Register today for OSC Dialogue 2024: Inviting, thriving and secure capital markets

Notice and Request for Comment – Application for Exemption from the Marketplace Rules – Trumid Financial LLC

A. Background

Trumid Financial LLC (Trumid) has applied for an exemption from National Instrument 21-101 Marketplace Operation (NI 21-101), National Instrument 23-101 Trading Rules (NI 23-101), and National Instrument 23-103 Electronic Trading and Direct Electronic Access to Marketplaces (NI 23-103) in their entirety (together, the Marketplace Rules).

Trumid is registered as an alternative trading system (ATS) and broker-dealer with the United States Securities and Exchange Commission (SEC) and is a member of the Financial Industry Regulatory Authority (FINRA), the U.S. equivalent of the Investment Industry Regulatory Organization of Canada (IIROC).

Trumid proposes to offer direct access in Ontario to its trading facilities to prospective participants in Ontario for the trading of USD corporate debt securities and has applied for an exemption from the Marketplace Rules on the basis that it is already subject to regulatory oversight in its home jurisdiction by the SEC and FINRA.

B. Application and Draft Exemption Order

In the application, Trumid has outlined how it meets the criteria for exemption from the Marketplace Rules as set out in CSA Staff Notice 21-328 Regulatory Approach to Foreign Marketplaces Trading Fixed Income Securities.{1} The application and draft exemption order are attached as Appendices A and B, respectively, to this Notice.

C. Comment Process

The Commission is seeking public comment on all aspects of Trumid's application and the draft exemption order.

Please provide your comments in writing, via e-mail, on or before April 6, 2020, to the attention of:

Ontario Securities Commission

20 Queen Street West

22nd Floor

Toronto, Ontario

M5H 3S8

Fax: 416-593-2318

Email: [email protected]

The confidentiality of submissions cannot be maintained as the comment letters and a summary of written comments received during the comment period will be published.

Questions may be referred to:

Heather Cohen

Legal Counsel, Market Regulation

Email: [email protected]

Ruxandra Smith

Senior Accountant, Market Regulation

Email: [email protected]

{1} Available at https://www.osc.gov.on.ca/en/6097.htm.

Appendix A

Ramandeep Grewal

Direct: 416 869-5265

[email protected]

|

November 13, 2019 |

Confidential |

|

|

|

|

Our File No. 137149.1001 |

By Email &Courier |

|

|

|

|

Ontario Securities Commission |

|

|

|

|

|

20 Queen Street West |

|

|

|

|

|

Suite 1900, Box 55 |

|

|

|

|

|

Toronto, Ontario M5H 3S8 |

|

|

|

|

|

Fax: (416) 593-2318 |

|

|

|

|

|

<<Attention: Secretary to the Commission>> |

|

Dear Sirs/Mesdames:

Re: Trumid Financial LLC -- Application for Exemption from Certain Marketplace Rules That Apply To Alternative Trading System

We are Canadian counsel to, and are filing this application (the "Application") with the Ontario Securities Commission (the "OSC") on behalf of, Trumid Financial, LLC ("Trumid" or the "Applicant") for an order under Section 15.1 of National Instrument 21-101 -- Marketplace Operation ("NI 21-101"), Section 12.1 of National Instrument 23-101 -- Trading Rules ("NI 23-101") and Section 10 of National Instrument 23-103 -- Electronic Trading and Direct Access to Marketplaces ("NI 23-103" and, together with NI 21-101 and NI 23-101, the "Marketplace Rules") exempting Trumid from the application of all provisions of the Marketplace Rules that apply to a person or company carrying on business as an alternative trading system ("ATS") in Ontario (the "Requested Relief").

In Ontario, an ATS is regulated as a marketplace under NI 21-101. The requirements applicable to an ATS are in some aspects different from the requirements for recognition of an exchange, which is also regulated as a marketplace under NI 21-101. In particular, there is a requirement in Section 6.1 of NI 21-101 that an ATS may not carry on business as an ATS unless it is registered as a dealer, it is a member of a self-regulatory entity and it complies with the provisions of Marketplace Rules. A majority of the provisions of Marketplace Rules, however, apply equally to an exchange and an ATS.

Similar to an exchange submitting Form 21-101F1 ("F1") and an application to the OSC for recognition as an exchange in Ontario, an ATS is required to submit to the OSC Form 21-101F2 ("F2") 45 days before it intends to begin carrying on business as an ATS in Ontario and must wait for the OSC to resolve any regulatory issues in coordination with the issuance of the registration as an investment dealer before commencing carrying on activities as an ATS.{1}

In OSC Staff Notice 21-702 Regulatory Approach for Foreign Based Stock Exchanges, as updated, ("OSC Staff Notice 21-702"), OSC Staff has provided the basis for the exemption of foreign-based exchanges from the exchange recognition requirement under section 21.(1) of the Securities Act (Ontario) ("OSA") and has prescribed criteria in relation to applications by foreign exchanges for such an exemption. These criteria are set out in Appendix A to the Application.

In part (b)(i) of the OSC Staff Notice 21-702, OSC Staff have provided a rationale for granting an exchange a recognition exemption stating that most foreign based stock exchanges are subject to a regulatory regime in their country of origin (home jurisdiction) and full regulation, similar to that applied to domestic exchanges, which may be duplicative and inefficient when imposed in addition to the home jurisdiction regulation requirements. Also, trades and orders executed on the foreign stock exchange should be subject to the same rules regardless of where the investor is located or the order is entered. OSC Staff Notice 21-702 further states that, as long as a foreign exchange can establish that it meets the same criteria that a domestic exchange has to meet and that access will be through an Ontario registrant, it would not be contrary to the public interest to grant such foreign exchange an exemption from the requirement to be recognized in order to operate with clients in Ontario.

The Applicant submits that the regulation requirements imposed by the Marketplace Rules are sufficiently similar for an exchange and an ATS to justify granting an exemption from such requirements for a foreign based and regulated ATS under the same rationale that, if an ATS can demonstrate sufficient compliance with the criteria that has to be met by a domestic ATS, the balance between having efficient capital markets and protecting public interest would be achieved and the granting of the Requested Relief would be warranted.

The Applicant submits that it is able to substantially meet or otherwise address the criteria listed in the Form F2, many of which are the same as for an exchange recognition exemption listed in OSC Staff Notice 21-702 (as set out in Appendix A to this Application). The Applicant will, therefore, use the same format of an exchange recognition exemption application and the applicable criteria listed in Appendix A, modified where appropriate, to demonstrate its compliance with ATS registration requirements in Ontario.

Reference will be made in this Application to the Trumid Rulebook (the "Trumid Rulebook"), which is available on the Trumid website at: https://www.trumid.com/files/Trumid_SEC-registered_Rulebook.pdf The Trumid rules are contained in the Trumid Rulebook (the "Trumid Rules") and are separated into 7 chapters and each focusing on a specific area. The Trumid Rulebook is the governing document for the system. In order to become users, applicants must undertake to be bound by the Trumid Rules.

For convenience, this Application is divided into the following Parts:

Section 1

-- Background

Section 2

-- Application of Approval Criteria Applicable to the ATS

1.

Regulation of the ATS

2.

Governance

3.

Regulation of Products

4.

Access

5.

Regulation of Participants on the ATS

6.

Clearing and Settlement

7.

Systems and Technology

8.

Financial Viability

9.

Transparency and Reporting

10.

Record Keeping

11.

Outsourcing

12.

Fees

13.

Information Sharing and Oversight Arrangements

14.

IOSCO Principles

Section 3

-- Submissions

Section 4

-- Other Matters

SECTION 1 -- Background

1.1 Description of Trumid and its business

1. Trumid is a limited liability company existing under the laws of Delaware in the United States (the "U.S."), with its head office located in New York, New York, U.S.

2. Trumid was founded in 2014 and operates as the electronic service provider of a USD corporate debt securities trading platform for institutional clients. At the time of submitting the Application, Trumid has 443 buy-side and sell-side institutional clients and has effected nearly USD $90bn in corporate bonds trades since inception. Trumid does not provide access to any retail clients.

3. Trumid is registered as an ATS and broker-dealer with the U.S. Securities and Exchange Commission ("SEC") (SEC#: 8-69500) and is a member of Financial Industry Regulatory Authority ("FINRA") (CRD#: 172129), a U.S. equivalent of Investment Industry Regulatory Organization of Canada ("IIROC").

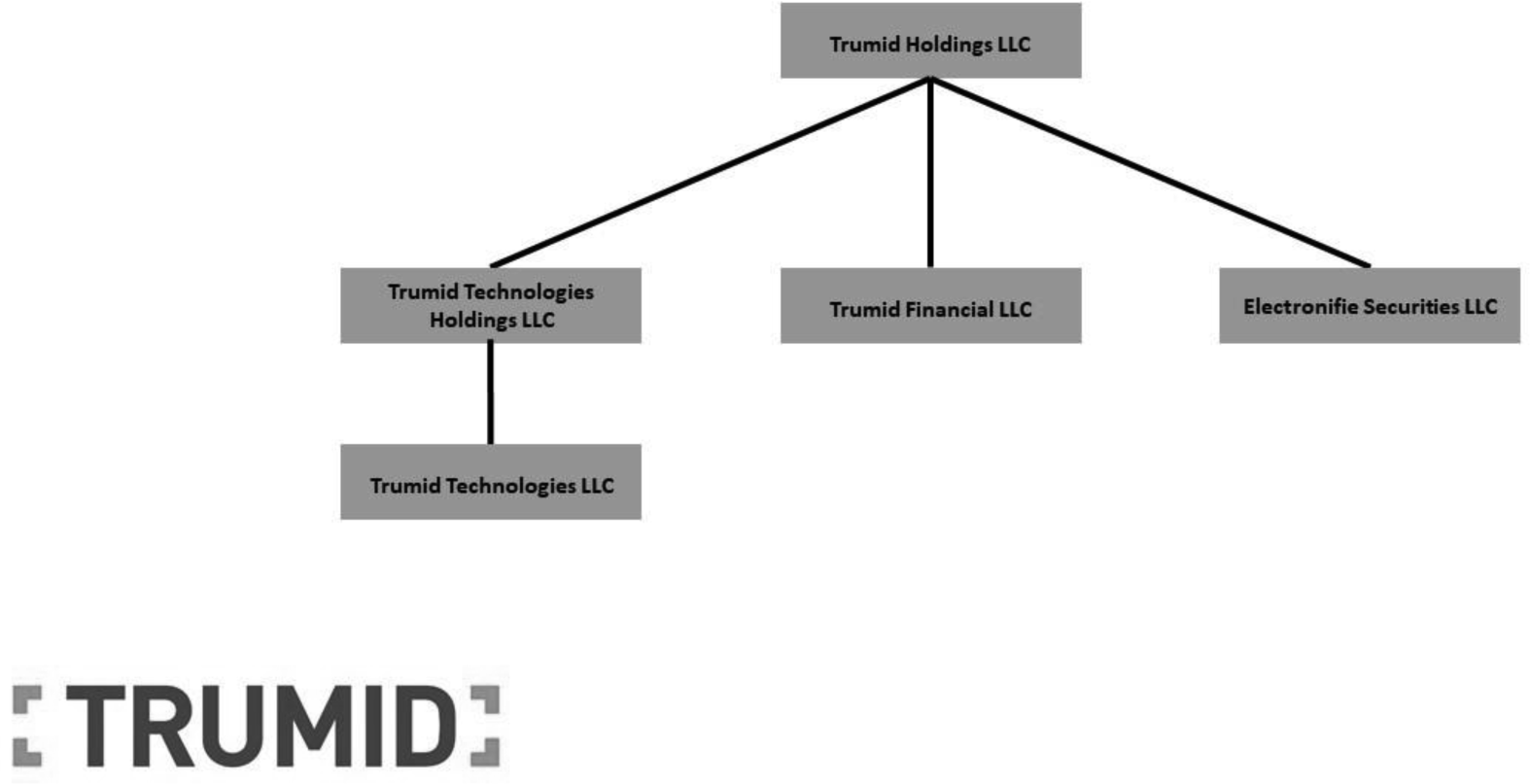

4. Trumid operates as an ATS under SEC Rules. Trumid has a technology affiliate, Trumid Technologies, LLC, which has developed the platform application and licenses the application for Trumid to operate. Trumid Technologies, LLC also designs and develops technology solutions for institutional clients. Both Trumid and Trumid Technologies, LLC, are wholly-owned subsidiaries of Trumid Holdings, LLC. All entities are under common management and control, and the corporate structure is as set out below.

5. Trading of USD corporate bonds is facilitated through Trumid's Market Center (2.0) interface (the "Platform"). Trumid's technology solution is html5 based and offered over the internet. The technology provides access to an electronic application that allows clients to access available trades in USD corporate bonds. Clients are onboarded by Trumid and Trumid's intermediary, State Street Global Markets, LLC ("SSGM" or the "Intermediary"), to access the application, which allows those clients (the "Users") to initiate transactions that are then matched by the application.

6. The onboarding documentation required by Trumid includes an agreement signed by the onboarding client agreeing to the terms and conditions of the use of the Platform (the "User Agreement"), Customer Account Application and Authorized Trader Form. Trumid also aids in the collection of onboarding documentation required by SSGM, which includes a DVP/RVP agreement, Tax ID Form, Authorized Trader Form, Execution Agreement with an Electronic Trading Addendum, Trumid-specific Annex to the aforementioned Addendum, Standard Settlement Instructions ("SSIs"), Investment Adviser Letter (as applicable) and a Prime Brokerage Release Form ("Form 151") (as applicable).

7. The Platform offers access to multiple protocols which run in parallel on the Trumid Market Center. The Anonymous Protocol ("AP") allows institutional clients to select securities in which they wish to transact, leave partially or fully informed Indications of Interest ("IOIs") or fully informed orders, and have the technology solution notify those users when one or more of his/her securities of interest are able to engage in a time-limited, trading session (in a Central Limit Order Book format, a "CLOB"). Traders with electronic matches are prompted to firm up their orders and may electronically engage in the CLOB. Price levels are only first displayed in this CLOB and are always live (executable) with a minimum size of US$1mm. Traders may choose to improve their price, execute against the opposing side or cancel during this phase (prior to any match).

If a trade is effected, the CLOB immediately ends and progresses to a volume-clearing, time-limited, single price phase at the level just transacted. This volume-clearing phase is known as the Trumid Phase and is where most transactions on the Platform occur.

To execute transactions which are matched in the AP, Trumid has contracted with a separate, third-party intermediary, SSGM, which is a US-based, SEC and FINRA-registered, broker dealer (SEC#: 8-69862/CRD#: 285852), and a wholly-owned subsidiary of State Street Corp.. That intermediary serves as executing broker and is counterparty to all client transactions. In its capacity, this third-party intermediary dealer handles all client funds and executory responsibilities, including settlement and clearing. Trumid is not involved with the settlement or clearing of any transactions.

8. Trumid also runs an Attributed Trading Protocol ("ATP"), which uses technology to better connect sell side dealers with their institutional, buy side clients. Interactions are in the form of negotiations and follow market standard engagement protocol, but without free form conversation. There are no minimum order sizes and all matches feature 'last look' functionality when aggressed upon (note: in the ATP, opposing parties are known to each other). Matches in the ATP are directly between the sell side dealer (as executing broker) and the buy side client. As with trades effected on under the AP, Trumid is similarly not involved with the settlement or clearing of any transactions for ATP trades. Despite its registration with the SEC as a broker-dealer, Trumid is not a direct party to any transaction and does not trade for its own account. Trumid also does not handle any client funds or securities, nor hold any client accounts. Lastly, as Trumid is not the executing broker, Trumid is also not involved with the settlement or clearing of transactions.

9. It is expected that certain Ontario institutional investors wish to become clients of Trumid in order to access the liquidity afforded by the robust, existing network of clients.

10. Trumid proposes to offer access to its Platform to prospective participants in Ontario (the "Ontario Participants"). In order to obtain direct access to the Platform, an Ontario Participant must agree to abide by the Trumid Rulebook and consent to submit to the jurisdiction of Trumid. The Trumid Rulebook provides clear and transparent access criteria and requirements for all market participants on the Platform, as well as minimum financial requirements for participants to maintain the financial integrity of the Platform. Trumid applies these criteria to all Platform participants in an impartial manner.

11. There are no retail clients on the Platform. Trumid's institutional Platform participants include both buy side and sell side institutions, ranging from smaller hedge funds (i.e., funds with US$100mm AUM), to some of the largest asset managers in the world (i.e., those with several trillion USD in AUM). Sell side participants include similarly scaled institutions (smaller regional dealers to some of the largest banks in the world).

Ontario Participants and Requested Relief

12. Ontario Participants will be comprised of institutional investors that qualify as permitted clients as defined in Section 1.1 of NI 31-103.

13. Trumid intends to provide Ontario Participants with direct access to the Platform. Trumid is asking for the Requested Relief in order for Ontario Participants to be able to access trading on the Platform.

14. Trumid has no physical presence in Ontario and does not otherwise carry on business in Ontario except as described herein.

Location

15. Trumid is based at 5 Bryant Park, 8th Floor, New York, New York, U.S.

Size

16. The vast majority of Trumid's 440+ institutional clients are located in the U.S. However, a number are in jurisdictions which allow the company to operate under foreign exemptions (e.g., the UK, Cayman Islands, Singapore, etc.). To date, approximately 99% of Trumid's trading volume has originated from U.S. clients. Trumid expects the great majority of activity to continue to come from U.S. clients.

Ownership and corporate structure

17. Trumid is a wholly-owned subsidiary of Trumid Holdings, LLC, a private limited liability company incorporated under the laws of Delaware, U.S. Trumid Holdings, LLC owns 100% of shares of Trumid.

18. Trumid has no subsidiaries, but is affiliated with Electronifie Securities LLC and Trumid Technologies, LLC. All companies are under common management and control and wholly owned by Trumid Holdings, LLC.

19. Trumid Holdings, LLC is wholly owned by individuals and private investors, a significant portion of whom are directors and/or officers of Trumid.

Third Party Clearance and Settlement Entity

20. In its capacity as third party intermediary, SSGM, the executing broker, is responsible for clearing and settlement (SSGM self-clears and settles). Trumid is not involved with the settlement or clearing of transactions.

Trading of Debt Securities

21. Trumid provides its clients with access to trades in USD corporate debt securities as facilitated by the Platform. As is standard in the corporate bond market, Trumid also may facilitate a US Treasury ("UST") trade for those clients wishing to hedge out the interest rate exposure from 'spread-based' corporate bond trades.

Tradeable Securities

22. Participants on the Platform may choose to trade any of the 22,000+, TRACE-eligible, USD corporate bonds contained on Trumid's eligible-to-trade, security-master list. In order to trade, a participant must enter a security's description either through a search feature or directly on an order ticket (all securities contain either an ISIN or CUSIP to confirm identification). Desired direction, size, price and 'good-for' times must also be entered on an order ticket. In the AP, participants interact only with the Platform, never directly with the opposing side (and executions are directly against SSGM). The Trumid Market Center AP maintains anonymity of its users before, during and after all transactions. Participants would not know if opposing interest is that of a US-based user, an Ontario-based user or a user from any other valid jurisdiction.

Security selection in the ATP is identical to the AP. However, in the ATP, both parties are aware of the identity of the other party and executions occur directly between a sell side dealer and its buy side client.

23. Trumid's Rulebook provides Rule 306 to address Trade Cancellations and Adjustments. This section also includes Trumid's Error Trade Policy.

SECTION 2 APPLICATION OF APPROVAL CRITERIA TO THE ATS

1.1 REGULATION OF THE ATS

Regulation of the ATS -- The ATS is regulated in an appropriate manner in another jurisdiction by a foreign regulator (the Foreign Regulator).

1.1.1 In the U.S., an ATS is defined in Rule 300 (a) of Regulation ATS under the 1934 Securities Exchange Act ("Regulation ATS") as any organization, association, person, group of persons, or system:

1) That constitutes, maintains, or provides a market place or facilities for bringing together purchasers and sellers of securities or for otherwise performing with respect to securities the functions commonly performed by a stock exchange; and

2) That does not:

i. Set rules governing the conduct of subscribers other than the conduct of such subscribers' trading on such organization, association, person, group of persons, or system; or

ii. Discipline subscribers other than by exclusion from trading.

1.1.2. An ATS is a trading system that meets the definition of "exchange" under federal securities laws of the United States but is not required to register as a national securities exchange if the ATS operates under the exemption provided under Rule 3a1-1(a)(2) of the U.S. 1934 Securities Exchange Act (the "Exchange Act").{2} To operate under this exemption, an ATS must comply with the requirements set forth in Rules 300-303 of Regulation ATS, which include, among other things, registering as a broker-dealer under Section 15 of the Exchange Act. Regulation ATS establishes a regulatory framework for ATSs. Under Rule 3a1-1 exemption and Regulation ATS, ATSs are allowed to choose whether to register as national securities exchanges, or to register as broker-dealers and comply with additional requirements under Regulation ATS, depending on their activities and trading volume. Trumid is operating as an ATS, registered as a broker-dealer pursuant to section 15 of the Exchange Act and is a member of FINRA, a self-regulatory organization that governs broker-dealers in the U.S. As such, Trumid is subject to the regulatory supervision by the SEC and FINRA.

1.1.3. In Ontario, Section 6.1 of NI 21-101 requires broker-dealer firms, as well as their professional representatives, to be registered with the OSC and also be a member of IIROC in order to operate their business as an ATS in Ontario. Similarly, in the U.S., broker-dealers are regulated under the Exchange Act by the SEC. All brokers and dealers must be registered with the SEC pursuant to section 15 of the Exchange Act and are subject to its regulations. They must as well be a member of at least one self-regulatory organization ("SRO"), which is further delegated some regulatory authority. Most broker-dealers in the U.S. are members of FINRA.

1.1.4. In the U.S., responsibility for regulating the conduct of investment businesses, providing investor protection and preventing market manipulation rests with the SEC. Additional authority rests with FINRA, an SRO that imposes rules of conduct on its dealer-members and maintains confidence in the probity of business and financial services in the U.S.

1.1.5. The principal legal provisions for investor protection in the U.S.' financial services sector are contained in, and derived from, the federal Securities Act of 1933 and the Exchange Act and the SEC fulfils its regulatory responsibilities within the framework established by this legislation.

1.1.6. FINRA is a not-for-profit entity, and the largest SRO in the securities industry in the U.S., FINRA is a membership based organization that creates and enforces rules for its broker-dealer members based on U.S. federal laws and is overseen by the SEC. FINRA is on the front line in licensing and regulating broker-dealers. Its stated mission is "to safeguard the investing public against fraud and bad practices." The SEC oversees FINRA.

1.1.7. In its enforcement capacity, FINRA has the power to take disciplinary actions against registered individuals or firms that violate the industry's rules. It is also responsible for overseeing the mediation and arbitration processes for disputes between customers and brokers.

1.2. Authority of the Foreign Regulator -- The Foreign Regulator has the appropriate authority and procedures for oversight of the ATS. This includes regular, periodic oversight reviews of the ATS by the Foreign Regulator.

Scope of authority

1.2.1. The SEC enforces the federal securities laws of the United States and regulates the majority of the securities industry. Its regulatory coverage includes the U.S. stock exchanges, options markets and options exchanges as well as all other electronic exchanges and other electronic securities markets.

1.2.2. The SEC's primary function is to oversee organizations and individuals in the securities markets, including securities exchanges, brokerage firms, dealers, investment advisors, and investment funds. Through established securities rules and regulations, the SEC promotes disclosure and sharing of market-related information, fair dealing, and protection against fraud. The SEC has the authority to bring civil actions to enforce its rules and works with the United States Justice Department on matters requiring criminal enforcement.

1.2.3. Together, the SEC and FINRA establish a regulatory structure for overseeing broker-dealers operating as ATSs. This regulatory structure includes, as applicable: financial and other fitness criteria for participants on an ATS; reporting and record-keeping requirements; procedures governing the treatment of customer funds and property; conduct of business standards; provisions designed to protect the integrity of the markets; and statutory prohibitions on fraud, abuse and market manipulation.

1.2.4. FINRA's regulation of broker-dealers follows United States federal rules. These rules include, but are not limited to:

• Days and hours of operations

• Lot size

• Membership requirements

• Required documentation

• Settlement cycles

• Procedures and policies

1.2.5. FINRA also performs periodic audits of broker-dealers. These audits review firms' internal procedures and applications. Firms' books and records are also verified for compliance with FINRA's rules.

1.2.6. Broker-dealers also have ongoing duties of financial responsibility, customer protection, and good conduct. These duties are imposed through the rules such as the following:

• Customer protection rule. Customer funds and securities must be segregated from the broker-dealer's proprietary business operations.

• Record-keeping. Basic bookkeeping requirements include records of trades, receipts, positions held in different securities, trial balances, complaints, and compliance, together with reports to be filed periodically.

• Fair dealing. Execute client orders promptly, disclose information relevant to investors, charge prices in line with market conditions, and disclose conflicts of interest.

• Suitability of clients. Only recommend investments or strategies that are suitable for the clients concerned.

• Communication. Be fair, balanced, and not misleading in communications with clients, seeking approval before communication as needed.

• Gifts and contributions. Observe rules concerning maximum value of gifts made to clients and political contributions.

• Suspicious Activity Reports (SARs). File reports of any suspicious activities noted by the broker-dealer, including investments over predefined monetary limits.

Source of authority to supervise the foreign ATS (including rules and policy statements)

1.2.7. Pursuant to SEC Rule 3a1-1(1), Trumid is exempted from the definition of "Exchange" as a broker-dealer operating as an ATS that complies with Regulation ATS. As such, Trumid is subject to regulation under Rule 301(b) of Regulation ATS.

1.2.8. To acquire and maintain its status as an ATS, an ATS is required to comply with several statutorily-prescribed requirements set out in Rule 301(b) of Regulation ATS, subject to available exemptions. The Rule 301(b) of Regulation ATS registration requirements for ATSs can be found at: https://www.ecfr.gov/cgi-bin/text-idx?node=17:4.0.1.1.3&rgn=div5#_top.

1.2.9. In general, an ATS must continue to fulfil these obligations to maintain its status as an ATS operating as a broker-dealer. Among other things, an ATS is required to:

(a) Register and maintain registration as a broker-dealer;

(b) Give notice, i.e. file with the SEC, Division of Trading and Markets, an initial operation report at least 20 days prior to commencing operation as an ATS and file an amendment of this report at least 20 days prior to any material change to its operation;

(c) If trading 5 percent or more of the average daily volume of corporate debt securities traded in the U.S., provide fair access to other broker-dealers by:

(i) establishing written standards for granting access to trading on its system;

(ii) not unreasonably prohibiting or limiting any person access to the ATS by applying the established standards in an unfair or discriminatory manner;

(iii) charging reasonable fees that are not inconsistent with providing equivalent access to brokers-dealers who access the ATS through a national securities exchange or national securities association;{3}

(d) have systems and controls in place to monitor transactions on the ATS;

(e) retain sufficient financial resources for the performance of its functions as an ATS;

(f) operate its markets with due attention to the protection of investors;

(g) ensure that trading is conducted in an orderly and fair manner;

(h) maintain suitable arrangements for trade reporting;

(i) maintain suitable arrangements for the clearing and settlement of contracts;

(j) monitor compliance with its rules;

(k) investigate complaints with respect to its business;

(l) maintain rules to deal with the default of its clients;

(m) co-operate with other regulatory bodies through the sharing of information or otherwise;

(n) maintain high standards of integrity and fair dealing; and

(o) prevent abuse.

1.2.10. In 1998, SEC adopted Regulation ATS{4}, to impose essential elements of market-oriented regulation on alternative trading systems. This regulation addressed the concerns raised by the market activities of alternative trading systems that choose to register as broker-dealers.

1.2.11. To allow an ATS to operate without disproportionate burdens, a system with less than five percent of the trading volume in all securities it trades is required to: (1) file with the Commission a notice of operation and quarterly reports; (2) maintain records, including an audit trail of transactions; and (3) refrain from using the words "exchange," "stock market," or similar terms in its name.

1.2.12. If, however, an ATS with five percent or more of the trading volume in any national market system security chooses to register as a broker-dealer (instead of as an exchange), in addition to the requirements for smaller ATSs set out above, Regulation ATS requires such ATSs to be linked with a registered market in order to disseminate the best priced orders in those national market system securities displayed in their systems (including institutional orders) into the public quote stream. Such ATSs must also comply with the same market rules governing execution priorities and obligations that apply to members of the registered exchange or national securities association to which the ATS is linked.{5}

1.2.13. In addition, ATSs with twenty percent or more of the trading volume in any single security, whether equity or debt, would be required to: (1) grant or deny access based on objective standards established by the trading system and applied in a non-- discriminatory manner; and (2) establish procedures to ensure adequate systems capacity, integrity, and contingency planning. Moreover, because ATSs that choose to register as broker-dealers are not required to surveil activities on their markets, the SEC works with FINRA and other SROs to ensure that they can operate ongoing, real-time surveillance for market manipulation and fraud and develop surveillance and examination procedures specifically targeted to ATSs they oversee.{6}

1.2.14. The SEC is the authority charged with ensuring that ATSs (such as Trumid) continue to comply with the Regulation ATS. The SEC has the power to direct any ATS that is failing, or had failed, to comply with the Regulation ATS to take action to remedy such non-compliance. It also has the power to censure and /or to revoke the exemption of any ATS that fails to meet the Regulation ATS requirements and demand that it be registered as a national security exchange or cease ATS activities altogether. Accordingly, Trumid is subject to the oversight of the SEC and FINRA. Trumid enjoys a good-standing relationship with both its regulators.

1.2.15. The SEC exercises its supervisory responsibility by conducting an ongoing assessment of whether Trumid's rules, procedures and practices are adequate for the protection of investors and for the maintenance of an orderly market in accordance with the requirements under Regulation ATS and Trumid's SEC-registered Rulebook. For this purpose, the SEC and FINRA require Trumid and ATSs in general to report to them any material changes in their business and operation, including, materially adverse financial information or changes to its constitution. Further, ATSs must provide access to the SEC, upon request to, any records that an ATS is required to keep pursuant to Rule 301(b)(2)(ii) and Rule 302 and 303 of Regulation ATS).

Authorization, licensure or registration of the ATS

1.2.16. Trumid has a statutory obligation to ensure that its business as an ATS is conducted in an orderly manner so as to afford proper protection to investors. Failure to comply with this obligation may mean that Trumid could cease to be able to operate as an ATS.

1.2.17. Trumid requires each client to make representations and warranties as to the following:

(i) it is in compliance with all applicable laws in all material respects;

(ii) all information provided by it in writing to Trumid (including all information contained in applications, questionnaires and information forms, and including information delivered via electronic means) is true and accurate in all material respects;

(iii) it satisfactorily meets any eligibility criteria or other requirements contained in the Trumid Rules and is able to effect settlement of "Transactions" (as defined in the Trumid Rulebook) in accordance with the Trumid's Rules as set out in the Trumid Rulebook and the User Agreement;

(iv) it has all "Intellectual Property Rights" (as defined in the Trumid Rulebook) in and to any information submitted by it to the ATS, and its use of any software or equipment to access the ATS (other than software or equipment provided by Trumid) does not violate any third party's Intellectual Property Rights;

(v) it is authorized to enter into the Transactions entered into by it through the "System"(as defined in the Trumid Rulebook), and each of such Transactions, as confirmed by the System, is the legal, valid and binding obligation of User, enforceable against the User in accordance with its terms and the terms hereof;

(vi) it possesses the sophistication, experience, knowledge and expertise in financial and business matters to make its own investment decisions and to properly assess the merits, risks and suitability of investing in, and entering into Transactions in respect of, the Products;

(vii) the "Authorized Traders"(as defined in the Trumid Rulebook) are (x) capable of evaluating investment risks independently, both in general and with regard to particular Transactions and investment strategies involving a security or securities and (y) will exercise independent judgment in evaluating the merits of all potential Transactions;

(viii) it acknowledges, agrees and understands that (x) all Transactions are unsolicited transactions, (y) no Transaction will be solicited or recommended by Trumid or any of its representatives and (z) its decision to enter into any Transaction will be based on its own research and information, or on research and information obtained from a source other than Trumid and its representatives, and neither Trumid nor any of its representatives will have any input into its decision to enter into such Transaction;

(ix) it is and will continue to be either (x) a registered broker-dealer with at least $10 million in net capital, (y) a buy-side institution with at least $100 million in assets under management or (z) a primary dealer or bank with at least $50 million in assets; and

(x) it (x) has implemented policies and procedures to ensure its compliance with all Applicable Laws related to anti-money laundering and sanctions and (y) shall ensure that it follows such policies and procedures with respect to its use and access of the ATS (and ensure that its Authorized Traders follow such policies and procedures in accessing and using the ATS).

Furthermore, Users covenant to notify Trumid promptly in the event any of the foregoing representations and warranties become untrue at any time during the term of the User Agreement.

1.2.18. As Trumid regularly releases enhancements and updates to its system, Trumid regularly files updates to its "Form ATS"{7} with at least the requisite 20 days notice prior to implementing any material change to the operation of the ATS. The most recent filing made by Trumid that is in effect was filed on 01/16/2020.

1.3. The foreign regulator's approach to the detection and deterrence of abusive trading practices, market manipulation, and other unfair trading practices or disruptions of the market

1.3.1. Regulation ATS requires all ATSs to comply with antifraud, antimanipulation and other applicable provisions of the federal securities laws. The nature of corporate bond trading does not easily lend itself to manipulative trading, in the same manner as may be seen in other, more liquid/active asset classes. Regardless, Trumid regularly monitors activity on the system in real-time and again, with an end of day review. This entails the following:

(i) Trumid's tech-operations team monitors system performance and usage in real-time;

(ii) Trumid's operations team monitors client orders and executions in real-time;

(iii) Trumid's supervisor reviews and signs off on trades daily; and

(iv) Trumid employs a third-party compliance consultant to review Trumid's review (conducted weekly). All transactions on Trumid are reported to FINRA's TRACE.

Rule 201 of Trumid's Rulebook further addresses the Duties and Responsibilities of Users, to ensure compliance with all material laws. Lastly, Trumid's internal policies address and prohibit employee trading on material non-public information.

Laws, rules, regulations and policies that govern the authorization and ongoing supervision and oversight of market intermediaries in the U.S.

Procedures for dealing with the failure of a market intermediary in order to minimize damage and loss to investors and to contain systemic risk for market intermediaries who may deal with members and other participants located in Canada.

1.3.2. See also section 1.2 above and the information set out under paragraphs 1.2.14 and 1.2.15, and part 5, sections 5.1 and 5.2 and section 7.2 below for further information in this regard.

2. GOVERNANCE

2.1. Governance -- The governance structure and governance arrangements of the ATS ensure:

(a) Effective oversight of the ATS operations,

2.1.1. Trumid has independent departments handling product development, testing, change management (code deployment), infrastructure and system operation. Further, Trumid employs real-time monitoring of the ATS with end of day checks by management. Trades, and trading in employee personal accounts, are also regularly reviewed by a third-party, compliance consulting firm.

(b) That business and regulatory decisions are in keeping with its public interest mandate,

2.1.2. Trumid provides the trading environment for the trading of USD corporate debt securities. As an ATS conforming with U.S. regulatory requirements, Trumid offers a legally safe forum for USD corporate debt securities trading. As an ATS, Trumid comes under the direct jurisdiction of the SEC as discussed above.

2.1.3. Trumid has a statutory requirement to ensure that business on its markets is conducted in an orderly manner, providing proper protection to investors. The Trumid Rules have been designed to ensure compliance with all applicable legislation and to ensure a fair and orderly market. Trumid has an internal compliance department and contracts with a third-party compliance consultant which, amongst other things, monitors Trumid's compliance with all applicable legislation. Trumid's General Counsel/Chief Compliance Officer is responsible for updating policies and procedures to comply with changes in regulation.

(c) fair, meaningful and diverse representation on the board of directors and any committees of the board of directors, including:

(i) appropriate representation of independent directors, and

(ii) a proper balance among the interests of the different persons or companies using services and facilities of the ATS,

2.1.4. Trumid's directors are appointed pursuant to the terms of the Trumid limited liability agreement (the "LLC Agreement") and its by-laws and are subject to the duties and obligations imposed under Delaware law. Trumid's directors are appointed having regard to the need to have representation of a diverse range of skills and experience related to securities markets and debt trading.

(d) The ATS has policies and procedures to appropriately identify and manage conflicts of interest, and

2.1.5. Trumid takes potential conflicts of interest and the associated consequences seriously and has implemented appropriate procedures to mitigate the risk of such occurrences. Trumid does not trade for its own account so it has no interests to be conflicted. Further, neither SSGM, nor any SSGM affiliate, conducts proprietary trading on Trumid. Should an SSGM affiliate wish to trade on Trumid, it would first need to establish an intermediary relationship with an institution other than SSGM (to avoid any potential conflicts). These procedures supplement the legal duties on directors to avoid any situation in which he or she has, or could have, a direct or indirect interest that conflicts, or could conflict, with the interests of the firm.

2.1.6. Trumid's LLC Agreement prohibits Trumid's directors from being members of the board of directors of or employed in any capacity, including as a consultant, by any competitor of Trumid.

2.1.7. In addition, all Trumid employees are subject to contractual restrictions that are designed to mitigate, manage and limit conflicts of interest. Trumid also runs background checks on all of its employees.

2.1.8. Trumid has also implemented a Conflicts of Interest Policy which provides employees with an overview of Trumid's key obligations and the controls implemented in order to identify, manage and disclose actual conflicts of interest.

(e) There are appropriate qualifications, remuneration, limitation of liability and indemnity provisions for directors, officers and employees of the exchange.

2.1.9. As a Delaware LLC, the LLC Agreement is Trumid's principal governing document. Pursuant to the LLC Agreement -- the holders of Trumid Class A and Class B Shares, founder and employee shares, respectively, each nominate one director to the board, representing the interests of management. The other directors are designated by those members who have such rights.

2.1.10. Directors receive no remuneration, but every director is entitled to be indemnified by Trumid against all costs, charges, losses, expenses and liabilities incurred by him or her in the execution and discharge of his or her duties to Trumid or in relation thereto to the maximum extent allowable by law. The directors also have the benefit of the directors' and officers' liability insurance.

2.2. Fitness -- The ATS has policies and procedures under which it will take reasonable steps, and has taken such reasonable steps, to ensure that each director and officer is a fit and proper person.

2.2.1. Each director is appointed on merit based on skills, qualifications and experience and is subject to detailed disclosure requirements under Form BD, which includes information as to criminal or civil sanctions and regulatory actions, and such disclosures are publicly accessible on Trumid's Form BD filing.

3. REGULATION OF PRODUCTS

3.1. Review and Approval of Products -- The products traded on the ATS and any changes thereto are reviewed by the Foreign Regulator, and are either approved by the Foreign Regulator or are subject to requirements established by the Foreign Regulator that must be met before implementation of a product or changes to a product.

3.2. Product Specifications -- The terms and conditions of trading the products are in conformity with the usual commercial customs and practices for the trading of such products.

3.2.1. The SEC and FINRA establish a range of requirements that must be met before any new product is admitted for trading on the Platform. New products must be capable of being traded in a fair, orderly and efficient manner and the ATS must be designed so as to allow for its orderly pricing.

3.3. Risks Associated with Trading Products -- The ATS maintains adequate provisions to measure, manage and mitigate the risks associated with trading products on the ATS.

3.3.1. Trumid maintains adequate provisions to measure, manage and mitigate the risks associated with trading products on the ATS as required by regulation or as instituted by SSGM (the intermediary). These include, but are not limited to, conformance to daily trading limits, 'market access' controls (SEC 15c3-5) and internal controls. Appendix B to this Application sets out a description of all such controls.

4. ACCESS

4.1. Fair Access

(a) The ATS has established appropriate written standards for access to its services including requirements to ensure:

(i) Participants are appropriately registered as applicable under Ontario securities laws, or exempted from or not subject to these requirements,

(ii) The competence, integrity and authority of systems users, and

(iii) Systems users are adequately supervised.

(b) The access standards and the process for obtaining, limiting and denying access are fair, transparent and applied reasonably.

(c) The ATS shall not unreasonably prohibit, condition or limit access by a person or company to services offered by it.

(d) The ATS does not

(i) permit unreasonable discrimination among participants, or

(ii) impose any burden on competition that is not reasonably necessary and appropriate.

Access requirements

4.1.1. As a regulated ATS, Trumid is subject to U.S. marketplace regulatory requirements that are closely aligned with those outlined above. Trumid is obligated under the Regulation ATS and under FINRA Rules to ensure that access to its facilities is fair and non-- discriminatory. In particular, Trumid is required to "make transparent and non-discriminatory rules, based on objective criteria, governing access to, or membership of, its facilities" (Rule 301(b)(5)(ii) of Regulation ATS). However, as Trumid's trading volume does not currently exceed five percent of the average daily volume of corporate debt securities traded in the U.S., Trumid is not required to comply with some of the fair access requirements prescribed in Rule 301(b) of Regulation ATS as described in Section 1.2.9(c), 1.2.12 and 1.2.13 of this Application.

4.1.2. Trumid's access to the Platform criteria are outlined in the Trumid Rulebook and User documentation and applied equally to all applicants. Chapters 1 and 2 of the Trumid Rulebook set out the requirements for access to the Platform, as well as requirements relating to provision of information. Access requirements for prospective participants on the Platform are set out in Chapter 1 of the Trumid Rulebook. Chapter 2 specifies the requirements that are applicable to each participant, including, for instance, the prospective participant's regulatory status, capital holdings, AML and financial crime procedures. Rule 203 of Chapter 2 of the Trumid Rules sets out the obligations of Users to promptly provide information reasonably requested by Trumid. Chapter 4 sets out the ability of Trumid to investigate and suspend or terminate a User's access to the Platform for suspected breaches of the Rules.

4.1.3. When an applicant applies for access to the Platform, the applicant must confirm its regulatory status and SEC registration number (where applicable), and this is validated by Trumid's intermediary. A similar process is proposed to be implemented for Ontario Participants.

4.1.4. The Trumid Rulebook does not allow a person to enter into a trade on the Platform unless that person can validly enter into trades in accordance with the U.S. law and any other applicable law or regulation.

4.1.5. Trumid is regulated in the U.S. by the SEC and FINRA. It is therefore familiar with regulators imposing particular requirements as a result of local law and regulation. Trumid's rules are designed to ensure that its participants comply with these requirements through its Rule 105 -- Application of Rules and Jurisdiction under the Trumid Rulebook.

Due diligence and ongoing supervision

4.1.6. Trumid conducts a robust due diligence procedure to ensure that its Users are fit and proper, in order to protect the integrity of the Platform and the orderliness of its business. Once a User has been admitted, controls are also applied to any additional system users. System users are also subject to supervision on an ongoing basis.

4.1.7. Trumid's third-party compliance consultant performs regular due diligence on Trumid's client list to ensure none appear on applicable restricted or Office of Foreign Asset Control (OFAC) list. Further, ongoing customer due diligence/KYC procedures are performed regularly by Trumid's third-party intermediary, SSGM.

5. REGULATION OF PARTICIPANTS ON THE ATS

Regulation -- Trumid has the authority, resources, capabilities, systems and processes to set requirements governing the conduct of the participants on the Platform and monitoring their conduct.

5.1. Users and other participants are required to demonstrate their compliance with these requirements

5.1.1. Users attest to this information via execution of their onboarding and related documentation. The onboarding documentation required by Trumid includes collection of a User Agreement, Customer Account Application and an Authorized Trader Form. Additional information is collected and verified through SSGM's Know-Your-Client (KYC) process. Trumid also aids in the collection of onboarding documentation required by SSGM, which includes a DVP/RVP agreement, Tax ID Form, Authorized Trader Form, Execution Agreement with an Electronic Trading Addendum, Trumid-specific Annex to the aforementioned Addendum, Standard Settlement Instructions ("SSIs"), Investment Adviser Letter (as applicable) and a Prime Brokerage Release Form ("Form 151") (as applicable). SSGM conducts KYC on an initial and ongoing basis.

5.1.2. The financial resource requirements, standards, guides or thresholds required of Users are set out in Chapter 2 of the Trumid Rulebook (the "User Criteria"). Users attest to these financial criteria in their signed documentation and financial information is collected and verified through SSGM's KYC process.

5.1.3. All Users are required by Trumid to satisfy the User Criteria on an ongoing basis. The Users are required to notify Trumid of anything that Trumid might reasonably expect to be disclosed and are required to make that representation each time they access the system, per Section 6(b) of the User Agreement. This would include all legal, financial and regulatory matters that are material to their standing as Users. Users must also provide the information necessary to confirm their continued compliance with the eligibility criteria set out in the Trumid Rulebook.

5.1.4. In addition, the Trumid Rules have provisions regarding the conduct of Users. These include provisions relating to "prohibited practices" (see Rule 301 in Chapter 3 of the Trumid Rules), which are designed to prevent fraudulent and manipulative acts and practices. More generally, the provisions of Chapter 3 (Trading Practices) and Chapter 4 (Termination, Limitation or Suspension of Access) are designed to set out how trading on the Platform should take place in a fair and orderly manner and have been designed to ensure just and equitable principles of trade and to foster co-operation and co-ordination with persons or companies engaged in regulating, clearing, settling, processing information with respect to, and facilitating transactions in products traded on the Platform.

5.2. Client Advisory and Member Services

5.2.1. Trumid employs a team of client-facing employees (the "Client Team") to ensure all users are familiar with ATS protocols, new releases or enhancements, and/or for any market-related matter where assistance may be needed in real-time. Trumid's Client Team members are all FINRA-licensed, registered representatives ("RRs").

5.3. Regulation and Enforcement of Trumid Rules on Users

5.3.1. Trumid is not recognized as a national security exchange in the U.S. and, therefore, does not have any regulatory or enforcement powers over its Users. It does, however, have the authority to terminate, suspend or limit the Users' access to the Platform in case of misconduct, as provided in Chapter 4 of the Trumid Rulebook.

5.3.2. Trumid also has certain summary powers to deal with market emergencies that are set out in Rule 607 of the Trumid Rulebook. An "emergency" means any occurrence or circumstance which threatens or may threaten such matters as the fair and orderly trading in, or the liquidation of or delivery pursuant to, any Product, or the timely collection and payment of funds in connection with clearing and settlement of a transaction, and which, in the opinion of the chief executive officer or his designee, requires immediate action, including: any manipulative or attempted manipulative activity; any circumstances that may materially affect the performance of Products traded pursuant to the Rules, including failure of the payment system or the bankruptcy or insolvency of any User or any other person; and any other circumstance which may have a severe, adverse effect upon the functioning of Trumid or an intermediary.

5.4. Trumid's capacity to detect, investigate, and sanction persons who violate Trumid Rules

5.4.1. Rule 401 of the Trumid Rulebook sets out Trumid's capacity to investigate and sanction persons who violate Trumid Rules. Chapter 3 of the Trumid Rulebook prohibits fraud and abuse as well as other trading practices and market abuses.

5.4.2. Trumid has sufficient personnel, and sufficient software tools, to monitor the Platform. The trading operations and technology operations teams monitor the real time market for orderly trading on the Platform. Part of this monitoring includes enforcement of the Trumid's policies in respect of error trades and erroneous submissions. As a result of daily monitoring of the real-time market, trading operations may identify activity or behaviour which warrants further investigation or analysis (examples include but are not limited to: unusual price movements in the real-time market, or order behaviour which may be detrimental to the integrity of the market).

6. CLEARING AND SETTLEMENT

6.1. Clearing Arrangements -- The ATS has appropriate arrangements for the clearing and settlement of transactions through a clearing house.

6.2. Regulation of the Clearing House -- The clearing house is subject to acceptable regulation.

6.2.1. Trumid has contracted with SSGM to serve as intermediary for the ATS. SSGM, as executing broker of record, has appropriate arrangements for the clearing and settlement of transactions through a clearing house. Trumid is not involved in the clearing or settlement of transactions.

6.2.2. SSGM is registered with the SEC as a broker-dealer and is a member of FINRA. SSGM's affiliate, State Street Global Markets Canada Inc., is registered with IIROC and Canadian Securities Administrators ("CSA") as an investment dealer.

6.3. Access to the Clearing House

(a) The clearing house has established appropriate written standards for access to its services.

(b) The access standards for clearing members and the process for obtaining, limiting and denying access are fair, transparent and applied reasonably.

6.3.1. As noted above, clearing and settlement is undertaken by an independent third party, SSGM.

6.4. Sophistication of Technology of Clearing House -- The ATS has assured itself that the information technology used by the clearing house has been adequately reviewed and tested and provides at least the same level of safeguards as required of the ATS.

6.4.1. The Depository Trust and Clearing Corporation ("DTCC") applies industry best practice for development, implementation, operations, monitoring, management and maintenance of IT systems, using industry standard hardware and processes for which experienced resources are readily available.

6.5. Testing

6.5.1. All releases (both major and minor/patches) undergo similar testing regiments:

6.5.2. Testing of a release includes: developer testing of each feature on a local build, peer review and automated testing of new code, code merging into test environments, automated regression testing, quality assurance and manual regression testing, quality assurance signoff, product development signoff, and production release, as set out below:

(a) Developer testing: Each developer tests his/her own code to ensure proper functionality on a local machine (sandboxed environment).

(b) Peer review: Other developers review the writer's code to ensure optimization and proper function.

(c) Automated testing of new code to ensure proper functionality.

(d) Merging of new code into a test environment.

(e) Automated testing of merged code to ensure proper functionality of new code and proper functionality of previously existing code.

(f) Quality assurance and manual regression testing to ensure proper functionality of new code and proper functionality of previously existing code.

(g) Quality assurance signoff.

(h) Product development signoff.

(i) Production release.

6.6. Risk Management of Clearing House -- The ATS has assured itself that the clearing house has established appropriate risk management policies and procedures, contingency plans, default procedures and internal controls

6.6.1. As noted above, Trumid has contracted with SSGM to serve as intermediary for the ATS. SSGM, as executing broker of record, has appropriate arrangements for the clearing and settlement of transactions through a clearing house. SSGM self-clears and settles.

7. SYSTEMS AND TECHNOLOGY

7.1. Systems and Technology -- Each of the ATS's critical systems has appropriate internal controls to ensure completeness, accuracy, integrity and security of information, and, in addition, has sufficient capacity and business continuity plans to enable the ATS to properly carry on its business. Critical systems are those that support the following functions:

(a) order entry,

(b) order routing,

(c) execution,

(d) trade reporting,

(e) trade comparison,

(f) data feeds,

(g) market surveillance,

(h) trade clearing, and

(i) financial reporting.

7.1.1. Trumid's critical systems that have appropriate internal controls as applicable to its trading functionality and include:

(a) security selection and reference data,

(b) order entry,

(c) fat finger controls,

(d) order matching,

(e) trade reporting,

(f) trade routing,

(g) data feeds, and

(h) market surveillance.

Regulatory Requirements

Description of the matching system -- Manner of Operation of the Trumid ATS

7.1.2. Trumid operates multiple protocols, which run in parallel: An anonymous, network-based, matching engine ("AT"); as well as an attributable trading protocol ("ATP"), which will facilitate transactions between sell side dealers wishing to divulge their identity to their pre-authorized clients.{8} Users (persons or entities authorized to utilize the Trumid ATS) will designate to Trumid the persons authorized to trade on their behalf ("Authorized Traders").

Trading Operation

Anonymous Protocol

Swarms

7.1.3. A "Trumid Swarm" launches when a participant, or multiple participants, firm up opposing interests on a given security (creating an order). Users wishing to make multiple, 2-sided markets on separate securities (including one or more 'locked markets'), may elect to do so through a liquidity provision feature which may be added to the User's order window. The swarm begins with the exclusive active phase, which lasts for 2 minutes (or such other time as may be established by Trumid). Users see basic, descriptive bond information, as well as the inside market (best bid/best ask). Users can enter buy and sell at the displayed prices or enter bids/offers at defined price intervals within the market. Users may also view the time-ordered progression of system notifications and actions taken. Orders may be cancelled or amended at any time.

7.1.4. Users may enter both a buy or sell order for the same bond (a 2-sided market), but are not permitted to enter multiple buy or sell orders on the same security. A User also may not enter a lower-priced sell order than his/her buy order (i.e., an inverted market).

7.1.5. Trade executions in the Exclusive Active Phase are released simultaneously to the purchaser and seller, and all Trumid Users receive notification that the particular bond traded. Trumid Users are informed of the transaction price, and the Swarm immediately progresses, at the just-executed price, to the Trumid Phase. Only those participants who were parties to a trade are informed of the volume traded. Executions to Users are reported net of the designated markup/markdown. Prioritization in the Exclusive Active Phase is price/time.

7.1.6. If no trade has occurred, orders which remain unexecuted (and un-cancelled) at the end of the exclusive active phase carry over into the (public) active phase. These orders remain live and firm, and comprise the initial Active Phase order stacks. ?

Active Phase

7.1.7. The second stage of a Trumid Swarm is the "Active Phase", which lasts for 5 minutes (or such other time as may be established by Trumid). All applicable participants are notified of and have the ability to participate in, the Active Phase. During this phase, Users see basic, descriptive bond information, as well as the inside market (best bid/best ask). Users may choose to buy or sell at the displayed prices or enter bids/offers at defined price intervals within the market. If a User's own order represents the bid or offer which is first in line to be executed (most aggressive price and earliest time), the Trumid ATS provides that User a visual indication of his/her 'First [in line]' status.

7.1.8. In any phase, if an order is only partially filled, the balance of the order remains outstanding until the end of the Swarm, unless cancelled sooner. A User always has the ability to cancel all of his/her outstanding orders simultaneously at any time.

7.1.9. Trumid has the ability to cancel or suspend a Swarm due to technical malfunction of the Trumid ATS itself. Users are responsible for monitoring market and credit-specific headlines throughout a Swarm as well as for managing orders accordingly.

7.1.10. In an Active Phase, if no activity occurs to improve the inside market for more than a management-determined period of time (i.e., 20 seconds), the system invites all Swarm participants at the top of the market (both on the bid side and offered side) to trade in the middle of the market via a 'dark invite'. Users accepting the dark invite will have a super-priority order at the middle of the market, supplementing the publicly viewable 'lit' order. If Users on both sides of the market accept the invite, a transaction occurs at the mid-market price.

7.1.11. Trade executions in the Active Phase are released simultaneously to the purchaser and seller, and all Trumid Users receive notification that the particular bond traded. Trumid Users are informed of the transaction price, and the Swarm immediately progresses, at the just-executed price, to the Trumid Phase. Only those participants who were party to a trade are informed of the amount traded. Executions to Users are reported net of the designated markup/markdown. Prioritization in the exclusive Active Phase is price/time.

7.1.12. If no trade has occurred, orders at the midpoint resulting from an accepted dark invitation which remain un-cancelled and unexecuted at the end of the Active Phase may carry over into the Trumid Phase. These orders remain live. Any existing orders which are not at the midpoint are automatically cancelled.

Trumid Phase

7.1.13. The Trumid Phase is the third and final stage of a Trumid Swarm and lasts for 5 minutes (or such other time as may be established by Trumid). Like the Active Phase, all Trumid Users are welcome to participate in the Trumid Phase.

7.1.14. During the Trumid Phase, a single, algorithmically calculated, 'volume clearing' mid-price is displayed for each particular bond (the "Trumid Price"). The Trumid Price of any given bond is determined either by 1) the price activity of the Active Phases, 2) the execution price of a just-traded transaction, or 3) an algorithmically calculated Fair Value Model Price (FVMP). Trumid also offers the ability for a User to launch a Swarm directly into the Trumid phase though a Trumid ATS component called "Bond Stream". Bond Stream displays to a User which bonds on that User's Watchlist were recently transacted and reported to FINRA's TRACE, as well as the price of those transactions. Users may elect to place an order at that just-transacted price which will immediately launch a Trumid Phase. This action indicates to the market when a User desires to repeat a transaction price which was just proven (through execution) in the broader market. Additionally, Trumid has the ability to launch a Trumid-Phase-only Swarm. As is the case with all Trumid Phases, this action displays a central, volume-clearing level, which is immediately available to all Trumid users.

7.1.15. In the Trumid Phase, Users may only enter orders to buy or sell at the determined Trumid Price. Users are permitted to cancel unexecuted orders at any point while opposing orders are executed instantly.

7.1.16. Trade executions in the Trumid Phase are released simultaneously to the purchaser and seller, and all Trumid Users receive notification that the particular bond has traded. Trumid Users are informed of the transaction price and only those participants who were parties to the trade are informed of the amount traded. Executions to Users are reported net of the designated markup/markdown. Since all trades in the Trumid Phase occur at the Trumid Price, prioritization in the Trumid Phase is time only.

Fees Paid by Users to Trumid ATS

7.1.17. Trumid is compensated through fees paid by Users on a per-trade basis. There are no subscription fees. Markups/markdowns are displayed on order tickets, electronic notifications and within the Swarm window. Trades are reported to counterparties and trade reporting authorities net of markup/markdown.

7.1.18. The markup schedule for bonds is as follows, subject to change in accordance with the Rulebook:

Price Based Bonds:

• Unless otherwise noted, price-based bond transactions are charged a markup/markdown of 1/16 of 1 point (.0625), per side. (For instance, if the Trumid price is 80, a buyer will pay 80.0625, and a seller will receive 79.9375).

• For investment grade or "IG" bonds where the maturity of the traded instrument is less than or equal to 90 days, the markup/markdown is 5/1000 of 1 point (.005), per side.

• For IG bonds where the maturity of the traded instrument is greater than 90 days but less than or equal to 12 months, the markup/markdown is 1/100 of 1 point (.01), per side.

• For IG bonds where the maturity of the traded instrument is greater than 12 months but less than or equal to 14 months, the markup/markdown is 2/100 of 1 point (.02), per side.

• For bank/financial/insurance perpetual preferred ("Perps") or hybrid ("Hybrids") securities issued by a company whose parent has an IG rating, the markup/markdown is 1/32 of 1 point (.03125).

Spread Based Bonds:

• Unless otherwise noted, spread based bond transactions are charged a markup/markdown dependent on the maturity of the reference benchmark.

• If the maturity of the reference benchmark is greater than 14 months but less than or equal to 5 years, the markup/markdown is 0.5bps. For instance, if the Trumid level on a spread based bond is +100, a buyer's execution level will be calculated as +99.5bps and a seller's execution level will be +100.5bps.

• If the maturity of the reference benchmark is greater than 5 years but less than or equal to 10 years, the markup/markdown is 0.4bps.

• If the maturity of the reference benchmark is greater than 10 years, the markup/markdown is .3bps.

7.1.19. Notwithstanding the aforementioned schedule, bonds trade at a reduced markup/markdown on the day the are first available to trade, plus the following business day. Newly-issued bonds are publicly communicated to Users of the system and the reduction of a markup/markdown on each relevant security is displayed.

Description of the architecture of the systems, including hardware and distribution network, as well as any pre-- and post-trade risk-management controls

7.1.20. Trumid is not subject to any capacity, integrity and security of the automated systems requirements, but ensures that the risk management controls are in place. The pre and post-trade risk management controls include:

(a) SEC 15c3-5 market access controls: Fat finger checks ensuring bids and offers are within a reasonable tolerance away from prior execution prices, ensuring maximum order sizes are hard coded to prevent outsized orders, administrative portals to provide client administrators with direct access for trader limits.

(b) Trade cancellation: Trumid has the capability and is permitted, per the Trumid Rulebook, to cancel any trade that it determines detrimental to market integrity.

(c) User-level permissions: Trading credentials are provided only after documentation is completed and risk limits are automatically received by the system from the Intermediary.

(d) Volume and price limiting functionality: Automated limit controls enforce risk limits imposed on clients by the Intermediary as well as any restrictive limits imposed by the client's administrators.

Market continuity provision

7.1.21. Trumid has detailed business continuity and disaster recovery plans and procedures for the Platform's operations. The Trumid ATS is cloud-hosted by Amazon Web Services ("AWS") and accessed via the internet. The Platform is strategically located in two, geographically distinct, AWS data centers. Issues with any one data center are opaque to Users as either data center is fully capable of supporting the application. In the event the primary data center is lost due to a larger, regional issue, the Platform is designed to be up and running in our disaster recovery (secondary) data center within 3 hours.

7.2. Information Technology Risk Management Procedures -- The ATS has appropriate risk management procedures in place including those that handle trading errors, trading halts and circuit breakers.{9}

7.2.1. Trumid takes steps to ensure that a fair and orderly market is maintained with regard to the submission of orders, and to protect both the Platform and Users' own systems and infrastructure from inappropriate activity. Trumid performs ongoing monitoring of the Platform, including, without limitation, performance and capacity, orders sent by Users on an individual and aggregated basis, message flow, and the concentration flow of orders, to detect potential threats to the orderly functioning of the market.

7.2.2. In addition to measures listed in sections 9.1 -- 9.7, Trumid has arrangements to prevent disorderly trading and breaches of capacity limits, including those set out in section 7.1.20.

7.2.3. In terms of Trumid's approach to foster system resiliency, integrity, reliability and cybersecurity, Trumid follows best practices for cybersecurity and utilizes both AWS services and Trumid-implemented firewalls to ensure the integrity of Trumid's infrastructure. Trumid regularly conducts penetration tests and vulnerability scans to ensure those best practices are reviewed and validated by third party experts. Further, Trumid's disaster recovery facility has real-time data replication, along with hourly off-site data backups. Trumid's use of AWS's RDS service also makes an additional, on-site backup every five minutes. Finally, Trumid conducts a regular fail over test to the disaster recovery location each quarter.

Trade Halts

7.2.4. Rule 307 of the Trumid Rulebook states Trumid may, in its reasonable judgment and without liability to any User, Authorized Trader or other party, delay the commencement of any Trading Swarm or cease an ongoing Trading Swarm if news or events warrant such action. Any such delay or cessation of a Trading Swarm shall be electronically communicated as soon as is practicable, to the extent possible, to all Authorized Traders.

Error Trades

7.2.5. Rule 306 of the Trumid Rulebook states that Trumid may cancel any Trumid Market Center trade that it determines would be detrimental to market integrity. All determinations of Trumid to cancel a trade, or to decline to cancel a trade, shall be final, and Trumid shall not have any liability for Losses arising out of determinations made by Trumid pursuant to this Rule, notwithstanding the limitations on liability otherwise set forth in Rule 608.

(a) Determination to Review a Trade. Trumid may determine to review a Trumid Market Center trade based on its independent analysis of market activity or upon request for review by a User. A request for review must be made within 15 minutes of the execution of the trade, and Trumid shall determine whether to review a trade promptly after such request has been received. In the absence of a timely request for review, during volatile market conditions, upon the release of significant news, or in any other circumstance in which Trumid deems it to be appropriate, Trumid may determine, in its sole discretion, that a trade shall not be subject to review. Upon deciding to review a trade, Trumid will promptly issue an alert to involved Users indicating that the trade is under review. If Trumid accepts a request for review, Trumid shall complete such review within one business day after it accepts such request unless it notifies involved Users that it is unable to complete its review during this time period.

(b) Liability for Cancelled Trades. A person responsible for an Order that results in a cancelled trade may be liable for the reasonable out-of-pocket losses incurred by a person whose trade was cancelled.

(c) Trade Cancellation Procedures. Upon a determination by Trumid that a trade shall be cancelled, that decision will be implemented. The cancelled trade shall be reflected as cancelled in Trumid's official records and, if applicable, shall be reported by Trumid to the applicable intermediary.

8. FINANCIAL VIABILITY

8.1. Financial Viability -- The ATS has sufficient financial resources for the proper performance of its functions and to meet its responsibilities.

8.1.1. While Trumid has no executory responsibilities nor does it handle customer funds, settlement or clearing, Trumid, as a FINRA-registered broker dealer, has a minimum net capital requirement of US$250,000.

9. TRANSPARENCY AND REPORTING

9.1. Transparency -- The ATS has adequate arrangements to record and publish accurate and timely trade and order information. This information is provided to all participants on an equitable basis.

9.1.1. Section 8.2 of NI 21-101 in Ontario imposes certain pre-trade and post-trade information transparency requirements on ATSs displaying orders of corporate debt-securities. Section 10.1 requires disclosure by a marketplace (including an exchange and an ATS) on its website of certain information reasonably necessary to enable a person or company to understand the marketplace's operations or services it provides, including information related to the system's protocols and Rulebook. Further, revisions to OSC Staff Notice 21-703 align the transparency requirements for ATSs with those imposed on exchanges in the areas where the two marketplaces compete.

9.1.2. Rule 301(b)(3) of the Regulation ATS in the U.S. imposes similar market transparency requirements. The rule requires ATSs with five percent or more of trading volume in any covered security to publicly disseminate their best priced orders in those securities.{10}

9.1.3. All trades on Trumid are for securities which are TRACE-eligible. Trumid displays orders of corporate debt securities and provides accurate and timely information regarding orders. Additionally, Trumid also reports all transactions to TRACE in a timely manner, and automatically, via FIX, and would report transactions of Ontario-based participants in the same manner as it reports US-based participant trades. Trumid's reporting does not absolve any participants of their own regulatory reporting requirements.

10. RECORD KEEPING

10.1. Record Keeping -- The ATS has and maintains adequate systems in place for the keeping of books and records, including, but not limited to, those concerning the operations of the ATS, audit trail information on all trades, and compliance with, and/or violations of ATS requirements

10.1.1. Rule 302 of Regulation ATS requires ATSs to make and keep the records necessary to create a meaningful audit trail. Specifically, ATSs are required to maintain daily summaries of trading and time-sequenced records of order information, including the date and time the order was received, the date, time, and price at which the order was executed, and the identity of the parties to the transaction. In addition, ATSs are required to maintain a record of subscribers and any affiliations between subscribers and the ATS and of all notices provided to subscribers, including notices addressing hours of operation, system malfunctions, changes to system procedures, and instructions pertaining to access to the ATS.