiated at arm's length, and TSX is satisfied that there are no special benefits accruing to insiders, TSX does not review the relative price value of the consideration that is offered. Even if the target is an actively traded issuer and a market price is readily available, evaluating the true premium presents a number of challenges. Specifically, if a target or the issuer is undervalued or overvalued in its market, the true premium and resulting economic dilution may be very difficult to determine and pose significant uncertainty as to whether security holder approval would be required if TSX were to use price premium as a factor.

Certain market participants have expressed the view that a requirement to obtain security holder approval for significant dilution is a fundamental element of good corporate governance. The debate from a governance perspective is whether security holder approval should be required because directors are unable to or cannot be relied upon to reach a decision that is in the best interests of the security holders (or the transaction is motivated by an improper purpose). They draw parallels between security acquisitions and the rules that apply to issuers on private placements, where only limited discounting is permitted on major security issuances without first obtaining security holder approval. Accordingly, they believe security holders should have an expectation that transactions that will significantly dilute their economic and voting interests will first be brought to them for approval in the form of a security holder vote after prospectus level disclosure has been provided outlining the merits and risks of the proposed transaction. This approval may also relate to other deal terms incorporated in the approval of the acquisition, such as changes related to management or the business direction of the listed issuer. As neither securities nor corporate law in Canada requires security holder approval of arm's length dilutive transactions, TSX has required security holder approval for certain dilutive acquisitions (other than acquisitions of public companies), private placements and security based compensation arrangements, such as stock option plans. Many of the changes to the Manual made effective in 2005 relate to providing listed issuers with more flexibility in structuring their deals, provided that security holder approval is obtained in specific transactions.

While it may be argued that security holders that oppose an acquisition may simply sell their securities in the market, there are several potential difficulties with this argument. The announcement of the acquisition may have resulted in a decrease in the offeror's market price resulting in an economic loss for the security holder. In addition, if the security holder holds a significant interest in the offeror, a significant price discount may be necessary in order to liquidate the block. The security holder may have further difficulties selling the securities if the securities are not liquid.

Under corporate laws in Canada, directors have a fiduciary duty to act in the best interests of the corporation. Some may argue that the directors' decision should not be subject to a security holder approval because the directors are in a better position to make a decision, having access to information such as the corporation's strategy, prospects, risks (some of which may not be publicly available information), and access to professional advisors. The significance of a director's fiduciary duty should not be underestimated, particularly in this era of enhanced scrutiny of directors' obligations. Security holders have no such fiduciary duties and may have a variety of interests which may not be consistent with the best interests of the corporation.

Where security holders believe that a board was acting improperly or in breach of its fiduciary duties with respect to an acquisition, the security holder may pursue remedies in court under corporate law by means of a derivative or oppressive action. However, in order to proceed with such an action, the security holders would need to have sufficient economic resources to fund the action and absorb the costs if the action fails. While a class action may be possible, the proceedings may have many procedural challenges.

Some market participants believe that it may be difficult to provide information to security holders to permit them to make an informed decision and that such decisions are best left with the board. They also believe that security holder approval may reduce an issuer's ability to make acquisitions. In a competitive takeover bid situation, the requirement for security holder approval may disadvantage a TSX listed issuer competing with another issuer that is not subject to a security holder approval requirement. A security holder approval requirement may not exist for a competing offeror for a number of reasons, including the following: (i) the competing offeror is not a listed issuer; (ii) some foreign exchanges do not require security holder approval for such transactions (see below "Other Exchange Requirements"); or (iii) the issuer may be more mature in terms of both size and ability to offer cash rather than securities, meaning that even if the competing offeror were listed on an exchange that required security holder approval, it may not trigger such requirement due to the competing offeror's size or ability to offer cash.

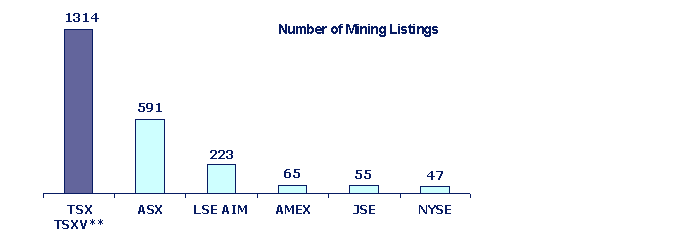

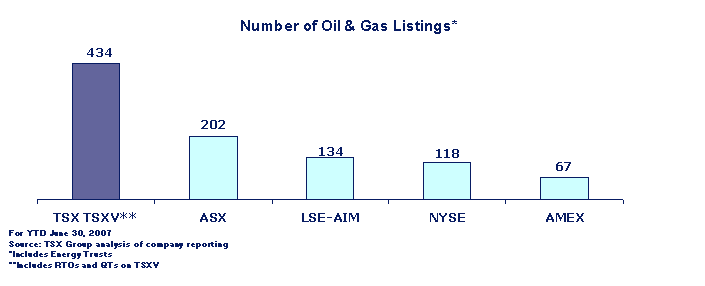

Resource issuers represent approximately 30% of TSX listed issuers by number{1}. These issuers tend to be active in mergers and acquisitions ("M&A"), frequently offering securities as consideration because they do not have the available resources to offer cash. These issuers generally complete more dilutive transactions, simply due to their smaller size. In addition, larger producing resource issuers may prefer to preserve cash for exploration and development expenditures by offering securities for an acquisition. Accordingly, a security holder approval requirement may disproportionately affect resource issuers and issuers with smaller market capitalizations. During the first half of 2007, there were 16 acquisitions completed in reliance of Subsection 611(d), of which 75% were completed by resource issuers in the mining or oil & gas sectors. The median market cap size of the offerors was $501.5 million. Attached as Appendix C is a graph of the number of resource issuers listed on comparative exchanges.

Certain market participants have argued that they rely upon the available relief in structuring their transactions. M&A advisors, for example, have argued that the absence of security holder approval may be taken into account during negotiations, factored into deal certainty and ultimately may impact the consideration which is paid. These market participants have argued that a requirement for security holder approval may ultimately result in more expensive acquisitions and may discourage such transactions, particularly where the acquiror is required to offer a premium to the market price of a target's securities. While some TSX listed issuers have voluntarily sought security holder approval for these transactions, these issuers are clearly in the minority with most issuers relying on Subsection 611(d). Readers should take note that advisor's roles include creating deal certainty and that a lack of a requirement for security holder approval aids in that role. Furthermore, some advisors fees are contingent upon consummation of these deals and may therefore be economically incentivized to argue against a requirement for security holder approval, without regard for the security holders best interest.

Other Exchange Requirements

TSX has reviewed other published exchange requirements as well as the applicable corporate law regimes that generally apply to issuers listed on those exchanges, and where possible sought verification of its interpretation of these requirements. This review included the following exchanges: Alternative Investment Market ("AIM"), American Stock Exchange ("AMEX"), Australian Securities Exchange ("ASX"), EuroNex/OMX ("EuroNex"), Johannesburg Stock Exchange ("JSE"), London Stock Exchange ("LSE"), NASDAQ National Market ("NASDAQ"), New York Stock Exchange ("NYSE"), Stock Exchange of Hong Kong ("HKSE") and TSX Venture Exchange. These exchanges were selected either because of geographical proximity, the number of interlisted issuers and/or the similar nature of listed issuers.

The relevant extracts of these rules are attached to this Request for Comments as Appendix B. The following is a summary overview of other exchange requirements and should be considered together with the extracts of the rules attached in Appendix B.

|

Exchange |

Requirement |

|

|

|

|

AIM |

No requirement for security holder approval for arm's length acquisitions, other than in connection |

|

with reverse takeovers. |

|

|

|

|

|

However, corporate laws that apply to the issuer must be followed, many of which in European |

|

|

countries require security holder approval for significant dilution. |

|

|

|

|

|

AMEX |

Security holder approval is required for the issuance or potential issuance of common stock that |

|

could result in an increase in outstanding common shares of 20% or more. |

|

|

|

|

|

ASX |

Provides an exemption from security holder approval equivalent to TSX relief. |

|

|

|

|

Security holder approval is required for acquisitions resulting in more than 15% dilution, but there |

|

|

is an exemption for schemes of arrangement (similar to Canadian plans of arrangement) and off |

|

|

market bids (similar to Canadian takeover bids) which are completed in accordance with the |

|

|

Australian Corporations Act. |

|

|

|

|

|

EuroNext / OMX |

No exchange requirement for security holder approval for dilutive acquisitions provided there is |

|

compliance with corporate requirements. |

|

|

|

|

|

European corporate law generally requires shareholder approval for dilution above a certain level |

|

|

if the shares are not offered to existing shareholders. For example, under French corporate law, |

|

|

shareholder approval is required for dilution of more than 10% where the shares are not issued |

|

|

first to existing shareholders. |

|

|

|

|

|

JSE |

Security holder approval is required for a transaction exceeding 30% dilution (measuring market |

|

cap, equity dilution and cash consideration). |

|

|

|

|

|

LSE |

Security holder approval is required for a transaction exceeding 25% dilution. |

|

|

|

|

NASDAQ |

Security holder approval is required for the issuance of stock where the issuance will have upon |

|

issuance voting power equal to or in excess of 20% of the voting power outstanding before the |

|

|

issuance. |

|

|

|

|

|

NYSE |

Security holder approval is required for the issuance of stock where the issuance will have upon |

|

issuance voting power equal to or in excess of 20% of the voting power outstanding before the |

|

|

issuance. |

|

|

|

|

|

HKSE |

Security holder approval is required for a transaction exceeding 50% dilution (measuring assets, |

|

profits, revenue, consideration or nominal value). |

|

|

|

|

|

TSX |

Security holder approval is required for acquisitions resulting in more than 25% dilution, but there |

|

is an exemption for the acquisition of public companies. |

|

|

|

|

|

TSX Venture |

No requirement for security holder approval for arm's length acquisitions, other than in connection |

|

with a change of control, reverse takeover or change of business. |

|

Exchange Comparative Analysis

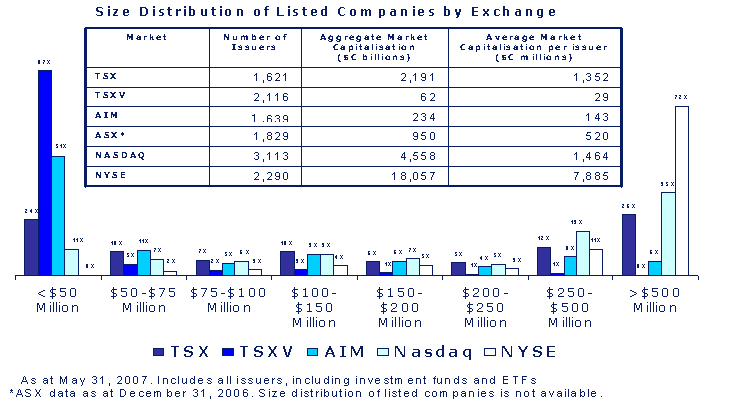

The U.S. exchanges require security holder approval for acquisitions through the issue of securities resulting in voting dilution exceeding 20%. Due to Canada's geographical proximity to the U.S., the regulatory framework of TSX is often compared to those of the U.S. exchanges. However, some consideration should be given to the profile of Canadian issuers while making this comparison. For example, the median market capitalisation of an issuer listed on TSX is $144 million compared to $1.4 billion on NYSE{2}. The U.S. exchanges may generally be characterized as listing larger, more mature issuers that have access to abundant cash flow or sources of credit to complete acquisitions on a cash basis. Comparatively, Canadian issuers tend to be more growth oriented issuers, frequently active in M&A to secure their growth.

Canadian capital markets generally cater to small to medium size enterprises ("SMEs"). Generally, TSX views SMEs as issuers with a market capitalization of $500 million or less. This metric is provided as an indication of the importance of these issuers to Canadian capital markets. Canadian issuers tend to access the public equity market at an earlier stage in company growth than is the norm in the U.S. capital markets. Where private equity usually still plays an important role in supporting the growth of smaller companies, public capital is already a viable option for SMEs in Canada.

AIM and ASX are principally SME capital markets. The U.S. capital market, comprised in large part by NYSE and NASDAQ listed issuers, is comparatively more of a large issuer capital market. Attached as Appendix D is a comparison of the size distribution of TSX, TSX Venture, NYSE, NASDAQ, AIM and ASX listed issuers.

Despite the difference in market capitalization size, the geographical proximity to the U.S. and the number of interlisted issuers on TSX and a U.S. exchange should also be a consideration for commentors. There are 212 issuers listed on both TSX and a U.S. exchange representing 13% of all listed issuers on TSX.{3} Given the geographical proximity and the number of interlisted issuers, there are a significant number of U.S. investors in TSX listed issuers who may expect TSX's requirements to be similar or identical to those of the U.S. exchanges. However, it should be noted that in the case of interlisted companies, the U.S. exchanges generally defer to the market requirements of the issuer's jurisdiction of incorporation. In addition, with increasing participation by international investors, there may be an expectation based on home country requirements for security holder approval requirements by TSX for dilutive acquisitions.

TSX has also reviewed the regulatory framework of exchanges such as the ASX, AIM, JSE and HKSE because these exchanges have more SME issuers listed than the U.S. exchanges, and/or more resource issuers listed. Based upon our review of the publicly available requirements and our understanding of the application of these requirements, ASX provides a similar exemption to that of TSX for the acquisition of public companies. AIM does not appear to have specific security holder approval requirements for the acquisition of public companies, other than for reverse take-overs. The JSE and HKSE require security holder approval for transactions exceeding 30% and 50% dilution, respectively. These exchanges notably tend to have more SME issuers than the U.S. exchanges and have a requirement which permits more dilutive transactions before requiring security holder approval.

In summary, our review of other exchanges indicates that the majority of other exchanges (or the corporate law in the jurisdiction in which each exchange is domiciled) require some form of security holder approval for dilutive acquisitions. However, some exchanges catering to SMEs either do not have rules that impose a security holder approval requirement over and above the corporate law requirements applicable to issuers (ASX and AIM) or permit more dilution than the U.S. exchanges before security holder approval is required (JSE and HKSE)

Public Interest

TSX is publishing the Request for Comments for a 60 day period, which expires December 12, 2007. TSX believes that it is important for its key stakeholders to have an opportunity to review any proposed amendments prior to their implementation.

Following the comment period, TSX will determine whether to propose an amendment to its current security holder approval requirements for acquisitions, based on the comments it receives. Any proposed amendment will be published for comments, together with a summary of the comments received prior to implementation. In the event that TSX does not propose an amendment, TSX will publish a subsequent notice, together with a summary of the comments received.

{1} As at June 30, 2007.

{2} As at June 30, 2007.

{3} As at June 30, 2007.

APPENDIX A

Section 611 of the Toronto Stock Exchange Company Manual

Sec. 611. Acquisitions.

(a) Where a listed issuer proposes to issue securities as full or partial consideration for property (which may include securities or assets) purchased from an insider of the listed issuer, TSX may require that documentation such as an independent valuation or engineer's report be provided.

(b) Security holder approval will be required in those instances where the number of securities issued or issuable to insiders as a group in payment of the purchase price for an acquisition exceeds 10% of the number of securities of the listed issuer which are outstanding on a nondiluted basis, prior to the date of closing of the transaction. Insiders receiving securities pursuant to the transaction are not eligible to vote their securities in respect of such approval.

(c) Subject to Subsection 611(d), security holder approval will be required in those instances where the number of securities issued or issuable in payment of the purchase price for an acquisition exceeds 25% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis.

(d) Subject to Sections 603 and 604 and to Subsection 611(b), TSX will not require security holder approval where a reporting issuer (or equivalent status) having 50 or more beneficial security holders, excluding insiders and employees, is acquired by the listed issuer.

(e) Where an acquisition by a listed issuer includes the assumption of security based compensation arrangements of a target issuer, securities issuable under such arrangements will be included in the securities issued or issuable for the purposes of the security holder approval requirement in Subsection 611(c). For the purpose of this Section 611, the assumption of security based compensation arrangements includes a direct assumption of a security based compensation arrangement as well as the cancellation of security based compensation arrangements in the target issuer and their replacement with arrangements in the listed issuer.

(f) Where an acquisition by a listed issuer includes the assumption of security based compensation arrangements of a target issuer, securities issuable under such arrangements are not subject to Subsection 613(a) if the number of assumed securities (and their exercise or subscription price, if applicable) is adjusted in accordance with the price per acquired security payable by the listed issuer.

(g) In calculating the number of securities issued or issuable in payment of the purchase price for an acquisition, any securities issued or issuable upon a concurrent private placement upon which the acquisition is contingent or otherwise linked will be included.

APPENDIX B

Other Exchange Requirements

Alternative Investment Market

Disclosure of corporate transactions

Substantial transactions

12. A substantial transaction is one which exceeds 10% in any of the class tests. It includes any transaction by a subsidiary of the AIM company but excludes any transactions of a revenue nature in the ordinary course of business and transactions to raise finance which do not involve a change in the fixed assets of the AIM company or its subsidiaries.

An AIM company must issue notification without delay as soon as the terms of any substantial transaction are agreed, disclosing the information specified by Schedule Four.

Schedule Four

In respect of transactions which require notifications pursuant to rules 12, 13, 14 and 15 an AIM company must notify the following information:

(a) particulars of the transaction, including the name of any company or business, where relevant;

(b) a description of the business carried on by, or using, the assets which are the subject of the transaction;

(c) the profits attributable to those assets;

(d) the value of those assets;

(e) the full consideration and how it is being satisfied;

(f) the effect on the AIM company;

(g) details of any service contracts of its proposed directors;

(h) in the case of a disposal, the application of the sale proceeds;

(i) in the case of a disposal, if shares or other securities are to form part of the consideration received, a statement whether such securities are to be sold or retained; and

(j) any other information necessary to enable investors to evaluate the effect of the transaction upon the AIM company.

American Stock Exchange

SHAREHOLDERS' APPROVAL (§§710-713)

Sec. 712. ACQUISITIONS

Approval of shareholders is required in accordance with §705 as a prerequisite to approval of applications to list additional shares to be issued as sole or partial consideration for an acquisition of the stock or assets of another company in the following circumstances:

(a) if any individual director, officer or substantial shareholder of the listed company has a 5% or greater interest (or such persons collectively have a 10% or greater interest), directly or indirectly, in the company or assets to be acquired or in the consideration to be paid in the transaction and the present or potential issuance of common stock, or securities convertible into common stock, could result in an increase in outstanding common shares of 5% or more; or

(b) where the present or potential issuance of common stock, or securities convertible into common stock, could result in an increase in outstanding common shares of 20% or more.

NOTE: A series of closely related transactions may be regarded as one transaction for the purpose of this policy. Companies engaged in merger or acquisition discussions must be particularly mindful of the Exchange's timely disclosure policies. In view of possible market sensitivity and the importance of providing investors with sufficient information relative to an intended merger or acquisition, listed company representatives are strongly urged to consult with the Exchange in advance of such disclosure.

Amended

November 25, 2002 (Amex-2002-87).

Australian Securities Exchange

New issues

Issues exceeding 15% of capital

Without the approval of holders of +ordinary securities, an entity must not issue or agree to issue more +equity securities than the number calculated according to the following formula.

- - - - - - - - - - - - - - - - - - - -

(A x B) -- C

- - - - - - - - - - - - - - - - - - - -

|

A= |

The number of fully paid +ordinary securities on issue 12 months before the date of issue or agreement, |

|

plus the number of fully paid +ordinary securities issued in the 12 months under an exception in rule 7.2, |

|

|

plus the number of party paid +ordinary securities that became fully paid in the 12 months, |

|

|

plus the number of fully paid +ordinary securities issued in the 12 months with approval of holders of +ordinary securities under this rule, |

|

|

less the number of fully paid +ordinary securities cancelled in the 12 months. |

|

|

|

|

|

B= |

15% |

|

|

|

|

C= |

The number of +equity securities issued or agreed to be issued in the 12 months before the date of issue or agreement to issue but not under an exception in rule 7.2 or with approval under this rule. |

...

Exceptions to rule 7.1

...

Rule 7.1 does not apply in any of the following cases.

...

Exception 5 An issue under an off-market bid that is required to comply with the Corporations Act or under a merger by way of scheme of arrangement under Part 5.1 of the Corporations Act.

EuroNext/OMX

The listing rules did not appear to contain specific requirements for security holder approval, however, our understanding is that many European corporate statutes provide for security holder approval of dilutive transactions where pre-emptive rights are not provided.

Johannesburg Stock Exchange

Categorization and explanation of terms

Any issuer considering a transaction must, at an early stage, consider the categorization of the transaction.

9.4 A transaction is categorized by assessing its size relative to that of the issuer proposing to make it and the listed holding company of such issuer, if applicable.

9.5 The comparison of size is made by the use of the percentage ratios set out in paragraph 9.6. The different categories of transactions are:

(a) Category 3 -- a transaction where any percentage ratio is 5% or more but each is less than 20%;

(b) Category 2 -- a transaction where any percentage ratio is 20% or more but each is less than 30%;

(c) Category 1 -- a transaction where any percentage ratio is 30% or more, or if the total consideration is not subject to any maximum; and

(d) Reverse take-over -- an acquisition by a listed company of a business, an unlisted company or assets where any percentage ratio is 100% or more, or which would result in a fundamental change in the business, or in a change in board or voting control (refer to definitions of "control" and "controlling shareholder") of the listed company, in which case this will be considered a new listing.

Percentage ratios

The percentage ratios are the figures, expressed as a percentage, resulting from each of the following calculations:

(a) consideration to market capitalization, being:

The consideration divided by the aggregate market value of all the listed equity securities, excluding treasury securities held in terms of the Act and shares held in terms of schedule 14.13,* of the listed company; or

(b) dilution, being:

the number of listed equity securities issued by a listed company as consideration for an acquisition compared to those in issue, excluding treasury securities held in terms of the Act and shares held in terms of schedule 14.13, * prior to the transaction; or

(c) transactions to be settled partly in cash and partly in shares:

the category size for such transaction is to be calculated by first assessing the cash to market capitalization percentage and then adding this percentage to the dilution percentage.

*The calculation showing all categorization workings, including the exclusion of treasury securities and shares held in terms of schedule 14.13, must be supplied to the JSE at the time of submission of the announcement and circular for approval.

...

Category 1 Requirements

9.22 In the case of a Category 1 transaction, the issuer must comply with paragraphs 9.20 and 9.21 (the Category 2 requirements). In addition, the company must obtain the approval of its shareholders in general meeting, and any agreement effecting the transaction must be conditional upon such approval being obtained and the circular should include a statement giving the directors' recommendation as to how shareholders should vote at the general meeting to approve the transaction and an indication as to how the directors intend to vote their shares, if applicable, at the general meeting.

9.23 In addition, if the Category 1 transaction results in an issue of securities that, together with any other securities of the same class issued during the previous 3 months, would increase the securities issued by more than 30%, then the issuer must include in the Category 1 circular the information required to be disclosed for a pre-listing statement.

London Stock Exchange

Classifying transactions

A transaction is classified by assessing its size relative to that of the listed company proposing to make it. The comparison of size is made by using the percentage ratios resulting from applying the class test calculations to a transaction. The class tests are set out in LR 10 Annex 1 (and modified or added to for specialist companies under LR 10.7).

LR 10.2.2

Except as otherwise provided in this chapter, transactions are classified as follows:

(1) Class 3 transaction: a transaction where all percentage ratios are less than 5%;

(2) Class 2 transaction: a transaction where any percentage ratio is 5% or more but each is less than 25%;

(3) Class 1 transaction: a transaction where any percentage ratio is 25% or more; and

(4) Reverse takeover: a transaction consisting of an acquisition by a listed company of a business, an unlisted company or assets where any percentage ratio is 100% or more or which would result in a fundamental change in the business or in a change in board or voting control of the listed company.

LR 10.5 Class 1 requirements

Notification and shareholder approval

A listed company must, in relation to a class 1 transaction:

(1) comply with the requirements of LR 10.4 (Class 2 requirements) for the transaction;

(2) send an explanatory circular to its shareholders and obtain their prior approval in a general meeting for the transaction; and

(3) ensure that any agreement effecting the transaction is conditional on that approval being obtained.

Note: LR 13 sets out requirements for the content and approval of class 1 circulars.

NASDAQ National Market

4350. Qualitative Listing Requirements for Nasdaq Issuers Except for Limited Partnerships

...

(i) Shareholder Approval

(1) Each issuer shall require shareholder approval or prior to the issuance of securities under subparagraph (A), (B), (C), or (D) below:

...

(D) in connection with a transaction other than a public offering involving:

(i) the sale, issuance or potential issuance by the issuer of common stock (or securities convertible into or exercisable for common stock) at a price less than the greater of book or market value which together with sales by officers, directors or substantial shareholders of the company equals 20% or more of common stock or 20% or more of the voting power outstanding before the issuance; or

(ii) the sale, issuance or potential issuance by the company of common stock (or securities convertible into or exercisable common stock) equal to 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance for less than the greater of book or market value of the stock.

New York Stock Exchange

Last Modified: 05/22/2007

312.00 Shareholder Approval Policy

312.03 Shareholder Approval

Shareholder approval is a prerequisite to issuing securities in the following situations:

(c) Shareholder approval is required prior to the issuance of common stock, or of securities convertible into or exercisable for common stock, in any transaction or series of related transactions if:

(1) the common stock has, or will have upon issuance, voting power equal to or in excess of 20 percent of the voting power outstanding before the issuance of such stock or of securities convertible into or exercisable for common stock; or

(2) the number of shares of common stock to be issued is, or will be upon issuance, equal to or in excess of 20 percent of the number of shares of common stock outstanding before the issuance of the common stock or of securities convertible into or exercisable for common stock. However, shareholder approval will not be required for any such issuance involving:

• any public offering for cash;

• any bona fide private financing, if such financing involves a sale of:

• common stock, for cash, at a price at least as great as each of the book and market value of the issuer's common stock; or

• securities convertible into or exercisable for common stock, for cash, if the conversion or exercise price is at least as great as each of the book and market value of the issuer's common stock.

(d) Shareholder approval is required prior to an issuance that will result in a change of control of the issuer

Stock Exchange of Hong Kong Limited

Major Transactions

14.09 A major transaction is any acquisition or realisation of assets (including securities) by a listed issuer or any of its subsidiaries where:--

(1) the value of the assets being acquired or realised represents 50 per cent. or more of the assets or consolidated assets, as the case may be, of the acquiring or realising group; or

(2) the net profit (after deducting all charges except taxation and excluding extraordinary items) attributable to the assets being acquired or realised as disclosed in the latest published audited accounts represents 50 per cent. or more of such net profit of the acquiring or realising group. In the case of a bank which is entitled to avail itself, and has availed itself, of the benefit of any of the provisions of Part III of the Tenth Schedule to the Companies Ordinance the net profit shall be taken as the profit (after taxation and after transfers to and from inner reserves) as disclosed in the latest published audited accounts or consolidated accounts (as appropriate) of the bank; or

(3) the aggregate value of the consideration given or received represents 50 per cent. or more of the assets or consolidated assets, as the case may be, of the acquiring or realising group; or

(4) the value of the equity capital issued as consideration by the acquiring issuer represents 50 per cent. or more of the value of the equity capital previously in issue.

Where the relative figures on the bases set out in sub-paragraphs (1), (3) and (4) are below the relevant percentages but the relative figure on the basis set out in sub-paragraph (2) is above the relevant threshold, the Exchange may be prepared to disregard the net profits test set out in sub-paragraph (2) if the issuer can clearly demonstrate that the comparison is affected by exceptional factors without which the comparison would have produced a result below the percentage.

14.10 A major transaction must be made conditional on approval by shareholders. Such approval may be obtained either by convening a general meeting of the issuer or by means of the written approval of the transaction by a shareholder who holds or shareholders who together hold more than 50 per cent. in nominal value of the securities giving the right to attend and vote at such general meeting. The Exchange will normally require that any shareholder shall abstain from voting at that general meeting and will not accept the written approval of any such shareholder if such shareholder has a material interest in the transaction. In that event, a statement that such shareholder will not vote must be included in the circular to shareholders.

Note:

Where the Exchange permits a written certificate of shareholders' approval to be given in lieu of a resolution

passed at a shareholders' meeting, the certificate must be signed by a single shareholder or a closely allied

group of shareholders.

14.11 A major transaction is also a discloseable transaction and the relevant requirements of rules 14.12 to 14.19 inclusive apply. The provisions of rule 14.35 may also be relevant.

Notification to

Announcement

Circular to

Shareholders'

Accountants'

the Exchange

Shareholders

Approval

Report

Share transaction

Yes

Yes

No

No (Note 1)

No

Discloseable transaction

Yes

Yes

Yes

No

No

Major transaction

Yes

Yes

Yes

Yes (Note 2)

Yes(Note 3)

Very substantial disposal

Yes

Yes

Yes

Yes (Note 2)

Yes (Note 5)

Very substantial acquisition

Yes

Yes

Yes

Yes (Note 2)

Yes (Note 4)

Reverse takeover

Yes

Yes

Yes

Yes (Notes 2&6)

Yes (Note 4)

Main Board companies are required to publish the announcement in the news papers. GEM companies are only required to post the announcement on our GEM website.

Note 1:

No shareholders' approval is necessary if the consideration shares are issued under a general mandate.

Note 2:

Any shareholder and his associates must abstain from voting if such shareholder has a material interest in the

transaction.

Note 3:

For acquisitions of businesses and/or companies only. The accountants' report is for the three preceding financial

years on the business, company or companies being acquired.

Note 4:

An accountants' report for the three preceding financial years on any business, company or companies being

acquired is required.

Note 5:

An accountants' report on the listed issuer's group is required.

Note 6:

Approval of the Exchange is necessary.

TSX Venture Exchange

POLICY 5.3 ACQUISITIONS AND DISPOSITIONS OF NON-CASH ASSETS

(as at June 29, 2004)

7.4 Shareholder Approval

(a) The Exchange can require Shareholder approval if it considers it necessary or advisable. The Exchange generally considers Shareholder approval to be necessary for:

(i) any transaction which results in the creation of a new Control Person;

(ii) any acquisition which together with any concurrent or related transactions results in the issuance of more than 10% of the outstanding Listed Shares (calculated before the acquisition and the concurrent transaction) where Non Arms Length Parties have a 20% or greater interest in the asset, property or business to be acquired;

(iii) any acquisition which together with any concurrent or related transactions results in the issuance of more than 20% of the outstanding Listed Shares (calculated before the acquisition and the concurrent transaction) where Non Arms Length Parties have any interest in the asset, property or business to be acquired;

(iv) any Reviewable Disposition which is a sale of more than 50% of the Issuer's assets, business or undertaking; or

(v) if requested by the Exchange, a transaction for which the consideration to be paid exceeds the Exchange's vendor consideration guidelines set out in Policy 5.4--Escrow, Vendor Consideration and Resale Restrictions.

.........

Appendix C

Resource Listed Companies

TSX-TSX Venture, NYSE, LSE-AIM & ASX

Appendix D

Size Distribution of Listed Companies

TSX, TSX Venture, NYSE, NASDAQ AIM and ASX