Register today for OSC Dialogue 2024: Inviting, thriving and secure capital markets

IIROC Notice 12-0315 – Proposed Provisions Respecting Third-Party Electronic Access to Marketplaces – Investment Industry Regulatory Organization of Canada (IIROC)

Executive Summary

On September 12, 2012, the Board of Directors of IIROC ("Board") approved the publication for comment of:

• proposed amendments to UMIR respecting third-party electronic access to marketplaces ("Proposed UMIR Amendments") that would introduce:

• requirements for a Participant providing "direct electronic access",

• provisions governing a Participant in a "routing arrangement" with an investment dealer,

• requirements for supervision of orders entered by an order execution client by a Participant that provides order execution services, and

• gatekeeper obligations on a marketplace that provides access to a Participant or Access Person and on a Participant that provides direct electronic access to a client or to an investment dealer under a routing arrangement; and

• proposed amendments to the Dealer Member Rules ("Proposed DMR Amendments") that would:

• provide an exemption from the suitability obligations whenever a Dealer Member accepts an order from a client or transmits an order for a client who has been provided with direct electronic access, subject to specific conditions, and

• prohibit a Dealer Member that offers order execution only services to Retail Customers from allowing its clients to use automated order systems or allowing its clients to manually send orders that exceed the threshold on the number of orders as set by IIROC from time to time.

In addition, the Board authorized the withdrawal from further consideration an earlier proposal published in April of 2007 that would have clarified the obligations of Participants, Access Persons and marketplaces regarding direct access to marketplaces.{1}

The Proposed UMIR Amendments and Proposed DMR Amendments (collectively, the "Proposed Amendments") are intended to provide a comprehensive framework to regulate various forms of third-party electronic access to marketplaces and complement the proposed amendments to National Instrument 23-103 -- Electronic Trading dealing with direct electronic access to marketplaces ("CSA Access Proposals").{2} In recent years there has been a proliferation of sophisticated, high-speed trading technology that has caused various risks to emerge including financial, regulatory, legal and operational risks associated with electronic access to marketplaces. IIROC believes that there should be a common set of rules for the granting of direct electronic access that applies across all marketplaces. This common set of requirements would protect overall market integrity and facilitate trading in a multiple marketplace environment.

While the Proposed Amendments will introduce a new and more comprehensive framework for third-party electronic access to marketplaces, many of the components of these requirements build on: existing marketplace requirements for direct market access; regulatory requirements and guidance on trade supervision and compliance; and established industry practices. As such, many of Proposed Amendments either formalize or clarify existing requirements or practices.

The Proposed Amendments do not affect the entry of orders on a marketplace that are intermediated by an individual registrant or trader of a Participant.{3}

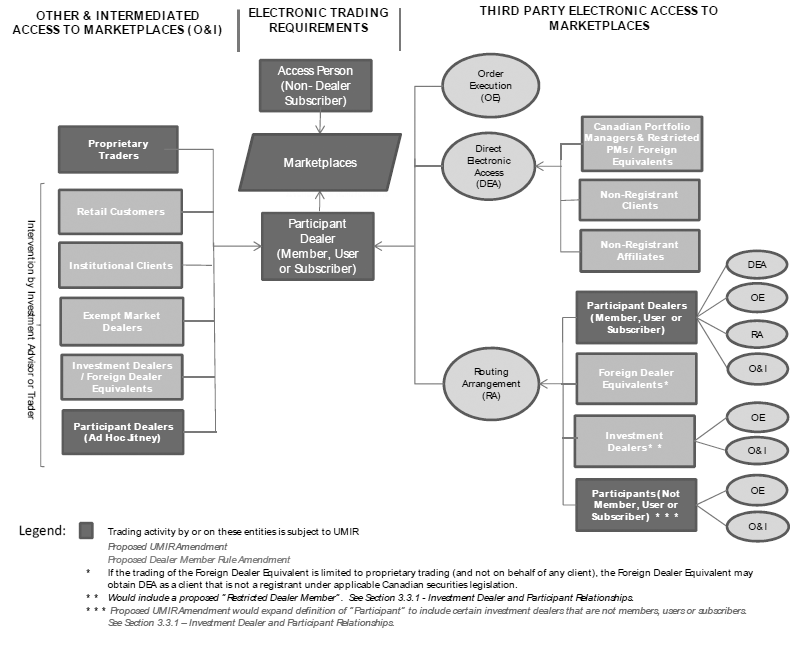

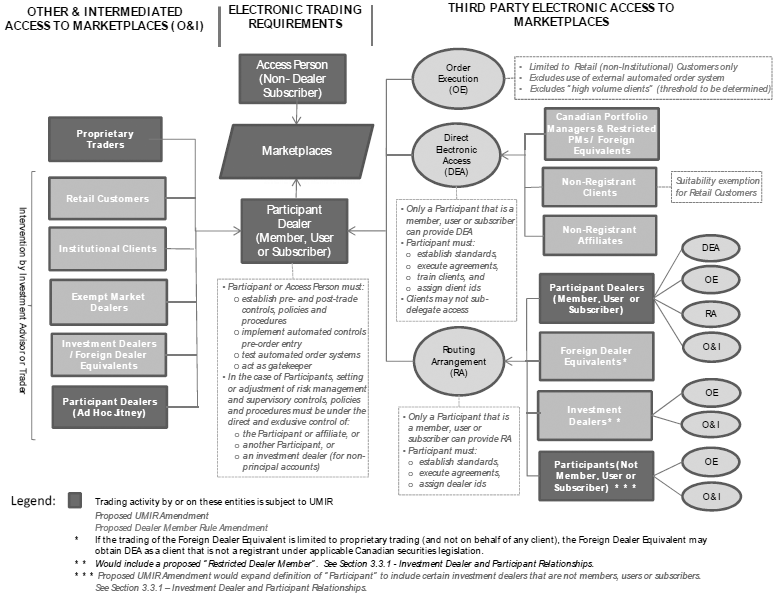

The following diagram{4} summarizes the order flow to marketplaces assuming the adoption of the Proposed Amendments, and earlier proposed amendments to UMIR respecting electronic trading.{5} Currently, all marketplaces trading listed or quoted securities in Canada operate as electronic markets. The diagram confirms that:

• all orders entered on a marketplace in respect of a listed or quoted security are subject to UMIR;

• the only means to access a marketplace for the purpose of trading a listed or quoted security is:

• as an Access Person as a subscriber to an ATS, or

• by or through a Participant as a member of an Exchange or subscriber to an ATS; and

• unless a client order is intermediated by an investment advisor or trader at a Participant, the only third-party access that a Participant can provide will be governed by one of three options:

• order execution service,

• direct electronic access, or

• routing arrangement.

In order to facilitate the preparation of comments on the Proposed Amendments, IIROC intends to hold information sessions with industry participants during the comment period to address questions related to the Proposed Amendments. Notice of dates and locations for the information session will be published in a separate IIROC Notice in the near future.

Generally speaking, the impact of the Proposed Amendments would be to require a Participant granting access to a marketplace through direct electronic access or a routing arrangement to:

• establish standards to manage the attendant risks;

• enter into a written agreement with each client or investment dealer provided access;

• establish and apply appropriate supervisory and compliance procedures for orders entered under direct electronic access or routing arrangements;

• at least annually review the standards and compliance of each client and investment dealer with the standards and written agreement; and

• establish procedures for reporting to IIROC non-compliance by a client or investment dealer with the standards or written agreement.

The Proposed Amendments would also require a Participant offering order execution services to review, on an on-going basis, whether the account was appropriate to use such service and, on an annual basis, that the account is not using a third-party automated order system.

IIROC would expect that, if the Proposed Amendments are approved by the Recognizing Regulators, the amendments would be implemented on the later of:

• the date the CSA Access Proposals become effective; and

• 180 days following the publication of notice of approval of the amendments

To the extent that a Participant has an existing agreement with a client or an investment dealer for electronic access to a marketplace, the Participant would have a further 180 days to bring such agreements into compliance with the requirements of the amendments.

1. Policy Development Process

IIROC has been recognized as a self-regulatory organization by each of the Canadian provincial securities regulatory authorities (the "Recognizing Regulators") and, as such, is authorized to be a regulation services provider for the purposes of National Instrument 21-101 ("Marketplace Operations Instrument") and National instrument 23-101 ("CSA Trading Rules").

As a regulation services provider, IIROC administers and enforces trading rules for the marketplaces that retain the services of IIROC.{6} IIROC has adopted, and the Recognizing Regulators have approved, UMIR as the integrity trading rules that will apply in any marketplace that retains IIROC as its regulation services provider.

The Market Rules Advisory Committee ("MRAC") of IIROC reviewed the Proposed Amendments. MRAC is an advisory committee comprised of representatives of each of the marketplaces for which IIROC acts as a regulation services provider; Participants, institutional investors and subscribers, and the legal and compliance community.{7}

The text of the Proposed UMIR Amendments is set out in Appendix "A". The text of the Proposed DMR Amendments is set out in Appendix "B". The Proposed Amendments deal with various forms of third-party electronic access to marketplaces and are designed to complement and supplement provisions regulating electronic trading that are being proposed by the Canadian Securities Administrators ("CSA") in the CSA Access Proposals. For this reason, the Board has determined the Proposed Amendments to be in the public interest.

Comments are requested on all aspects of the Proposed Amendments, including any matter which they do not specifically address. Comments on the Proposed Amendments should be in writing and delivered by January 23, 2013 to:

Naomi Solomon,

Senior Policy Counsel, Market Regulation Policy,

Investment Industry Regulatory Organization of Canada,

Suite 2000

121 King Street West,

Toronto, Ontario. M5H 3T9

Fax: 416.646.7265

e-mail: [email protected]

A copy should also be provided to the Recognizing Regulators by forwarding a copy to:

Susan Greenglass

Director, Market Regulation

Ontario Securities Commission

Suite 1903, Box 55,

20 Queen Street West

Toronto, Ontario. M5H 3S8

Fax: (416) 595-8940

e-mail: [email protected]

Commentators should be aware that a copy of their comment letter will be made publicly available on the IIROC website (www.iiroc.ca under the heading "Policy" and sub-heading "Market Proposals/Comments" and/or "Dealer Member Rules -- Policy Proposals and Comment") upon receipt. A summary of the comments contained in each submission will also be included in a future IIROC Notice.

In order to facilitate the preparation of comments on the Proposed Amendments, IIROC intends to hold information sessions with industry participants during the comment period to address questions related to the Proposed Amendments. Notice of dates and locations for the information session will be published in a separate IIROC Notice in the near future.

After considering the comments on the Proposed Amendments received in response to this Request for Comments together with any comments of the Recognizing Regulators, IIROC may recommend that revisions be made to the applicable proposed amendments. If the revisions are not of a material nature, the Board has authorized the President to approve the revisions on behalf of IIROC and the applicable proposed amendments as revised will be subject to approval by the Recognizing Regulators. If the revisions are material, the applicable proposed amendments as revised will be submitted to the Board for ratification and, if ratified, will be republished for further public comment.

2. Background to the Proposed Amendments

2.1 Earlier Proposals to Regulate Access to Marketplaces

In April 2007, amendments were proposed to UMIR that were intended to clarify the obligations of Participants, Access Persons and marketplaces regarding direct access to markets (the "2007 Proposal").{8} The 2007 Proposal would have introduced, among other things:

• a provision that a person with "Dealer-Sponsored Access" would be subject to UMIR (either as a "Participant" in the case of a dealer with Dealer-Sponsored Access or as an "Access Person" for a person other than a dealer); and

• a requirement for training and proficiency for each person entitled to enter orders on a marketplace on behalf of an Access Person.

The 2007 Proposal was published concurrently with proposed amendments to the CSA Trading Rules. With the publication of the Proposed Amendments dealing with the same subject matter, the 2007 Proposal is withdrawn from further consideration by the Recognizing Regulators. The elements of the 2007 Proposal referenced above have not been included in the Proposed Amendments.{9}

2.2 International Developments and Initiatives

Following the 2007 Proposal, regulatory developments in other jurisdictions concerning electronic trading and access to marketplaces have been monitored. Almost all jurisdictions have experienced a proliferation of sophisticated, high-speed trading technology that has caused various risks to emerge including financial, regulatory, legal and operational risks, associated with market access.

The Proposed Amendments respecting third-party electronic access to marketplaces are aligned with the principles outlined in the Final Report prepared by the International Organization of Securities Commissions ("IOSCO") entitled Principles for Direct Electronic Access to Markets, in August, 2010{10} (the "IOSCO DEA Report"). In particular, the IOSCO DEA Report included eight principles applicable to DEA arrangements in three key areas:

• pre-conditions for DEA;

• information flow; and

• adequate systems and controls.

The IOSCO DEA Report recommended three principles for the pre-conditions for DEA:

• Minimum Customer Standards: Each DEA customer must have appropriate financial resources and procedures in place to ensure that all relevant persons are both familiar with, and comply with, the rules of the market and have knowledge of and proficiency in the use of the order entry system used by the DEA customer; and intermediaries must maintain minimum customer standards.

• Legally Binding Agreement: There should be a recorded, legally binding contract between the intermediary and the DEA customer, the nature and detail of which should be appropriate to the nature of the service provided.

• Intermediary's Responsibility for Trades: An intermediary retains ultimate responsibility for all orders under its authority, and for compliance of such orders with all regulatory requirements and market rules.

With respect to information flow, the IOSCO DEA Report recommended two guiding principles:

• Customer Identification: Intermediaries must disclose to market authorities the identity of their DEA customers in order to facilitate market surveillance.

• Pre- and Post-Trade Information: Markets should provide member firms with access to relevant pre- and post-trade information (on a real-time basis) to enable these firms to implement appropriate monitoring and risk management controls.

In the third area covered by the IOSCO DEA Report, IOSCO set out principles regarding the responsibilities of markets and intermediaries:

• Markets: A market should not permit DEA unless there are in place effective systems and controls reasonably designed to enable the management of risk with regard to fair and orderly trading including, in particular, automated pre-trade controls that enable intermediaries to implement appropriate trading limits.

• Intermediaries: Intermediaries (including, as appropriate, clearing firms) should use controls, including automated pre-trade controls, which can limit or prevent a DEA Customer from placing an order that exceeds a relevant intermediary's existing position or credit limits.

• Adequacy of Systems: Intermediaries (including clearing firms) and markets should have adequate operational and technical capabilities to manage appropriately the risks posed by DEA.

In the U.S., Rule 15c3-5 requires broker-dealers providing DEA to implement risk management controls and supervisory procedures reasonably designed to manage the financial, regulatory and other risks of this business activity. This rule effectively prohibits broker-dealers from providing unfiltered access to any marketplace. The other recent international regulatory initiatives noted, propose or have finalized similar frameworks for electronic access to marketplaces with reference to the principles in the IOSCO DEA Report, reflecting the impact of changes in market structure across jurisdictions.{11}

2.3 Electronic Trading Rule and Proposed UMIR Requirements

In April of 2011, the CSA published for comment the proposed National Instrument 23-103 Electronic Trading and Direct Electronic Access to Marketplaces and its Companion Policy (23-103 CP) (the "Proposed ETR").{12} The Proposed ETR would have replaced a number of proposed changes to the CSA Trading Rules regarding access to marketplaces that had been published concurrent with the 2007 Proposal. On June 28, 2012, the CSA published National Instrument 23-103 Electronic Trading ("ETR"). The ETR, which will become effective March 1, 2013, governs the requirements for risk controls, policies and procedures that marketplace participants and marketplaces must implement in regard to electronic trading.{13} Concurrent with the publication of the ETR, IIROC also published proposed amendments and proposed guidance to UMIR to implement ETR and complement its provisions ("Proposed UMIR ETR Requirements").{14}

The Proposed UMIR ETR Requirements will introduce new provisions detailing the responsibilities of Participants and Access Persons with respect to the supervision of electronic trading. These provisions will align UMIR with the requirements set out in the ETR applicable to "market participants" which includes both Participants and Access Persons under UMIR.{15} In particular, the Proposed UMIR ETR Requirements would:

• expand the existing supervisory requirements for trading to specifically include the establishment and maintenance of risk management and supervisory controls, policies and procedures related to access to one or more marketplaces and/or the use of an automated order system;

• permit, in certain circumstances, a Participant to authorize an investment dealer to perform on its behalf the setting or adjustment of a risk management or supervisory control policy or procedure to an investment dealer by a written agreement; and

• impose specific gatekeeper obligations on a Participant who has authorized an investment dealer to perform on its behalf the setting or adjustment of a risk management or supervisory control policy or procedure to an investment dealer.

The most significant impacts of the Proposed UMIR ETR Requirements would be to:

• ensure that Participants and Access Persons adopt, document and maintain a system of risk management and supervisory controls, policies and procedures reasonably designed to manage the risks associated with electronic trading and access to marketplaces;

• ensure that Participants and Access Persons are effectively supervising trading activity and are accounting for the risks associated with electronic access to marketplaces in their supervisory and compliance monitoring procedures; and

• require an appropriate level of understanding, ongoing testing and appropriate monitoring of any automated order systems in use by a Participant, Access Person, or any client of a Participant.

In particular, the ETR and the Proposed UMIR ETR Requirements will require each Participant or Access Person to adopt risk management and supervisory controls, policies and procedures that must be reasonably designed to:

• ensure that all orders (including those that may be entered by third-party electronic access provided by a Participant) are monitored pre-entry to a marketplace and post-trade;

• systematically limit the financial exposure of the Participant or Access Person;

• ensure compliance with all marketplace and regulatory requirements;

• ensure the Participant or Access Person can stop or cancel the entry of orders to a marketplace;

• ensure the Participant or Access Person can suspend or terminate any marketplace access granted to a client; and

• ensure the entry of orders does not interfere with fair and orderly markets.

IIROC would expect that, if the Proposed UMIR ETR Requirements are approved by the Recognizing Regulators, the amendments would be implemented on the later of:

• March 1, 2013, the date the ETR becomes effective; and

• 120 days following the publication of notice of approval of the amendments.

2.4 CSA Access Proposals

Provisions respecting direct electronic access to marketplaces included in the Proposed ETR were not included in the ETR. However, these provisions dealing with direct electronic access are now incorporated into the CSA Access Proposals.

The CSA Access Proposals build on the obligations outlined in Section 11.1 of National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations{16} ("NI 31-103") under which a registered firm must establish, maintain and apply policies and procedures that establish a system of controls and supervision sufficient to:

• provide reasonable assurance that the firm and each individual acting on its behalf complies with securities legislation; and

• manage the risks associated with its business in accordance with prudent business practices.

The Proposed Amendments complement the CSA Access Proposals. The Proposed Amendments also contain additional provisions related to the provision of third-party electronic access to marketplaces by Participants through the mechanisms of direct electronic access to clients, order routing arrangements between investment dealers and order execution services presently offered to a range of client account types.

2.5 Current Marketplace Requirements for "Direct Access"

Requirements relating to the granting of direct access to marketplaces are currently established under the rules of the exchanges and in the policies and contractual provisions which an ATS has with its subscribers. The TSX, TSXV and TMX Select have substantially similar requirements{17} which include:

• a list of "eligible clients", or classes of entities which are generally various domestic and foreign institutional customers as well as order execution clients that are eligible to transmit orders electronically directly to the trading system;

• conditions for connections which Participants/Members/Subscribers must follow in order to transmit orders received electronically from an eligible client through the infrastructure of the Participant or through a third-party system contracted by the Participant and approved by the marketplace, directly to the trading system, including obtaining prior written approval of the marketplace that:

• the system of the Participant meets the prescribed conditions, and

• a standard form of agreement with the prescribed conditions is entered into between the Participant and an eligible client; and

• mandating Participant/Member/Subscriber responsibility for compliance with marketplace requirements with respect to the entry and execution of orders transmitted by eligible customers through the Participant.

Alpha Exchange,{18} (and formerly Alpha ATS), maintains trading policies concerning Direct Market Access with comparable requirements to the TSX, but does not include order execution clients in its list of "DMA Eligible Clients". Omega and CNSX, with regard to access to its "Pure Trading" facility, have maintained policies on Direct Market Access which are substantially the same as those of the TMX Group marketplaces.{19} Other ATSs that permit investment dealers to be subscribers have generally incorporated by reference the requirements of the TSX into their contractual arrangements with subscribers who are Participants.

If the CSA Access Proposals and the Proposed UMIR Amendments are approved, the result would be a common set of rules applying to the granting of direct electronic access that would apply across all marketplaces that have retained IIROC as their regulation services provider.{20} This common set of requirements would facilitate trading in a multiple marketplace environment. If the CSA Access Proposals and the Proposed UMIR Amendments are approved, IIROC would expect that the exchanges would repeal their rules and the ATSs would repeal their policies and contractual provisions governing direct electronic access.

2.6 Current UMIR Trading Supervision Requirements for Direct Access to Marketplaces

Trading supervision requirements related to direct access to marketplaces have been addressed in Rule 7.1 and Policy 7.1 of UMIR, in the context of marketplace requirements governing direct access. Currently, Rule 7.1 establishes trading supervision obligations which Participants must follow, including:

• adopting written policies and procedures to be followed by directors, officers, partners and employees of the Participant that are adequate, taking into account the business and affairs of the Participant, to ensure compliance with UMIR and each Policy; and

• complying, prior to the entry of an order on a marketplace, with:

• applicable regulatory standards with respect to the review, acceptance and approval of orders,

• the policies and procedures adopted, and

• all requirements of UMIR and each Policy.

Policy 7.1 elaborates on the responsibility of Participants for trading supervision and compliance, including for orders entered on a marketplace without the involvement of a trader as the client maintains a "systems interconnect arrangement", in accordance with marketplace requirements. Policy 7.1 directs that the obligation to supervise:

• applies to the Participant whatever the means with which an order is entered on a marketplace, including if entered directly by a client and routed to a marketplace through the trading system of the Participant; and

• requires adequate supervision policies and procedures to address the potential additional risk exposure with orders not directly handled by the Participant but which are the Participant's responsibility.

The supervision requirements in UMIR were supplemented by guidance concerning direct access to marketplaces. In 2005, guidance was issued concerning supervision of persons with "direct access".{21} A Participant providing "direct access" was advised that they were not relieved from any obligations under UMIR with respect to the supervision of trading activities by a "direct access client" and retained full responsibility for any order entered by a direct access client, even though that order would be electronically routed to the marketplace. The policies and procedures of a Participant were mandated to specifically address the additional risk exposure which the Participant had for orders not directly handled by the Participant prior to the entry on a marketplace.

Between 2007 and 2009, additional guidance{22} has been issued setting out regulatory expectations concerning compliance and supervision obligations under Policy 7.1 of UMIR in regard to:

• order execution services provided to a client that is a Retail Customer (an "order execution client");

• dealer-sponsored access services or "Direct Market Access" provided to a client, excluding order execution clients (a "DMA client"); and

• algorithmic trading.

The guidance provided to Participants was substantially similar for both order execution and DMA client streams and emphasized that:

• the source of, or means with which, an order is entered does not relieve a Participant of responsibility for, and the supervision of, such orders including:

• the detection of UMIR violations, and

• implementation of systems reasonably designed to prevent the entry and execution of "unreasonable" orders and trades on a marketplace whether the Participant, or a DMA client of the Participant, is using an algorithmic trading system, and

• the Dealer Member Rules applicable to order execution services or institutional DMA clients{23} would not alter or relieve a Participant from any obligations under Policy 7.1.

Enforcement cases that have been taken by IIROC under Rule 7.1 and Policy 7.1 have reinforced the requirement of a Participant to properly supervise "DMA trading",{24} holding that Participants that provide DMA to IIROC-regulated marketplaces retain the ultimate responsibility for any order entered and to ensure that trading supervision obligations under UMIR are met.

3. Discussion of the Proposed Amendments

The following is a summary of the principal components of the Proposed UMIR Amendments and the Proposed DMR Amendments:

3.1 Regulatory Framework for Third-Party Electronic Access to Marketplaces

The Proposed ETR would have established a framework for direct electronic access to marketplaces premised (in a similar vein to the marketplace rules concerning direct access) on the Participant as provider of, and primary gatekeeper to, electronic access to marketplaces. The provisions in the Proposed ETR related to a dealer providing electronic access to marketplaces have now been included in the CSA Access Proposals. Provisions relating to DEA and also order routing and order execution services will also be included in UMIR as part of the Proposed UMIR Amendments, given IIROC's jurisdiction governing Participants and Access Persons, to whom the electronic access requirements are effectively directed. The comments received on the Proposed ETR in regard to the provisions on direct electronic access to marketplaces have been taken into account with regard to formulation of the Proposed UMIR Amendments and Proposed DMR Amendments.

The Proposed ETR included specific new terminology and a definition of an arrangement for electronic access to marketplaces, namely "direct electronic access" ("DEA"). Previously, DEA was referred to in IIROC's guidance and commonly known as "direct market access" or "DMA" based on the requirements established by the marketplaces or as "dealer-sponsored access" using the terminology from the 2007 Proposal. The Proposed UMIR Amendments would adopt a definition of the term as:

"direct electronic access" means an arrangement between a Participant that is a member, user or subscriber and a client that permits the client to electronically transmit an order containing the identifier of the Participant:

• through the systems of the Participant for automatic onward transmission to a marketplace; or

• directly to a marketplace without being electronically transmitted through the systems of the Participant.

This definition in the Proposed UMIR Amendments is consistent with the definition in the CSA Access Proposals. The definitions are revised from that in the Proposed ETR to clarify that the electronic transmission by a client of an order containing the Participant's identifier, to a marketplace, would be considered to be a DEA whether or not the client's order first passes through the Participant's systems. If a Participant retains a service provider to provide technology, the order may not be transmitted through the "systems of the Participant" but the access will be considered to be direct market access under the second branch of the definition. Whether an order is transmitted through the systems of the Participant, the Participant retains responsibilities and obligations for the order under UMIR and, in particular, the order will remain subject to the risk management and supervisory controls, policies and procedures that the Participant must adopt in accordance with the Proposed UMIR ETR Requirements.

The standards which a Participant must adhere to in providing DEA under the Proposed UMIR Amendments are also consistent with the CSA Access Proposals. The Proposed DMR Amendments will provide a new proposed suitability exemption in Dealer Member Rule 1300.1 for certain Retail Customers{25} who may be granted DEA in accordance with the principles expressed by the CSA in the Proposed ETR.{26}

In addition, the Proposed Amendments go beyond the provisions in the CSA Access Proposals to address other identified arrangements for electronic access to marketplaces provided by a Participant which may have similar risks to the Participant and the market as "direct electronic access". These arrangements enable an investment dealer{27} or other client to send orders to a Participant electronically in a similar manner as a DEA client would send its orders to a Participant. The "DEA-like" trading arrangements are defined in the Proposed UMIR Amendments as:

• a "routing arrangement" under which a Participant that is a member, user or subscriber permits an investment dealer or foreign dealer equivalent{28} to electronically transmit an order relating to a security:

• through the systems of the Participant for automatic onward transmission to:

•a marketplace to which the Participant has access using the identifier of the Participant, or

•a foreign organized regulated market to which the Participant has access directly or through a dealer in the other jurisdiction; or

• directly to a marketplace using the identifier of the Participant without being electronically transmitted through the systems of the Participant; and

• an "order execution service", being a service that meets the requirements, from time to time, under Dealer Member Rule 3200.{29}

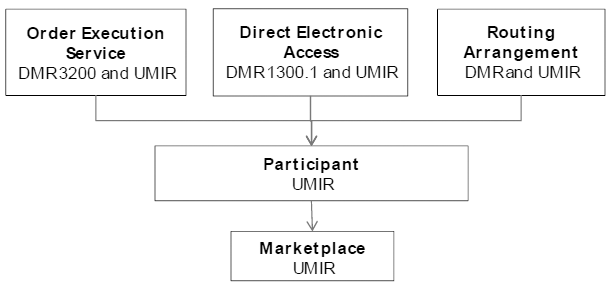

The following diagram outlines the regulatory framework, discussed below, for electronic access to marketplaces:

In IIROC's view, routing arrangements and order execution services pose similar systemic risks to DEA. All three arrangements for access to a marketplace require the electronic transmission of orders directly to a marketplace. Accordingly, the intention of the Proposed UMIR Amendments, together with Proposed DMR Amendments, is to ensure that each arrangement with a Participant for electronic access to a marketplace is appropriately supervised and regulated.

The Proposed UMIR Amendments provide for similar requirements to govern routing arrangements and trading though an order execution service, as with DEA, supplemented by new proposed requirements in Dealer Member Rule 3200 related to the provision of order execution services.

The definitions of both "direct electronic access" and "routing arrangement" contemplate that orders may be entered on a marketplace using the identifier of the Participant without being electronically transmitted through the systems of the Participant. Whether or not an order first passes through the Participant's systems, the Proposed UMIR ETR Requirements would make the order subject to the risk management and supervisory controls, policies and procedures established by the Participant including automated controls to examine each order before entry on a marketplace to prevent the entry of an order which would result in:

• the Participant exceeding pre-determined credit or capital thresholds;

• a client of the Participant exceeding pre-determined credit or other limits assigned by the Participant or to that client;

• the Participant or client exceeding pre-determined limits on the value or volume of unexecuted orders for a particular security or class of securities; or

• an order this is not in compliance with Requirements.

In accordance with ETR and the Proposed UMIR ETR Requirements, a Participant may, on a reasonable basis and in connection with trading by a client of investment dealer that is to be entered on a marketplace pursuant to the routing arrangement, authorize that investment dealer to perform on the Participant's behalf, the setting or adjusting of specific risk management or supervisory controls, policies or procedures, including the automated controls. Notwithstanding that a Participant may have authorized an investment dealer to set or adjust the specific risk management or supervisory controls, policies or procedures in respect of client orders from that investment dealer, the Participant remains responsible under UMIR in respect of such orders.

In order to allow Dealer Members to provide direct electronic access to their clients, while ensuring that such access is not provided through an order execution only service, the Proposed DMR Amendments would make changes to Dealer Member Rules 1300.1 and 3200.

The proposed amendments to Dealer Member Rule 1300.1 would allow a Dealer Member to accept or transmit orders for a client who has been provided with DEA, without being subject to the suitability obligations that would otherwise apply for acceptance of orders, as long as the Dealer Member:

• first determines that DEA is suitable for the client (whether a Retail Customer or Institutional Customer{30});

• complies with any UMIR provisions relating to the granting of DEA; and

• does not provide any recommendations to the Retail Customer.

In order to ensure that the regulatory framework is set up such that the appropriate type of service is provided, the Proposed DMR Amendments would amend Dealer Member Rule 3200 to clarify that order execution only services may only be offered to Retail Customers and that Dealer Members offering an order execution only service must not allow such Retail Customers to:

• use their own automated order system to generate orders to be sent to the Dealer Member or send orders to the Dealer Member on a pre-determine basis; or

• manually send orders or generate orders to the Dealer Member that exceed the threshold on the number of orders as set by IIROC from time to time.

It should be noted that access to marketplaces may also be gained, indirectly, by those clients or registrants using an advisor or trader to enter transactions on their behalf for execution on a marketplace. Due to its structure, an advisory account would not be subject to these requirements. The general suitability assessment requirements, and related exemptions, are set out in Dealer Member Rule 1300.1. The manner by which suitability is assessed for Institutional Customers is set out in Dealer Member Rule 2700.{31}

3.2 Regulation of "Direct Electronic Access"

3.2.1 Participant and DEA Client Relationships

The Proposed UMIR Amendments would specifically add Rule 7.13 to address the requirements for a Participant that is a member, user or subscriber to provide DEA to a client. As with the CSA Access Proposals (and the earlier Proposed ETR), Rule 7.13 would not prescribe an "eligible client list" of types of clients able to have DEA. This approach is different from that currently imposed under marketplace rules and policies governing DMA (which generally include various foreign and domestic institutions or registrants as well as clients trading through an order execution service). Rather, the proposed Rule sets minimum standards for provision of DEA, which is more appropriate and consistent with other jurisdictions.

Under the Proposed UMIR Amendments, a Participant may provide DEA to clients who are not registrants under Canadian securities legislation. The only categories of Canadian registrants entitled to have DEA are a portfolio manager or a restricted portfolio manager. As non-dealers, a DEA client would generally not be subject to IIROC's jurisdiction (unless the DEA client was also a subscriber to an ATS and therefore an Access Person for the purposes of UMIR). Rather, the proposed DEA regime relies on the Participant{32} providing DEA to act as gatekeeper, according to prescribed minimum standards in UMIR, for the provision of DEA to its non-dealer clients. The proposed DEA regime is accordingly consistent with the current marketplace rules and policies to the extent that the Participant is responsible for compliance with the requirements respecting the entry and execution of orders transmitted electronically by DEA clients through or using the Participant to the marketplace.

Under the Proposed DMR Amendments, a new suitability exemption would be provided in Rule 1300.1 for orders accepted from or transmitted for any clients with DEA as long as, among other things, the Dealer Member has determined that providing DEA to the client is suitable for that client.

There are two additional conditions a Dealer Member must meet in order to be exempt from the suitability requirements applicable to orders, namely the Dealer Member must:

• not provide any recommendation to any Retail Customers that have been provided with direct electronic access; and

• comply with the rules in UMIR applicable to the direct electronic access service offering and the requirements of NI 23-103.{33}

The prohibition against providing recommendations to Retail Customers is meant as an additional safeguard to mitigate the risk that the Dealer Member may be able to provide recommendations to the Retail Customer and then allow the Retail Customer to use its direct electronic access systems to process the recommended transaction. Without this condition, the exemption provided would allow a Dealer Member or Registered Representative to make recommendations without being responsible for the suitability of those recommendations, a gap that does not exist under the current regime. A similar exemption is not introduced for Institutional Customers as IIROC recognizes that when dealing with Institutional Customers, the Dealer Members often provide trade recommendations which are acceptable as long as the Dealer Member meets its sophistication assessment suitability obligations with respect to recommendations provided to an Institutional Customer.

DEA is not, however, intended to be widely applicable to Retail Customers. Rather, the expectation that Retail Customers will generally not qualify for DEA (and thus not be able to avail themselves of the suitability exemption) would be set out in Part 9 of Policy 7.1 of UMIR. The policy would also recognize exceptional circumstances when DEA could be provided to non-institutional investors, including:

• sophisticated former traders and floor brokers; and

• a person or company having assets under administration with a value approaching that of an Institutional Customer that has access to and knowledge regarding the necessary technology to use DEA.

In these circumstances, the Participant must set higher standards than for Institutional Customers to mitigate exposure to undue and higher risk associated with a Retail Customer employing DEA.

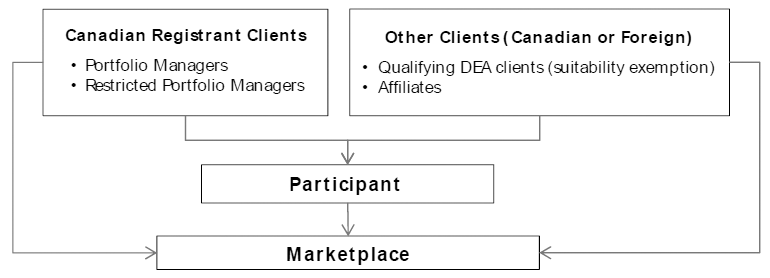

The following diagram illustrates a Participant's potential DEA client relationships:

3.2.2 Minimum Standards for DEA / Written Agreement

The minimum standards to be established by a Participant providing DEA to its client are included in proposed Rule 7.13 and are comparable to the requirements suggested in the Proposed ETR. The standards would require that the DEA client must:

• have sufficient resources to meet any financial obligations that may result from the use of DEA;

• have reasonable knowledge and proficiency to use the order entry system;

• have reasonable knowledge of and ability to comply with all Requirements,{34} including order marking as required by Rule 6.2 of UMIR; and

• have reasonable arrangements in place to monitor the entry of orders transmitted using DEA.

The standards would also require that the Participant that provides DEA:

• take all reasonable steps to ensure that the use of automated order systems{35} by itself or any client, does not interfere with fair and orderly markets; and

• ensure that each automated order system used by the client or any of its clients is tested in accordance with prudent business practices.

These minimum standards are considered necessary by the CSA and IIROC to ensure that the Participant properly manages its risks and that a DEA client has sufficient financial resources and knowledge of both the order entry system and applicable marketplace and regulatory requirements. In this manner, the Participant establishes, maintains and applies reasonable standards for DEA including evaluating its risks in providing DEA to a specific client. Each potential DEA client must be vetted individually with reasonable standards tailored to each client.

Adherence to the minimum prescribed standards and any more stringent requirements which may be imposed by the Participant providing DEA to a client, must, among other things, be included in the terms of a written agreement to be entered into by the Participant with the DEA client as a precondition to the grant of DEA to a client. In all cases, a Participant must provide the DEA client with all relevant amendments or changes to applicable Requirements and the standards established by the Participant.

The written agreement between the Participant and the client must contain a number of provisions, including:

• the ability of the Participant, without prior notice, to:

• reject any order,

• vary, correct or cancel any order entered on a marketplace, or

• discontinue accepting orders from the client;

• a requirement that the client immediately inform the Participant if the client fails or expects not to meet the standards set by the Participant; and

• a requirement that the client activity will comply with:

• all Requirements,

• product limits or credit or other financial limits specified by the Participant.

IIROC would expect that existing DMA agreements in place between Participants and their clients would remain in place under the current marketplace rules and policies until the Proposed UMIR Amendments relating to DEA take effect. IIROC expects that the Proposed UMIR Amendments would be implemented 180 days following the publication of notice of approval of the amendments by the Recognizing Regulators. While IIROC would expect that existing agreements with clients would be replaced or amended during their annual or periodic review, as a transitional matter, IIROC would permit Participants a further 180 days following the implementation of the amendments to replace or amend the existing agreements to comply with the requirements for written agreements.

3.2.3 Client Trading -- Sub-delegation of DEA

The CSA and IIROC propose that DEA clients should not "sub-delegate" their DEA access and, in turn, provide it to their clients except for certain limited arrangements. In particular, some DEA clients may act as a "hub" and aggregate orders of affiliates before sending the orders to the Participant. The CSA and IIROC propose that these arrangements can occur only if the DEA client is a Canadian registrant (portfolio manager or restricted portfolio manager) or an entity that is registered in an analogous category in a foreign jurisdiction that is a signatory to the International Organization for Securities Commissions' Multilateral Memorandum of Understanding.{36} Control over sub-delegation in this manner is required to mitigate against the risk of providing market access to those who have little or no incentive or obligation to comply with the regulatory requirements or financial, credit or position limits imposed upon them.

The terms of the written agreement with a DEA client must include the prohibition on sub-delegation except as permitted for the prescribed types of DEA clients, and further provide that a DEA client that trades for the account of any other person as permitted, must ensure that the orders for the other person flow through the systems of the DEA client before being entered on a marketplace directly or indirectly through a Participant. Requiring orders to flow through the systems of the DEA client allows the DEA client to impose the necessary controls to manage its risks given its knowledge of the ultimate client. The Participant is responsible to ensure, however, that the DEA client has adequate controls in place to monitor the orders entering the client's system, in addition to the Participant maintaining its own controls to manage its risks. In particular, the written agreement with the DEA client must provide that the client will not permit any person to transmit an order using the DEA other than personnel of the client who have been authorized by the client to transmit orders using DEA.

3.2.4 Restriction on DEA Order Transmission

The Participant that is a member, user or subscriber and has granted DEA to a client must ensure that no order is transmitted by the client using DEA unless:

• the Participant:

• maintains and applies the established standards for DEA,

• is satisfied that the client meets the established standards for DEA, and

• is satisfied the client is in compliance with the written agreement entered into; and

• the order is subject to the risk management and supervisory controls, policies and procedures established by the Participant including the automated controls to examine each order before entry on a marketplace.{37}

3.2.5 Annual Review and Confirmation

The Participant must review and confirm at least annually that the established standards are adequate, maintained and consistently applied and that the written agreement with the prescribed terms has been complied with by the DEA client and Participant.

3.2.6 Notice to Market Regulator and DEA Client Identifier

The Proposed UMIR Amendments would require a Participant upon entry into a written agreement with a DEA client to immediately notify IIROC of:

• the name of the client;

• contact information for the client so that additional information may be obtained if necessary following the entry of an order by the client; and

• the names of all personnel of the client authorized to enter an order using DEA.

The Participant would also be required to notify IIROC of any change to the information provided. Under proposed Rule 10.18, a Participant would have a "gatekeeper obligation" to immediately notify IIROC if the Participant terminates the client's DEA access, or knows or has reason to believe that the client has or may have breached a material provision of any standard established by the Participant for granting DEA or the written agreement between the Participant and the client regarding DEA.

Following the initial notification that a Participant has granted DEA to a client, IIROC would assign the DEA client a unique identifier under proposed Rule 10.15(c) of UMIR. Pursuant to proposed Rule 6.2 (1)(a)(iv) of UMIR, the identifier of the DEA client would be required to be contained on each order entered through DEA by that client on a marketplace.

3.2.7 Trading Supervision Obligations Applicable to DEA

While Policy 7.1 of UMIR already addresses aspects of supervision related to electronic access to marketplaces, the Proposed UMIR Amendments would expand the policy to specifically address DEA. In that regard, consequential amendments would include the new terminology used in the provisions dealing with "direct electronic access". In addition, proposed Part 9 of Policy 7.1 would supplement the trading supervision requirements in Parts 1, 2, 3, 5, 7 and 8, of Policy 7.1 to specifically set out regulatory expectations regarding:

• the provision of DEA to a Retail Customer;{38}

• the Participant's obligations to ensure that any modification to a previously approved automated order system in use by a client continues to maintain appropriate safeguards; and

• the requirement to monitor orders entered by the client to identify any breaches of established standards, the agreement regarding DEA, unauthorized trading, improper sub-delegation of access, or failure to flow orders through the systems of a DEA client trading on behalf of other persons.

3.3 Regulation of "Routing Arrangements"

3.3.1 Investment Dealer and Participant Relationships

Currently, investment dealers transmit orders electronically:

• to a Participant for entry on a marketplace by the Participant; or

• directly to a marketplace under a Participant's identifier in a similar manner to that permitted to a DEA client.

Generally speaking, UMIR has not specifically addressed the risks of such arrangements. To capture access arrangements between investment dealers and Participants for regulatory purposes, the Proposed UMIR Amendments would define "routing arrangement" as a new category of electronic access to marketplaces. A routing arrangement recognizes the existing grants of electronic access to a marketplace from Participants to:

• other Participants;

• investment dealers that are not a member of an Exchange, user of a QTRS or subscriber to an ATS; and

• foreign dealer equivalents.{39}

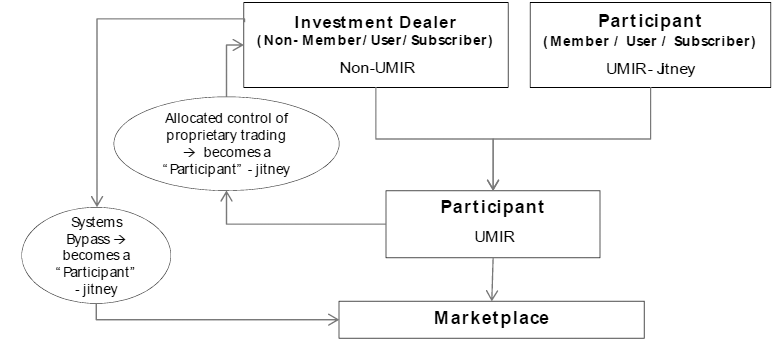

Currently, those investment dealers that are not a member, user or subscriber are not subject to UMIR except to the extent that a related entity to a Participant is party to the routing arrangement.{40} Under the Proposed UMIR Amendments, the definition of "Participant" would be expanded to include an investment dealer that is a party to a routing arrangement with a Participant and, in the applicable written agreement, the investment dealer:

• may enter orders directly to the marketplace without being electronically transmitted through the Participant's systems and the investment dealer has been authorized to perform on behalf of the Participant the setting or adjustment of a specific risk management or supervisory control, policy or procedure respecting orders from client accounts; or

• has been authorized to perform on behalf of the Participant the setting or adjustment of a specific risk management or supervisory control, policy or procedure respecting an account in which the investment dealer or a related entity of the investment dealer holds a direct or indirect interest other than in the commission charged on a transaction or reasonable fee for the administration of the account (that is an account in which proprietary trading is taking place).

The expanded definition of "Participant" ensures a level playing field in that any investment dealer with the ability to enter orders directly on a marketplace while being authorized to set or adjust the various controls, policies or procedures governing such orders will be subject to UMIR with IIROC oversight of their trading activities. ETR only permits a Participant to authorize an investment dealer to set or adjust specific risk or supervisory controls, policies and procedures in respect of "client" trading by the investment dealer when the investment dealer "has better access to information relating to the ultimate client". The expanded definition of "Participant" would make an investment dealer subject to UMIR if the authorization extended to trading by an account in which the investment dealer or a related entity of the investment dealer holds a direct or indirect interest other than an interest in the commission charged on a transaction or a reasonable fee for administration of the account. The expanded definition of "Participant" should not be construed in any way as permitting an authorization over the setting or adjustment of risk management or supervisory controls, policies and procedures by a Participant to an investment dealer in respect of "proprietary" trading when the only interest in the account is that of the investment dealer or related entities. This aspect of the expanded definition of Participant is essentially an anti-avoidance provision to ensure that if an investment dealer has a direct or indirect interest in the account of the "ultimate client" that the investment dealer will become subject to UMIR if the investment dealer is authorized by the Participant to set or adjust the various controls, policies and procedures related to trading by that account.

Notwithstanding the expanded definition of "Participant", a Participant that is not a member, user or subscriber of a marketplace will not be able to provide direct access under DEA or a routing arrangement to other investment dealers or foreign dealer equivalents.

A Participant would not be able to enter into a routing arrangement with a registered dealer that was not an investment dealer. As such, other registered dealers such as exempt market dealers ("EMDs") may not gain direct access to a marketplace from a Participant either under a routing arrangement or DEA. Similarly, a Participant would not be able to enter into a routing arrangement with a foreign dealer unless that dealer that was registered in a jurisdiction that is a signatory to the International Organization of Securities Commissions' Multilateral Memorandum of Understanding in a category analogous to that of "investment dealer" under Canadian securities legislation. These restrictions will prevent regulatory arbitrage with respect to trading and encourage registered dealers wishing to have direct access to a marketplace to become a member of IIROC (and be subject to the Dealer Member Rules and, in certain cases, UMIR or be subject to a comparable regulatory regime in a foreign jurisdiction).{41}

In the case of a routing arrangement between Participants, any order entered on a marketplace by a Participant on behalf of the other Participant is defined as a "jitney order" under Rule 1.1 of UMIR and must be marked accordingly.{42} This requirement will apply to an investment dealer that becomes a "Participant" under the expanded definition without being a member, user or subscriber. As such, an order entered on a marketplace by an investment dealer that is a Participant by reason of being a party to a routing arrangement (with the ability to enter orders on a marketplace directly without being transmitted through a member, user or subscriber while being authorized to set or adjust the various controls, policies or procedures respecting such orders or having been authorized to set or adjust the various controls, policies or procedures respecting orders in which the investment dealer or a related entity has a direct or indirect interest) would therefore be a "jitney order". Similarly, if the investment dealer (who is not a member, user or subscriber) is authorized, under the routing arrangement, to perform on behalf of the Participant the setting or adjustment of a specific risk management or supervisory control, policy or procedure for orders from accounts in which the investment dealer has an interest, the investment dealer will be a "Participant" and the orders will be marked as a "jitney order".

The following diagram illustrates the potential dealer relationships in a routing arrangement:

3.3.2 Minimum Standards for Routing Arrangement / Written Agreement

The Proposed UMIR Amendments address the risks associated with routing arrangements by introducing requirements that are comparable to those for DEA. Each Participant is expected to assess the risks an investment dealer's order flow may present to its business before establishing the standards for a routing arrangement. The minimum standards to be established by a Participant to enter into a routing arrangement with an investment dealer or foreign dealer equivalent are included in proposed Rule 7.12 of UMIR. The Participant must require an investment dealer or foreign dealer equivalent to:

• have sufficient resources to meet any financial obligations that may result from the routing arrangement;

• have reasonable knowledge of and proficiency to use the order entry system;

• have reasonable knowledge of and ability to comply with all Requirements, including order marking as required by Rule 6.2 of UMIR; and

• have reasonable arrangements in place to monitor the entry of orders transmitted under the routing arrangement.

The Participant that is providing access under the routing arrangement must:

• take all reasonable steps to ensure that the use of automated order systems by itself or any investment dealer or foreign dealer equivalent, does not interfere with fair and orderly markets; and

• ensure that each automated order system used by the investment dealer or foreign dealer equivalent or any client is tested in accordance with prudent business practices.

These minimum standards are considered necessary to ensure that the Participant properly manages its risks and that an investment dealer has sufficient financial resources and knowledge of both the order entry system and applicable marketplace and regulatory requirements. In this manner, the Participant establishes, maintains and applies reasonable standards for a routing arrangement, evaluating its risks with order routing from a specific investment dealer or foreign dealer equivalent. Each potential routing arrangement must be vetted independently with reasonable standards tailored to each investment dealer.

Adherence to the minimum prescribed standards and any more stringent requirements which may be imposed by the Participant entering into a routing arrangement with an investment dealer or foreign dealer equivalent must, among other things, be included in the terms of a written agreement to be entered into by the Participant with the investment dealer or foreign dealer equivalent as a precondition to the entering into the routing arrangement. IIROC would expect that existing arrangements between Participants and investment dealers would continue until the Proposed UMIR Amendments dealing with routing arrangements come into effect. IIROC expects that the Proposed UMIR Amendments would be implemented 180 days following the publication of notice of approval of the amendments by the Recognizing Regulators. While IIROC would expect that existing agreements with investment dealers would be replaced or amended during their annual or periodic review, as a transitional matter, IIROC would permit Participants a further 180 days following the implementation of the amendments to replace or amend the existing agreements to comply with the requirements for written agreements.

In addition, an investment dealer has an obligation under National Instrument 31-103 -- Registration Requirements, Exemptions and Ongoing Registrant Obligations to manage the risks associated with its business in accordance with prudent business practices. This obligation would require an investment dealer that implements a routing arrangement to ensure that it understands the risks to its business when doing so and manages these risks accordingly.

3.3.3 Restriction on Order Transmission in a Routing Arrangement

The Participant that is a member, user or subscriber and has granted access under a routing arrangement must ensure that no order is transmitted under the routing arrangement unless:

• the Participant that has granted access under the routing arrangement:

• maintains and applies the established standards for routing arrangements,

• is satisfied that the investment dealer or foreign dealer equivalent meets the established standards for routing arrangements, and

• is satisfied the investment dealer or foreign dealer equivalent is in compliance with the written agreement entered into; and

• the order is subject to the risk management and supervisory controls, policies and procedures established by the Participant including the automated controls to examine each order before entry on a marketplace.{43}

3.3.4 Annual Review and Confirmation

The Participant must review and confirm at least annually that the established standards are adequate, maintained and consistently applied and that the written agreement with the prescribed terms has been complied with by the Participant and by the investment dealer or foreign dealer equivalent.

3.3.5 Notice to Market Regulator and Investment Dealer Identifier

The Proposed UMIR Amendments would require a Participant, upon entering into a written agreement with an investment dealer or foreign dealer equivalent respecting a routing arrangement, to immediately notify IIROC of:

• the name of the investment dealer or foreign dealer equivalent; and

• contact information so that additional information may be obtained if necessary following the entry of an order by the investment dealer or foreign dealer equivalent.

The Participant would also be required to notify IIROC of any change to the information provided. Under proposed Rule 10.18, a Participant would have a "gatekeeper obligation" to immediately notify IIROC if the Participant terminates the routing arrangement, or knows or has reason to believe that the investment dealer or the foreign dealer equivalent has or may have breached a material provision of any standard established by the Participant for the routing arrangement or the written agreement between the Participant and the investment dealer or foreign dealer equivalent regarding the routing arrangement.

Following the initial notification that a Participant has entered into a routing arrangement, IIROC would assign a unique identifier to the investment dealer or foreign dealer equivalent under proposed Rule 10.15(b) of UMIR, provided such an identifier has not previously been assigned to the investment dealer. Pursuant to proposed Rule 6.2(1)(a)(v) of UMIR, the identifier of the investment dealer or foreign dealer equivalent would be required to be contained on each order entered on a marketplace under a routing arrangement.

3.3.6 Trading Supervision Obligations Applicable to Routing Arrangements

While Policy 7.1 of UMIR already addresses aspects of supervision related to electronic access to marketplaces, the Proposed UMIR Amendments would expand the policy to specifically address the proposed requirements for routing arrangements. In that regard, consequential amendments to Policy 7.1 would include the new terminology used in the provisions dealing with "routing arrangements". In addition, proposed Part 10 of Policy 7.1 would supplement the trading supervision requirements in Parts 1, 2, 3, 5, 7 and 8, of Policy 7.1 to specifically set out regulatory expectations regarding:

• the establishment of sufficiently stringent standards by the Participant for each investment dealer or foreign dealer equivalent to ensure the Participant is not exposed to undue risk;

• the Participant's obligations to ensure that any modification to a previously approved automated order system in use by an investment dealer or foreign dealer equivalent continues to maintain appropriate safeguards;

• the Participant's responsibility to properly identify an originating investment dealer or foreign dealer equivalent and to maintain policies and procedures to appropriately mark and identify the originating investment dealer or foreign dealer equivalent for each order that is ultimately transmitted through the routing arrangement; and

• the requirement that the Participant monitor orders entered by the investment dealer or foreign dealer equivalent to identify any breaches of established standards or the routing arrangement agreement.

3.4 Order Execution Service

3.4.1 Clients Eligible to Trade Through an Order Execution Service

The Proposed UMIR Amendments would define "order execution service" as a service that meets the requirements, from time to time, of Dealer Member Rule 3200 governing suitability relief for trades not recommended by a dealer member, commonly known as "discount brokerage trading". The use of an order execution service may present similar systems risks as DEA or routing arrangements when automated order systems that are not provided as part of the order execution service are used by clients to transmit orders, or when a large number of orders are transmitted through an order execution service. The Proposed DMR Amendments have been integrated into the framework for regulation of electronic access to marketplaces in order to address these risks. Rule 3200 is proposed to be amended to clarify the limitations on the type of client that may access an order execution service and the type of trading activity that may be engaged through this form of access to marketplaces (in particular, a prohibition on the use of certain automated order systems and a threshold on the number of orders as described more fully in section 3.4.2).

In the view of IIROC, the order execution service was intended to provide a non-advised platform for electronic access to a marketplace by Retail Customers that do not use automated order systems or trade in large volumes as may an Institutional Customer trading through DEA. To ensure that order execution services are directed only to Retail Customers, it is proposed that Rule 3200 be amended to restrict the service to the acceptance of orders from Retail Customers. This would apply whether an order execution service is offered by Participants directly to clients or by non-Participant investment dealers that transmit their order execution service order flow through a routing arrangement to a Participant for execution on a marketplace.

Accordingly, the Proposed DMR Amendments would clarify that an Institutional Customer would not be eligible for an order execution account and would be required to trade as a DEA client. IIROC expects that, in the transition to implementation of the Proposed DMR Amendments, should they be approved by the securities regulatory authorities, an institutional account held with a dealer providing an order execution service would be transferred to the appropriate DEA service within a firm or its affiliate and that the appropriate standards, agreement and technology to comply with the DEA regulatory requirements would be adopted in relation to the client.

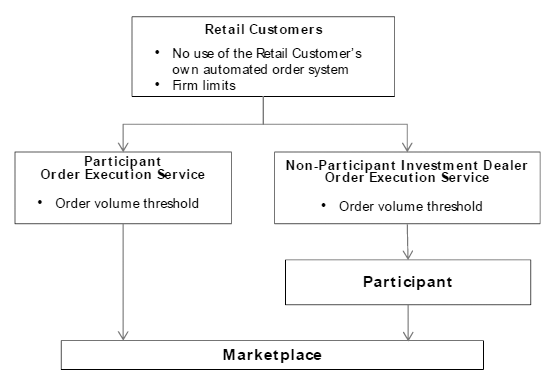

The following diagram illustrates the potential client and dealer relationships with respect to order execution services, should the proposed amendments to Dealer Member Rule 3200 be adopted:

3.4.2 Trading Supervision Obligations for Order Execution Services

The proposed amendments to Dealer Member Rule 3200 also impose an obligation on a dealer providing an order execution service to prohibit an order execution client from:

• using their own automated order system to transmit or generate orders for transmission to the dealer providing the order execution service for execution on a marketplace; or

• manually sending or generating orders to the Dealer Member that exceed the threshold on the number of orders as set by IIROC from time to time.

A "threshold on the number of orders" for order execution services is not intended to be set at this time; however IIROC seeks to reserve the authority to do so in the event order volumes associated with order execution services may pose risks to market integrity. Nonetheless, IIROC would expect that firms offering an order execution service would impose thresholds for client trading so that the dealer is not exposed to undue risk and the risk to market integrity is mitigated.

The related Proposed UMIR Amendments include a proposed Part 11 of Policy 7.1 to address trading supervision responsibilities of Participant firms that provide order execution services which are additional to the trading supervision requirements in Parts 1, 2, 3, 5, 7, and 8 of Policy 7.1. A Participant is expected to monitor orders entered by its order execution service client to determine whether the client is using an automated order system other than as provided by the order execution service and confirm this least annually with the client. In this manner, both a Participant firm and a non-Participant investment dealer that provides an order execution service would be responsible to ensure that order execution service clients are precluded from using an automated order system external to the firm.

3.5 Additional Proposed UMIR Amendments

3.5.1 Proposed UMIR Amendments Impacting Marketplaces

The Proposed UMIR Amendments include obligations on marketplaces as part of the proposed regulatory framework for regulation of electronic access to marketplaces. Under proposed amendments to Rule 6.1, a marketplace could not allow an order to be entered on the marketplace unless the order had been:

• entered by or transmitted through a Participant that is a member, user or subscriber of that marketplace or an Access Person with access to trading on that marketplace and the order contains the unique identifier of the Participant or Access Person assigned to it by the Market Regulator; or

• generated automatically by the marketplace for a person with Marketplace Trading Obligations to meet their obligations.

This proposed amendment would confirm that access to a marketplace is a "closed system" and that each means of having an order entered on a marketplace must be subject to appropriate regulatory oversight.

The proposed Rule 10.18 of UMIR would impose a "gatekeeper obligation" on marketplaces. A marketplace would be required to report to IIROC if the marketplace:

• terminates the access of a Participant or Access Person to the marketplace; or

• knows or has reason to believe that the Participant or Access Person has or may have breached a material provision of a Marketplace Rule or agreement pursuant to which the Participant or Access Person was granted access to the marketplace.

3.5.2 Proposed UMIR Amendments Impacting Participants

Under proposed amendments to Rule 6.1, a Participant could not allow an order to be entered on the marketplace or transmitted to a marketplace containing the identifier of the Participant unless the order has been:

• received, processed and entered by an employee of the Participant; or

• entered on or transmitted to a marketplace through:

• direct electronic access,

• a routing arrangement, or

• an order execution service.

This proposed amendment would confirm that access by a Participant to a marketplace is a "closed system" and that each means of having an order entered on, or transmitted to, a marketplace by or on behalf of the Participant must be subject to appropriate regulatory oversight.

3.5.3 Proposed UMIR Amendments Impacting Access Persons

Under proposed amendments to Rule 6.1, an Access Person could not allow an order to be entered on the marketplace or transmitted to a marketplace containing the identifier of the Access Person unless the order is:

• for the account of the Access Person; or

• entered by an Access Person who is a portfolio manager or a restricted portfolio manager on behalf of the client.

This proposed amendment would confirm that access by an Access Person to a marketplace is part of a "closed system" and that the Access Person cannot delegate the access to a marketplace or conduct business similar to a "dealer".

4. Summary of the Impact of the Proposed Amendments

4.1 General Requirements Related to Third-Party Access to Marketplaces

The following is a summary of the most significant impacts of the adoption of the Proposed Amendments. In particular:

• Participants who provide direct electronic access to a client must:

• establish standards to manage the attendant risks,

• enter into written agreements with each client to which the Participant will provide access,

• establish and apply appropriate supervisory and compliance procedures for orders entered under direct electronic access,

• at least annually review the standards and compliance of each client with the standards and written agreement, and

• establish procedures for reporting to IIROC non-compliance by a client with the standards or written agreement;

• Participants who provide electronic access to a marketplace to an investment dealer or foreign dealer equivalent under a routing arrangement must:

• establish standards to manage the attendant risks,

• enter into written agreements with each investment dealer or foreign dealer equivalent for which the Participant will provide access,

• establish and apply appropriate supervisory and compliance procedures for orders entered under the routing arrangement,

• at least annually review the standards and compliance of each investment dealer or foreign dealer equivalent with the standards and written agreement, and

• establish procedures for reporting to IIROC non-compliance by an investment dealer or foreign dealer equivalent with the standards or written agreement;

• Participants who provide order execution services must:

• review client accounts on an on-going basis to ensure that those that are not eligible to transact within an order execution service are transferred or directed to a Participant that provides direct electronic access to clients,

• prior to implementation of the DMR Amendments and at least annually thereafter, confirm that order execution service client accounts are not employing an automated order system that is not provided by the order execution service, and

• monitor client orders on an ongoing basis from an order execution service to ensure that they are not generated from such an automatic order system; and

• marketplaces will have to review their policies and procedures to ensure that:

• orders entered on the marketplace are from a Participant that is a member, user or subscriber of that marketplace or an Access Person with access to trading on that marketplace, and

• the marketplace reports to IIROC any termination of access to the marketplace, potential material breach of any Marketplace Rule or agreement pursuant to which access was granted to a marketplace.

4.2 Significant Changes to Existing Regulatory Requirements

While the Proposed Amendments and the CSA Access Proposals will introduce a new and more comprehensive framework for third-party electronic access to marketplaces, many of the components of these requirements build on: existing marketplace requirements for direct market access; regulatory requirements and guidance on trade supervision and compliance; and established industry practices. As such, many of Proposed Amendments either formalize or clarify existing requirements or practices. If the Proposed Amendments and the CSA Access Proposals are adopted substantially as published, there would, however, be a number of changes to the existing regulatory requirements with respect to third-party electronic access to marketplaces.

4.2.1 Direct Electronic Access

For Participants who provide "direct market access" the current marketplace rules and contractual provisions with respect to "direct market access" would be repealed and would be replaced by IIROC and CSA requirements which, unlike the current marketplace rules and contractual provisions:

• eliminate the concept of an "eligible client list" and provide that DEA may be provided to clients (provided if the client is a registrant the access is limited to portfolio managers, restricted portfolio managers and foreign equivalents);

• require the Participant to establish standards and review the standards annually;

• eliminate the requirement for pre-approval of the systems of the Participant or the form of the agreement to be executed with each client provided DEA;

• require an annual review of compliance by each client with the standards and the written agreement;

• provide for a gatekeeper obligation for reporting non-compliance with the standard and written agreement; and

• specifically prohibit any sub-delegation of access by a client.

With the elimination of an "eligible client list", a Participant may offer DEA to a broader range of clients but the Participant must ensure that DEA is suitable for the client. A Participant is exempt from "suitability" requirements for orders entered through DEA by a client but the Participant is unable to provide recommendations to a client with DEA.

4.2.2 Order Routing Arrangements