Scheduled outage for OSC Electronic Filing Portal on Thursday, April 25, 2024 from 6:00 to 11:00 pm (EST)

CSA Mutual Fund Risk Classification Methodology for Use in Fund Facts and ETF Facts - CSA Notice of Amendments to National Instrument 81-102 Investment Funds and Related Consequential Amendments

CSA Mutual Fund Risk Classification Methodology for Use in Fund Facts and ETF Facts - CSA Notice of Amendments to National Instrument 81-102 Investment Funds and Related Consequential Amendments

CSA MUTUAL FUND RISK CLASSIFICATION METHODOLOGY

FOR USE IN FUND FACTS AND ETF FACTS

CSA NOTICE OF AMENDMENTS TO

NATIONAL INSTRUMENT 81-102 INVESTMENT FUNDS

AND

RELATED CONSEQUENTIAL AMENDMENTS

December 8, 2016

Introduction

The Canadian Securities Administrators (the CSA or we) are making amendments to mandate a CSA risk classification methodology (the Methodology) for use by fund managers to determine the investment risk level of conventional mutual funds and exchange-traded mutual funds (ETFs) (which are collectively referred to as mutual funds) for use in the Fund Facts document (Fund Facts) and in the ETF Facts document{1} (ETF Facts) respectively.

The amendments are to:

• National Instrument 81-102 Investment Funds (NI 81-102).

We are also making related consequential amendments to:

• National Instrument 81-101 Mutual Fund Prospectus Disclosure (NI 81-101), and

• Companion Policy 81-101CP to National Instrument 81-101 Mutual Fund Prospectus Disclosure (81-101CP).

We refer to the amendments to NI 81-102, and the related consequential amendments to NI 81-101 and 81-101CP together as the Amendments. The Amendments are part of Stage 3 of the CSA's implementation of the point of sale disclosure project (the POS Project). The text of the Amendments is included in annexes to this Notice and is available on the websites of members of the CSA.

We expect the Amendments to be adopted in each jurisdiction of Canada.

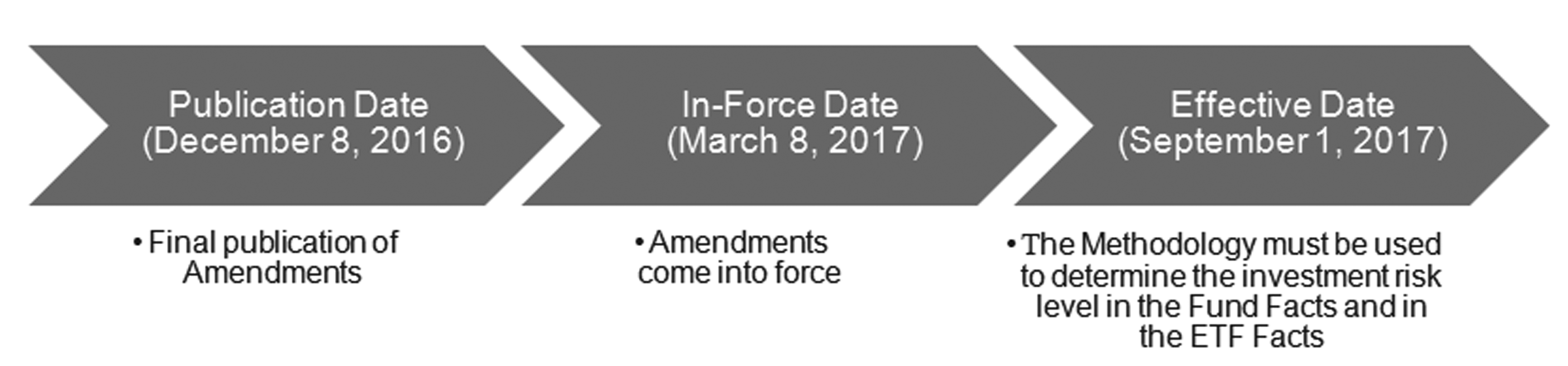

Subject to Ministerial approval requirements for rules, the Amendments come into force on March 8, 2017.

Substance and Purpose

We think that a mandated standardized risk classification methodology will provide for greater transparency and consistency than currently available, which will allow investors to more readily compare the investment risk levels of different mutual funds.

Background

Currently, the fund manager of a conventional mutual fund determines the investment risk level of the mutual fund for disclosure in the Fund Facts based on a risk classification methodology selected at the fund manager's discretion. The fund manager also identifies the mutual fund's investment risk level on the five-category scale prescribed in the Fund Facts ranging from Low to High.

The 2013 Proposal

An earlier version of the Methodology was published on December 12, 2013 by the CSA in CSA Notice 81-324 and Request for Comment Proposed CSA Mutual Fund Risk Classification Methodology for Use in Fund Facts (the 2013 Proposal). The 2013 Proposal was developed in response to stakeholder feedback that the CSA had received throughout the implementation of the POS Project for mutual funds, notably that a standardized risk classification methodology proposed by the CSA would be more useful to investors, as it would provide a consistent and comparable basis for measuring the investment risk level of different mutual funds.

A summary of the key themes arising from the 2013 Proposal was published in CSA Staff Notice 81-325 Status Report on Consultation under CSA Notice 81-324 and Request for Comment on Proposed CSA Mutual Fund Risk Classification Methodology for Use in Fund Facts.

The 2015 Proposal

After considering the comments received on the 2013 Proposal, the CSA published an amended version of the Methodology on December 10, 2015 (the 2015 Proposal) for a 90 day comment period that ended on March 9, 2016.

Summary of Written Comments Received by the CSA

We received 26 comment letters on the 2015 Proposal. We thank everyone who provided comments. Copies of the comment letters are posted on the website of Autorité des marchés financiers at www.lautorite.qc.ca and the website of the Ontario Securities Commission at www.osc.gov.on.ca. You can find the names of the commenters and a summary of the comments relating to the 2015 Proposal and our responses to those comments in Annex A to this Notice.

Generally, the majority of commenters supported the implementation of a standardized, mandatory risk classification methodology, and agreed with the use of standard deviation as the sole risk indicator to determine a mutual fund's investment risk level on the risk scale in the Fund Facts and the ETF Facts.

Summary of Key Changes to the 2015 Proposal

After considering the comments received, we have made some non-material changes to the 2015 Proposal. These changes are reflected in the Amendments that we are publishing as Annexes to this Notice. As these changes are not material, we are not republishing the Amendments for a further comment period.

The following is a summary of the key changes made to the 2015 Proposal.

• Mutual funds with less than 10 years of history -- Item 4 of Appendix F, NI 81-102

We are requiring a mutual fund that does not have the sufficient 10-year performance history to use the past performance of another mutual fund as proxy for the missing performance history: (i) when the mutual fund is a clone fund as defined under NI 81-102 and the underlying fund has 10 years performance history; or (ii) when there is another mutual fund with 10 years of performance history, that is subject to NI 81-102 and that has the same fund manager, portfolio manager, investment objectives and investment strategies as the mutual fund. The latter accommodation allows a corporate class version of the mutual fund or a mutual fund trust version of the mutual fund, with 10 years of performance history, to be used as a proxy for the missing performance history to calculate standard deviation under the Methodology.

• Reference Index -- Item 5 of Appendix F, NI 81-102

In selecting an appropriate reference index, we have clarified that each of the factors must be considered. While a mutual fund must consider each of the factors listed in Instruction (2) of Item 5 of Appendix F, NI 81-102 when selecting and monitoring the reasonableness of a reference index, we clarified that other factors may also be considered in selecting and monitoring the reasonableness of a reference index if such factors are relevant to the specific characteristics of the mutual fund.

In providing this clarification, we acknowledge that a reference index that reasonably approximates, or is expected to reasonably approximate, the standard deviation of the mutual fund may not necessarily meet all of the factors in Instruction (2) of Item 5 of Appendix F, NI 81-102.

• Prospectus Disclosure of the Methodology -- Item 9.1 of Part B, Form 81-101F1

If the performance history of another mutual fund is used as a proxy, a mutual fund must disclose in the prospectus a brief description of the other mutual fund. If the other mutual fund is changed, details of when and why the change was made must also be disclosed in the prospectus.

We are now also requiring that the Methodology be available on request at no cost.

Anticipated Costs and Benefits

The Methodology was developed in response to comments we received throughout the course of the POS Project regarding the need for a standardized risk classification methodology to determine the investment risk level of a conventional mutual fund in the Fund Facts. The Methodology will also be used to determine the investment risk level of an ETF in the ETF Facts. We think that the implementation of the Methodology will benefit both investors and the market participants by providing:

• a standardized risk classification methodology across all conventional mutual funds for use in the Fund Facts and all ETFs for use in the ETF Facts;{2}

• consistency and improved comparability between conventional mutual funds and/or ETFs; and

• enhanced transparency by enabling third parties to independently verify the risk rating disclosure of a conventional mutual fund in the Fund Facts or an ETF in the ETF Facts.

We further think that the costs of complying with the Methodology will be minimal since most fund managers already use standard deviation to determine, in whole or in part, a conventional mutual fund's investment risk level on the scale prescribed in the Fund Facts. In addition, as risk disclosure changes in the Fund Facts or ETF Facts between renewal dates are expected to occur infrequently, the costs involved would be insignificant.

Overall, we think the potential benefits of improved comparability of the investment risk levels disclosed in the Fund Facts and ETF Facts for investors, as well as enhanced transparency to the market, are proportionate to the costs of complying with the Methodology.

Transition

The Amendments will be proclaimed into force 90 days after their publication, that is on March 8, 2017. The Amendments have a transition period of 9 months after publication date so the Amendments will take effect on September 1, 2017 (the Effective Date). As of the Effective Date, the investment risk level of conventional mutual funds and ETFs must be determined by using the Methodology for each filing of a Fund Facts or ETF Facts, and at least annually.

The Effective Date also coincides with the effective date for the filing requirement for the initial ETF Facts. As of the Effective Date, an ETF that files a preliminary or pro forma prospectus must concurrently file an ETF Facts for each class or series of securities of the ETF offered under the prospectus and post the ETF Facts to the ETF's or ETF manager's website.{3}

Local Matters

Annex E to this Notice is being published in any local jurisdiction that is making related changes to local securities legislation, including local notices or other policy instruments in that jurisdiction. It also includes any additional information that is relevant to that jurisdiction only.

Some jurisdictions may require amendments to local securities legislation, in order to implement the Amendments. If statutory amendments are necessary in a jurisdiction, these changes will be initiated and published by the local provincial or territorial government.

Unpublished Materials

In developing the Amendments, we have not relied on any significant unpublished study, report or other written materials.

Content of the Annexes

The text of the Amendments is contained in the following annexes to this Notice and is available on the websites of members of the CSA:

Annex A

--

Summary of Public Comments on the 2015 Proposal

Annex B

--

Amendments to National Instrument 81-102 Investment Funds

Annex C

--

Amendments to National Instrument 81-101 Mutual Fund Prospectus Disclosure

Annex D

--

Changes to Companion Policy 81-101CP to National Instrument 81-101 Mutual Fund Prospectus Disclosure

Annex E

--

Local Matters

Questions

Please refer your questions to any of the following:

Me Chantal Leclerc, Project LeadSenior Policy AdvisorInvestment Funds BranchAutorité des marchés financiers514-395-0337, ext. 4463Wayne BridgemanDeputy DirectorCorporate FinanceThe Manitoba Securities Commission204-945-4905Melody ChenSenior Legal CounselCorporate FinanceBritish Columbia Securities Commission604-899-6530George HungerfordSenior Legal CounselLegal Services, Corporate FinanceBritish Columbia Securities Commission604-899-6690Irene LeeSenior Legal CounselInvestment Funds and Structured Products BranchOntario Securities Commission416-593-3668Danielle MayhewLegal CounselCorporate FinanceAlberta Securities Commission403-592-3059Viraf NaniaSenior AccountantInvestment Funds andStructured Products BranchOntario Securities Commission416-593-8267Michael WongSecurities AnalystCorporate FinanceBritish Columbia Securities Commission604-899-6852Dennis YanchusSenior EconomistStrategy and Operations -- Economic AnalysisOntario Securities Commission416-593-8095Abid ZamanAccountantInvestment Funds and Structured Products BranchOntario Securities Commission416-204-4955

{1} As published on December 8, 2016 "Mandating a Summary Disclosure Document for Exchange-Traded Mutual Funds and its Delivery -- CSA Notice of Amendments to National Instrument 41-101 General Prospectus Requirements and to Companion Policy 41-101CP to National Instrument 41-101 General Prospectus Requirements and Related Consequential Amendments".

{2} See footnote 1.

{3} See footnote 1.

ANNEX A

SUMMARY OF PUBLIC COMMENTS AND CSA RESPONSES ON CSA NOTICE AND REQUEST FOR COMMENT CSA MUTUAL FUND RISK CLASSIFICATION METHODOLOGY FOR USE IN FUND FACTS AND ETF FACTS PROPOSED AMENDMENTS TO NATIONAL INSTRUMENT 81-102 INVESTMENT FUNDS AND RELATED CONSEQUENTIAL AMENDMENTS (DECEMBER 10, 2015)

|

Table of Contents |

|

|

|

|

|

PART |

TITLE |

|

|

|

|

Part I |

Background |

|

|

|

|

Part II |

General Comments |

|

|

|

|

Part III |

Comments on the 2015 Proposal |

|

|

|

|

Part IV |

Comments on Transition |

|

|

|

|

Part V |

Other Comments |

|

|

|

|

Part VI |

List of Commenters |

- - - - - - - - - - - - - - - - - - - -

Part I -- Background

Summary of Comments

On December 10, 2015, the Canadian Securities Administrators (the CSA or we) published for comment proposed amendments (the Proposed Amendments or the 2015 Proposal) to National Instrument 81-102 Investment Funds (NI 81-102) and related consequential amendments to National Instrument 81-101 Mutual Fund Prospectus Disclosure, National Instrument 41-101 General Prospectus Requirements, Companion Policy to National Instrument 81-101 Mutual Fund Prospectus Disclosure and Companion Policy to National Instrument 41-101 General Prospectus Requirements, to implement the CSA Mutual Fund Risk Classification Methodology for Use in Fund Facts and ETF Facts (the Proposed Methodology).

The comment period expired on March 9, 2016. We received 26 comment letters and the commenters are listed in Part VI. This document only contains a summary of the comments received on the Proposed Methodology and the CSA's responses. We received comments on disclosure items in the Fund Facts, but we are not considering any additional disclosure items at this time. We also received comments on the application of the Proposed Methodology to alternative funds but the Proposed Amendments only contemplate the application of the Proposed Methodology to conventional mutual funds and exchange-traded mutual funds.

We have considered the comments we received and in response to the comments, we have made some amendments (the Methodology) to the Proposed Methodology.

We thank everyone who took the time to prepare and submit comment letters.

- - - - - - - - - - - - - - - - - - - -

|

Part II -- General Comments |

||

|

|

||

|

<<Issue>> |

<<Comments>> |

<<Responses>> |

|

|

||

|

General Support for the Proposed Methodology |

Commenters expressed broad support for a standardized risk classification methodology. They were supportive of providing greater transparency and consistency to allow investors to compare the investment risk levels of different mutual funds more readily. |

We thank all commenters for their feedback. |

|

|

||

|

|

|

We are proceeding with the final publiction of the Methodology with amendments to implement the Methodology for use by conventional mutual funds in the Fund Facts and exchange-traded mutual funds (ETFs, together with conventional mutual funds, mutual funds) in the ETF Facts.{1} |

{1} See Mandating a Summary Disclosure Document for Exchange-Traded Mutual Funds and its Delivery, CSA Notice of Amendments to National Instrument 41-101 General Prospectus Requirements and to Companion Policy 41-101CP to National Instrument 41-101 General Prospectus Requirements and Related Consequential Amendments as published on December 8, 2016.

|

Part III -- Comments on the 2015 Proposal |

|||||

|

|

|||||

|

<<Issue>> |

<<Comments>> |

<<Responses>> |

|||

|

|

|||||

|

1. |

Application to ETFs |

Many industry commenters, industry associations and investor advocates expressed support for extending the application of the Proposed Methodology to the ETF Facts. |

We thank the commenters for their support. Through the analysis it conducted, the CSA concluded that the Proposed Methodology can be applied to all mutual funds whether conventional or exchange-traded. We think that a standardized risk classification methodology for all mutual funds provides for greater transparency and consistency, which will allow investors to more readily compare mutual funds. |

||

|

|

|||||

|

|

|

One industry association commented that standard deviation for ETFs should be calculated with returns based on the net asset value (NAV), which would be consistent with performance reporting and continuous disclosure requirements. Few ETFs would have a different investment risk level calculated with returns based on market price. |

We agree with the commenter and are proposing that an ETF's standard deviation should be calculated with reference to the NAV rather than market value to ensure consistency with performance reporting and continuous disclosure requirements across mutual funds. |

||

|

|

|||||

|

|

|

One investor advocate indicated that it would not be appropriate to apply the Proposed Methodology to inverse and leveraged ETFs as they have risks that will not be captured by volatility. |

We respectfully disagree with the commenter. We continue to be of the view that the Proposed Methodology works well for a range of investment strategies, including inverse and leveraged ETFs. Our research indicates that inverse and leveraged ETFs have historically had very high standard deviation values and would, therefore, have a High risk rating under the Proposed Methodology. |

||

|

|

|||||

|

2. |

Application to Conventional Mutual Funds |

Some commenters suggested that it would not be appropriate to apply the Proposed Methodology to determine the investment risk levels of certain types of mutual funds. |

|

|

|

|

|

|||||

|

|

|

<<Target Date Funds>> -- Some investor advocates and one industry association suggested that the Proposed Methodology should be modified for target date funds to reflect the fact that volatility changes over time. |

In developing the Proposed Methodology, we performed an analysis of the shift in volatility profile of target date funds over their life. We noted that while the volatility of target date funds lowered as they approached their maturity date, the shift in volatility was relatively small. The vast majority of target date funds will remain in the same risk band over the course of their existence even with the lowering of the volatility and the small minority that do shift, will not shift by more than one risk band. As such, we do not believe that any modifications are required to the Proposed Methodology for target date funds. |

||

|

|

|||||

|

|

|

<<Fixed Income Funds>> -- One industry association commented that it is inappropriate to use historic standard deviation to determine the investment risk level of fixed income funds because the factors affecting risk are forward looking, i.e. time to maturity of the underlying bonds and stability of interest rates. The commenter also suggested that the price of long term bonds tend to be more volatile than short term bonds and a bond's interest rate risk decreases every year it moves closer to maturity. The commenter suggested that duration is a better measure of a bond's price sensitivity to changes in interest rates and, therefore, is a more appropriate risk measure for fixed income funds. |

The Proposed Methodology is based on historical volatility and not on future projections of any risk attributes. One of the primary purposes of introducing the Proposed Methodology was to address stakeholder concerns regarding the lack of consistency in the way risk for mutual funds was being assessed. A forward looking measure or a methodology based on future projections of risk could result in widely varying projections for the same asset class from one fund manager to another. Therefore, to ensure consistency of risk disclosure, we chose historical volatility as an appropriate risk measure. We are of the view that the Proposed Methodology can be used to determine the investment risk level for all mutual funds, including fixed income funds. The Proposed Methodology allows for the use of discretion to classify a mutual fund at a higher investment risk level should the fund manager deem that appropriate. |

||

|

|

|||||

|

|

|

<<Precious Metals Funds>> -- One commenter was of the view that standard deviation may not be the correct measure of risk for precious metals funds. The commenter was of the view that volatility is not an appropriate measure of risk because gold has intrinsic value and provides protection against falling equity prices and has low historical correlation to other asset classes and is an alternative holding for overall wealth protection. |

We respectfully disagree with the commenter. We reiterate that we are of the view that the Proposed Methodology can be used to determine the investment risk level for all mutual funds, including precious metal funds. The risk rating in the summary disclosure document is meant to provide the volatility risk of a particular series or class of a fund and is not meant to measure the contribution of that fund towards diversification within a portfolio. |

||

|

|

|||||

|

|

|

<<Fund of Funds and Model Portfolios>> -- One industry association suggested that fund of funds and model portfolios should provide a separate Fund Facts to summarize the risk profile of the underlying funds as a weighted percentage composition. |

For model portfolios, investors invest in each fund in a model portfolio. Accordingly, the investor is delivered the Fund Facts for each of the funds in the model portfolio which sets out the risk ratings for each of those funds. |

||

|

|

|

|

For a fund of funds, investors invest in the top fund. It would be misleading to represent the risk of a fund of funds as a weighted average of the risk of the underlying funds. |

||

|

|

|||||

|

|

|

<<Currency Hedged Series>> -- One investor advocate suggested that currency hedged series of a fund should have a separate investment risk level. |

The Proposed Methodology requires that the investment risk level of a mutual fund be determined by using the oldest series of the mutual fund, unless the oldest series has an attribute that results in a different investment risk level for the series. As such, the investment risk level of currency hedged series of a mutual fund should be determined separately if it is materially different from the oldest series of the mutual fund. |

||

|

|

|||||

|

3. |

Standard Deviation |

A number of industry commenters and industry associations expressed support for the use of standard deviation in the Proposed Methodology. Many industry commenters confirmed that they currently use the standard deviation methodology developed by the Investment Funds Institute of Canada (IFIC) (IFIC Methodology). |

We thank the commenters for their feedback. |

||

|

|

|||||

|

|

|

One industry association commented that while standard deviation is an informative measure, it is not a complete measure of risk and can mask risks arising from complexity of a mutual fund. For example, a short term fixed income fund or ETF can have very low historical volatility but may be quite risky due to the complexity of its underlying investments and very asymmetric risk profiles in the event of a credit event, liquidity issues or interest rate shock. |

Before accepting standard deviation as the preferred risk indicator, the CSA conducted a thorough study of 14 other indicators. This included an assessment of tail risk indicators such as Value at Risk (VaR) and Conditional Value at Risk (CVaR). Our analysis revealed that these tail risk measures had a high correlation with standard deviation. We found that standard deviation tended to underestimate risk relative to VaR in only a small minority of instances (a maximum of 3% of fund series in any given period, and typically less than 1% of fund series in any given period) and in such instances the funds were typically already classified as Medium to High or High risk. Considering the limits regarding data availability for funds and the amount of data required to calculate tail risk measures accurately and given the high correlation between these measures and standard deviation, we have concluded that standard deviation is the most appropriate risk indicator for the purposes of the Proposed Methodology. |

||

|

|

|||||

|

|

|

The same commenter also noted that past performance is not an indicator of future performance, but using standard deviation of past returns is an implicit endorsement of the use of past returns in an investor's evaluation of their risk and return goals. |

Under the "How risky is it?" section, the Fund Facts clearly acknowledges that the mutual fund's rating is based on how much the mutual fund's returns have changed from year to year and that the indicated rating does not provide the future volatility of the mutual fund. Investors are referred to the simplified prospectus for more information on the mutual fund's risks. |

||

|

|

|||||

|

|

|

One industry association and some investor advocates told us that because many risks are not captured by volatility, standard deviation could potentially be misleading to investors. |

Standard deviation is a good general measure of risk that can be applied to funds with widely varying investment mandates. Standard deviation can adequately capture many types of risk that have affected funds historically. As a measure of volatility, we think that standard deviation is not misleading to investors. We note that the Committee of European Regulators (CESR){2} and IFIC both adopted standard deviation for their methodologies. |

||

|

|

|||||

|

|

|

Some investor advocates were of the view that volatility is not understood by investors. Some investor advocates and one industry commenter told us that standard deviation is a measure of market fluctuation and investors are concerned with the risk of loss of capital, not market fluctuation. The investor advocates expressed concern that a mutual fund with no market fluctuation would be considered no risk which would provide false sense of security to investors. They told us that volatility itself is not risk, it is a weak proxy for risk and it does not show downside risk. |

The Fund Facts and the proposed ETF Facts provide a plain language explanation of what volatility means. The explanation indicates that money can be lost by a mutual fund even though it has a low risk rating. This language has tested well with investors in document testing conducted in other workstreams of the POS project. |

||

|

|

|

|

It is important to note that we have retained standard deviation for a number of reasons: |

||

|

|

|||||

|

|

|

|

|

1. |

It has a high correlation with many downside risk oriented metrics. |

|

|

|||||

|

|

|

|

|

2. |

Many mutual funds have limited history and often close or merge shortly after a tail event, thus we question how accurate many tail risk measures can actually be in practice. Therefore, we see value in the inclusion of upside volatility as we believe it is telling the investor something about the downside risk. |

|

|

|||||

|

|

|

|

|

3. |

We question how useful it is to base an investment decision or to compare investment products based on one data point such as minimum return or maximum drawdown given that these extreme events are hard to measure accurately (they are typically measured in practice only by realized loss which is inappropriate). |

|

|

|||||

|

|

|

|

|

4. |

The Fund Facts already includes disclosure of a loss metric: the worst 3-month period return. |

|

|

|||||

|

|

|

One investor advocate suggested showing the mean along with the standard deviation. The commenter also suggested using VaR because it quantifies the extent of a loss of an investment with a given level of confidence over a period of time. |

As mentioned in our previous consultation, the CSA are of the view that adding another risk indicator would complicate things without providing much in terms of information to investors. In performing our analysis of risk indicators, we looked at conventional mutual fund, index and ETF data from 1985 to 2013 both in Canada and in some cases, in other markets. We noted that if VaR, as an example, indicated high risk for a particular fund, standard deviation would have a similar higher risk indication. In only a small minority of instances (less than 3%) did standard deviation tend to underestimate risk relative to other tail risk indicators such as VaR. In such instances, these funds tended to already be classified in the Medium to High or High risk category based on the standard deviation calculation. We, therefore, concluded that standard deviation did as good a job as any other indicator while the additional complexity and regulatory burden associated with adding a secondary indicator was not justified. |

||

|

|

|||||

|

|

|

|

We found that standard deviation calculated over a 10 year period is a very stable and meaningful indicator. |

||

|

|

|||||

|

|

|

|

We do not believe that showing the mean along with the standard deviation would be useful for or well understood by the majority of investors. |

||

|

|

|||||

|

|

|

A number of investor advocates told us that standard deviation assumes a normal distribution curve and does not address how mutual funds behave in extreme market conditions. They asked the CSA to consider warning investors that not all mutual funds have a normal distribution curve and market conditions can change suddenly and increase volatility unexpectedly. |

The amount of data and complexity of the modelling required to accurately forecast how funds will behave in extreme market events is prohibitive. The presence of non-normality by itself does not necessarily imply that standard deviation is incorrect to use as a measure of relative risk, particularly when the data suggests that the use of alternative risk measures does not materially alter the risk ratings. Standard deviation can adequately convey risk, given the disclosure provided in the risk section of the Fund Facts and ETF Facts. |

||

|

|

|||||

|

4. |

Risk Scale |

Several industry commenters agreed with the decision to keep the five-category risk scale currently prescribed in the Fund Facts. |

We thank the commenters for their feedback. |

||

|

|

|||||

|

|

|

Some investor advocates told us that the risk scale should be 6 or 7 categories to prevent clustering of investment risk levels and to allow for more differentiation. |

Since the implementation of the Fund Facts, a five-category risk scale has been adopted by the CSA and used by the industry. |

||

|

|

|||||

|

|

|

|

While a six or seven category risk scale would provide for more differentiation of asset classes across risk bands, we acknowledged stakeholder feedback regarding costs for industry, and ultimately, for investors in adopting such a change. As such, we decided to retain the current five-band risk scale used in the Fund Facts and the proposed ETF Facts to avoid unnecessary reclassification of mutual funds. |

||

|

|

|

One industry commenter commented that the five-category risk scale has not been tested with investors and investors cannot meaningfully interpret it. The commenter, along with some investor advocates, suggested that the calculated standard deviation number should be shown on the five-category scale to allow investors to make their own interpretation. Some other investor advocates suggested that the risk scale should not use words but use numbers instead so the investor's representative can explain it in plain language. |

The five-category risk scale in the Fund Facts and in the ETF Facts model was well received by investors in earlier stages of the POS project. |

||

|

|

|||||

|

|

|||||

|

|

|

One industry commenter told us that a risk scale does not communicate the concept of loss and recovery to investors. Some commenters suggested showing recovery time while some investor advocates suggested showing maximum drawdown and the best and worst performance periods instead of using the risk scale. |

The concept of loss and recovery time has not been retained by the CSA for a number of reasons. Inception date bias is a significant problem for metrics such as maximum drawdown and time to recovery, and unlike standard deviation, the accuracy of these metrics is not improved by the use of benchmark data. |

||

|

|

|||||

|

|

|

|

However, under the "How has the fund performed?" section of the Fund Facts a table already shows the concept of loss in the best and worst returns in a 3-month period over the last 10 years. |

||

|

|

|||||

|

5. |

Frequency of Determining Investment Risk Level |

Some industry commenters and industry associations agreed that the investment risk level of mutual funds should be determined with each filing of the Fund Facts or ETF Facts, as applicable, and at least annually. |

We thank the commenters for their feedback. |

||

|

|

|||||

|

|

|

One investor advocate suggested that the CSA provide guidance as to when it would be appropriate to review each mutual fund's investment risk level more frequently than annually. |

We indicate in the Proposed Methodology that the investment risk level should be determined again whenever it is no longer reasonable in the circumstances. It is the fund manager's responsibility to determine if there is a change in circumstances that would trigger a review of the mutual fund's investment risk level. |

||

|

|

|||||

|

6. |

Use of Discretion |

Some industry commenters and industry associations told us that fund managers should be allowed to use discretion to both decrease and increase the investment risk level of a mutual fund given the fund manager's statutory duty to act in the best interests of the mutual fund. Some fund managers may want to decrease the investment risk level of a mutual fund derived from the standard deviation calculation to avoid unnecessary disruption and confusion to investors due to general market conditions and market volatility fluctuations, or where a mutual fund is on the cusp of, or fluctuates between, two standard deviation ranges. |

The CSA recognize that circumstances could give rise to the need for consideration of qualitative factors in addition to the quantitative calculation in determining the investment risk level of mutual funds. Therefore, the Proposed Methodology allows the use of discretion to classify a mutual fund at a higher investment risk level than that indicated by the quantitative calculation. |

||

|

|

|||||

|

|

|

One industry commenter and an industry association asked for clarification on when it would be "reasonable in the circumstances" to exercise discretion under the Proposed Methodology. |

While we acknowledge that the fund manager should have the knowledge and expertise to weigh all risk factors, objectively, it is important in order to maintain consistency in the disclosure across funds that a minimum risk disclosure, as determined by the 10 year standard deviation, be established. In the feedback to CSA Notice 81-324 and Request for Comment Proposed CSA Mutual Fund Risk Classification Methodology for Use in Fund Facts (2013 Proposal), we were told that the fund manager will be able to determine when it is reasonable in the circumstances to use discretion to increase the fund's investment risk level based on its knowledge and experience. |

||

|

|

|||||

|

|

|

Two industry associations suggested that the use of discretion should be disclosed in the description of the reference index in the management report of fund performance (MRFP) and one industry commenter suggested that it be disclosed in the Fund Facts. One investor advocate noted that a fund manager's use of discretion without an explanation gives investors no information about material qualitative risks. |

The ability to use discretion to increase the investment risk level of a mutual fund is part of the Proposed Methodology. Under the Proposed Methodology, a mutual fund must keep and maintain records if its investment risk level was increased including why it was reasonable to do so under the circumstances. |

||

|

|

|||||

|

7. |

10 Years of History |

While two industry commenters and one investor advocate supported using 10 years of history in the Proposed Methodology, other investor advocates commented that 10 years of history is too long as most funds do not have 10 years of history. Another industry commenter also suggested using a five year period. Similarly, one industry association noted that the CESR. methodology for UCITS funds uses 5 years of history. |

The CSA conducted extensive analysis while reviewing various time periods: three, five, seven and ten years and for the calculation of the standard deviation the CSA chose the 10-year history period as it provides a reasonable balance between indicator stability and data availability. In regard to shorter time periods (three, five and seven years) we note that shorter time periods cause frequent changes in the investment risk level for a number of mutual funds. We also note that a 10-year time period typically tends to catch at least one, if not more, downturns in economic and/or financial markets. |

||

|

|

|||||

|

|

|

An industry commenter suggested that the time period used for the Proposed Methodology should be as of the most recently completed calendar year so that it would be consistent with the time period for the year by year returns in the Fund Facts. This would allow for the investment risk level for all Fund Facts in a given year to be based on the same 10 year period. |

We think that using the calendar year would not properly reflect the standard deviation for mutual funds that have a prospectus renewal in the third quarter, for instance, as several months would not be reckoned with in calculating the standard deviation. Except for the year-by-year returns section, the determination of the investment risk level and of all other information items in the Fund Facts or the proposed ETF Facts must be made as at the end of the period that ends within 60 days before the date of the Fund Fact or the proposed ETF Facts. |

||

|

|

|||||

|

8. |

Reference Index |

<<Use of a Reference Index>> |

|

|

|

|

|

|||||

|

|

|

Some industry commenters expressed support for the use of a reference index to be used a proxy for a mutual fund with less than 10 years of history for the purpose of determining its investment risk level. |

We thank the commenters for their feedback. |

||

|

|

|||||

|

|

|

One industry commenter expressed concern that the earlier version of the Proposed Methodology published on December 12, 2013 by the CSA in the 2013 Proposal allowed the use of actual fund returns to the extent available and to backfill the missing data with the reference index returns, however, the Proposed Methodology did not. |

The Proposed Methodology has been revised to clarify that if a mutual fund has less than 10 years of history, then the mutual fund must select a reference index to use as a proxy to impute the return history for the remainder of the 10-year period. |

||

|

|

|||||

|

|

|

One industry commenter and some investor advocates suggested using only actual returns for a mutual fund with less than 10 years of history as it would be misleading to use reference index returns to determine its investment risk level. One investor advocate suggested showing both the actual returns and reference index returns separately. |

The Proposed Methodology requires the selection of a reference index that reasonably approximates the volatility and risk profile of the mutual fund. The Proposed Methodology also sets out criteria for selecting and monitoring the appropriateness of the reference index. We respectfully disagree that the use of a reference index would be misleading as the reference index only acts as a proxy for missing data in determining the investment risk level of the mutual fund. We are of the view that it would be more misleading to introduce significant inception date bias were we to use only the available return histories. |

||

|

|

|||||

|

|

|

|

As the reference index must reasonably approximate the standard deviation of the mutual fund, showing the actual returns and reference index returns separately does not seem to be necessary and may be misleading for investors. |

||

|

|

|||||

|

|

|

Two investor advocates suggested using actual data from the relevant Canadian Investment Funds Standards Committee (CIFSC) category to backfill missing data for funds with less than 10 years of history. |

We are of the view that the criteria for selecting a reference index in accordance with the Methodology means that a reference index will reasonably approximate the volatility and risk profile of the mutual fund which makes it a better proxy for missing data than general CIFSC category benchmarks assigned by data providers or an industry association. |

||

|

|

|||||

|

|

|

Another suggestion from an industry commenter was to use a single universal benchmark index for all the funds rather than use reference indices. This commenter also suggested providing a range of standard deviation for asset classes for comparison. |

A single universal reference index would not be appropriate for all mutual funds due to their distinctive risk profile and investment objectives. Additional disclosure in the Fund Facts, such as providing a range of standard deviations for various asset classes for comparison would, in our view, make the Fund Facts and ETF Facts more difficult to use for the average investor. |

||

|

|

|||||

|

|

|

One investor advocate expressed concern that using a reference index means an investor cannot determine if a fund manager's active management style adds volatility to a mutual fund or if it is a function of the reference index selected. The same commenter also suggested that a reference index will likely exhibit survivorship bias and inflate the investment risk level of a mutual fund. |

The Methodology provides specific guidance and requirements that must be met in selecting and monitoring a reference index so that it reasonably approximates the standard deviation of the mutual fund. The fund manager may also contemplate factors other than the ones identified in the Methodology in selecting a reference index if the fund manager considers them relevant to the specific characteristics of the mutual fund. |

||

|

|

|||||

|

|

|

<<Reference Index Selection Principles>> |

|

|

|

|

|

|||||

|

|

|

A few industry commenters and one industry association asked for further guidance to clarify what is expected in adhering to the principles, i.e. whether all the principles for reference fund selection need to be followed or whether they are only examples of principles to be considered. |

We have revised the commentary in Item 5 of Annex F -- Investment Risk Classification Methodology, NI 81-102 to indicate that a mutual fund must consider each of the factors listed in Instruction (2) of Item 5 when selecting and monitoring the reasonableness of a reference index. We also indicated that a mutual fund may consider other factors as appropriate in selecting and monitoring the reasonableness of a reference index. We acknowledge that a reference index that reasonably approximates the standard deviation of the mutual fund may not necessarily meet all of the factors in Instruction (2) of Item 5. |

||

|

|

|||||

|

|

|

Some industry associations and industry commenters told us that it would be difficult to meet all the principles for reference fund selection and that flexibility should be given to source an appropriate risk proxy. |

The factors that a mutual fund should consider in selecting and monitoring the reasonableness of a reference index have been revised. We are of the view that an appropriate reference index can be selected in accordance with the revised factors. |

||

|

|

|||||

|

|

|

One industry association commented that the reference indices available do not take into account certain investment strategies permitted in NI 81-102, e.g. short selling and use of derivatives. If an appropriate reference index cannot be sourced, one industry commenter told us that a reference index will need to be created but index creation involves significant costs and in some instances, it will not even be possible to create an appropriate reference index. |

Based on the feedback provided, we have made revisions to the Instructions to Item 5, Annex F -- Investment Risk Classification Methodology, NI 81-102, for selecting and monitoring an appropriate reference index for funds with less than 10 years of history. |

||

|

|

|||||

|

|

|

|

As indicated in the commentary, while all factors listed in the Instructions to Item 5, Annex F -- Investment Risk Classification Methodology, NI 81-102 when determining the reasonableness of a reference index must be considered, a reference index that reasonably approximates or is expected to reasonably approximate, the standard deviation of a mutual fund may not necessarily meet all the factors. |

||

|

|

|||||

|

|

|

A number of commenters asked for clarification regarding the principles for selecting an appropriate reference index for funds with less than 10 years of history. Commenters provided comments on the following principles set out in Proposed Amendments to Instruction (1), Item 4, Appendix F, NI 81-102: |

|

|

|

|

|

|||||

|

|

|

• Instruction (1)(a): "is made up of one or a composite of several market indices that best reflect the returns and volatility of the mutual funds and the portfolio of the mutual fund" -- One industry commenter asked for CSA guidance on the meaning of "best reflect the returns and volatility" and did not understand the distinction between the fund and its portfolio. |

This is now Instruction (1) and we have revised it to: A reference index must be made up of one permitted index, or where necessary, to more reasonably approximate the standard deviation of a mutual fund, a composite of several permitted indices.". |

||

|

|

|||||

|

|

|

• Instruction (1)(b): "has returns highly correlated to the returns of the mutual fund" -- A few commenters asked for clarification on the meaning of "highly correlated". Another industry commenter was of the view that returns that are highly correlated do not mean volatility between the mutual fund and the reference index are highly correlated. |

This is now Instruction 2(b) and we have revised it to: "has returns, or is expected to have returns, highly correlated to the returns of the mutual fund." The phrase "is expected to have returns" has been added in response to feedback about new or young mutual funds that do not have performance history. The phrase "highly correlated to the returns of the mutual fund" means that the reference index has returns that are closely linked to the returns of the mutual fund and will likely result in highly correlated returns of the reference index. |

||

|

|

|||||

|

|

|

One industry association and some industry commenters told us that new or young mutual funds do not have the performance history from which to calculate correlation and there are also some mutual funds that do not have a high correlation to a reference index. One commenter suggested adding the language "expected to be" for new and young mutual funds. |

|

|

|

|

|

|||||

|

|

|

• Instruction (1)(c): "contains a high proportion of the securities represented in the mutual fund's portfolio with similar portfolio allocations" -- One industry association and some industry commenters told us that new funds or funds that do not have a high correlation to a reference index such as a fund with an innovative strategy or is actively managed would not be able to meet this principle. |

This is now Instruction 2(a) and we have revised it to: "contains a high proportion of securities represented, or is expected to be represented, in the mutual fund's portfolio". The phrase "is expected to be represented" has been added in response to feedback about new or young mutual funds that do not have performance history. For actively managed mutual funds, or mutual funds with an innovative strategy, we note that a reference index can be made up of a composite of several permitted indices. |

||

|

|

|||||

|

|

|

Another industry commenter was of the view that a reference index that best represents a mutual fund's volatility may not necessarily contain a high proportion of securities represented in the mutual fund's portfolio. Other commenters told us that if the principle means the mutual fund has to have a low active share relative to a particular reference index, then some mutual funds that do not have an appropriate active share ratio will not be able to meet this principle. |

|

|

|

|

|

|||||

|

|

|

Another industry commenter told us that this principle would require index constituent data that may not be readily available, may be expensive to obtain and difficult to obtain where a blend of indices is selected as the reference index. |

|

|

|

|

|

|||||

|

|

|

These commenters suggest removal of this principle. |

|

|

|

|

|

|||||

|

|

|

• Instruction (1)(d): "has a historical systemic risk profile highly similar to the mutual fund" -- One industry commenter asked for clarification on the meaning of "similar". One industry commenter told us that new funds or funds that do not have a high correlation to a reference index will not meet this principle. Another industry commenter and one industry association told us this principle is a problem for actively managed funds because it may not be possible to come in the "beta" range and asked for guidance as to the appropriate period to measure beta. Alternatively, others commenters suggest removal of this principle. |

This is now Instruction 2(c) and we have revised it to: "has risk and return characteristics that are, or expected to be, similar to the mutual fund". The term "similar" means that the reference index has a historical systemic risk profile that is close to the historical systemic risk profile of the mutual fund. The phrase "expected to be" has been added in response to feedback about new or young mutual funds that do not have performance history. For actively managed mutual funds, we note that a reference index can be made up of a composite of several permitted indices. |

||

|

|

|||||

|

|

|

• Instruction (1)(e): "reflects the market sectors in which the mutual fund is investing" -- One industry commenter noted that actively managed funds would have difficulty meeting this principle and even if new reference indices need to be created, it is not clear if this would be possible. This commenter also asked for clarification and specifically, if the principle means all or some of market sectors in the mutual fund should be included in the reference index and vice versa. |

This is now Instruction 2(e) and we have revised it to: "is consistent with the investment objectives and investment strategies in which the mutual fund is investing". The revision was made in response to comments. |

||

|

|

|||||

|

|

|

• Instruction (1)(f): "has security allocations that represent invested position sizes on a similar pro rata basis to the mutual fund's total assets" -- One industry commenter told us that new funds or funds that do not have a high correlation to a reference index would not be able to meet this principle. For mutual funds with a concentrated portfolio, one industry commenter told us that it would be impossible to find a reference index to meet this principle. Another industry commenter told us that only index funds would be able to comply and suggested removal of this principle. |

This is now Instruction 2(f) and we have revised it to: "has investable constituents, and has security allocations that represent investable position sizes for the mutual fund." By "investible constituents" we mean assets classes in which mutual funds are able to invest in relatively easily. In this regard, the Consumer Price Index, for example, does not have investable constituents that a mutual fund can invest in. |

||

|

|

|||||

|

|

|

|

For mutual funds with a concentrated portfolio, we note that a reference index can be made up of a composite of several permitted indices. There are a large number of narrowly focused indices for most markets and asset classes from a large number of index providers available today. |

||

|

|

|||||

|

|

|

• Instruction (1)(g): "is denominated in, or converted into, the same currency as the mutual fund's reported net asset value" -- One industry commenter supported keeping this principle |

This is now Instruction 2(g) and remains unchanged. |

||

|

|

|||||

|

|

|

• Instruction (1)(h): "has its returns computed on the same basis (e.g. total return, net of withholding taxes, etc.) as the mutual fund's returns" |

Both Instruction (1)(h) and (1)(j) are now combined as Instruction 2(d) and we have revised it to: "has its returns computed (e.g. total return net of withholding taxes, etc.) on the same basis as the mutual fund's returns." |

||

|

|

|

and |

|

|

|

|

|

|

• Instruction (1)(j): "is based on an index or indices that have been adjusted by its index provider to include the reinvestment of all income and capital gains distributions in additional securities of the mutual fund" -- One industry commenter suggested replacing both principles with the requirement to use a reference index that is computed in the same manner as the mutual funds is required to calculate performance, as set forth in s.15.10, NI 81-102. |

|

|

|

|

|

|||||

|

|

|

• Instruction (1)(i): "is based on an index or indices that are each administered by an organization that is not affiliated with the mutual fund, its fund manager, portfolio fund manager or principal distributor, unless the index is widely recognized and used" -- One industry commenter supported keeping this principle. |

This Instruction replicates the definition of "permitted index" in NI 81-102. The term "permitted indices" has been added to Instruction (1) and Instruction (1)(i) has been removed. |

||

|

|

|||||

|

|

|

<<Clone Funds, Corporate Class Fund Versions of Trust Funds>> |

|

|

|

|

|

|||||

|

|

|

Two industry commenters were of the view that the Proposed Methodology should specifically allow top funds that do not have 10 years of history and that meet the definition of "clone fund" in NI 81-102 to use the underlying fund's history without having to seek exemptive relief. |

We agree that mutual funds that do not have 10 years of history and meet the definition of "clone fund" in NI 81-102 should use the underlying fund's performance history to determine its investment risk level without exemptive relief. We have revised the Proposed Methodology so that a mutual fund that is a "clone fund" with less than 10 years' history and that has an underlying fund with at least 10 years' history can impute the return history of the underlying fund for the remainder of the 10-year period. |

||

|

|

|||||

|

|

|

One of the two commenters also suggested that the Proposed Methodology allow a "sister fund" that has 10 years of history to be used as a proxy for a mutual fund with less than 10 years of history. There may be mutual funds offered in Canada that are the same or similar in strategy to funds offered by the same fund manager in other parts of the world under, for example, the UCITS directives in Europe. The UCITS funds are subject to investment restrictions and practices that are substantially similar to those that govern the Canadian mutual funds. If these "sister funds" have the same portfolio fund manager, investment objectives and strategies as the Canadian mutual fund, then the "sister fund" should be allowed to be used a proxy for a mutual fund with less than 10 years of history for the purpose of determining its investment risk level. |

Similarly, we have revised the Proposed Methodology so that mutual funds with less than 10 years' performance history and that have a mutual fund corporate class version or trust version with 10 years of performance history, is subject to NI 81-102, and has the same fund manager, portfolio fund manager, investment objectives and investment strategies as the mutual fund can impute the return history of the other mutual fund for the remainder of the 10-year period. For a mutual fund with less than 10 years' performance history but has a "sister fund" that is not subject to NI 81-102, we may consider allowing, through exemptive relief, the use of the sister fund's performance history for the purposes of determining the investment risk level of the mutual fund. |

||

|

|

|||||

|

|

|

The other commenter also suggested that where there is a trust fund with a corporate class version, the Proposed Methodology should allow a trust fund with 10 years of history to be used as a proxy for a corporate class fund with less than 10 years of history. Otherwise, the investment risk levels of the trust fund, which has actual returns, and corporate class fund, which uses reference index returns, may end up with different investment risk levels despite being identical funds. |

|

|

|

|

|

|||||

|

|

|

<<Multiple Indices>> |

|

|

|

|

|

|||||

|

|

|

One industry commenter asked whether multiple reference indices can be used for one mutual fund where one reference fund is appropriate in one period but another reference fund is more appropriate for another period. The commenter suggested this might occur when either the mutual fund's mandate has changed or the reference index has changed or has less than 10 years of history. |

The Proposed Methodology allows for the use of a composite of several permitted indices. The Proposed Methodology also requires that if the reference index has changed since the last prospectus, the prospectus provides details of when and why the change was made. |

||

|

|

|||||

|

|

|

<<Disclosing Reference Indices>> |

|

|

|

|

|

|||||

|

|

|

Two investor advocates suggested requiring disclosure to indicate when a reference index has been used by a mutual fund to determine its investment risk level. |

The Methodology requires that the prospectus of a mutual fund provides a brief description of the reference index and also requires that if the reference index has changed since the last disclosure, details of when and why the change was made are included. |

||

|

|

|||||

|

|

|

<<MRFP>> |

|

|

|

|

|

|||||

|

|

|

We received a number of comments regarding the reference index and the index that is shown in a mutual fund's MRFP. |

The reference index or indices used in the MRFP of a mutual fund can be used to determine the investment risk level if the reference index is selected in accordance with the Instructions to Item 5, Annex F -- Investment Risk Classification Methodology, NI 81-102. |

||

|

|

|

Two industry commenters suggested that the Proposed Methodology indicate that the index in the MRFP can also be used as the reference index to determine a mutual fund's investment risk level. An investor advocate suggested that this should be a requirement. However, one industry association and an industry commenter noted that given the principles to be adhered to in selecting a reference fund, the index used in the MRFP cannot be used as the reference index for the Proposed Methodology. |

We acknowledge that the index or indices used in the MRFP of a mutual fund may be different than its reference index used to determine its investment risk level under the Proposed Methodology. |

||

|

|

|||||

|

|

|

Another industry commenter noted that sales communications are generally required to be consistent with the simplified prospectus, annual information form and Fund Facts. The commenter expressed concern that for mutual funds with less than 10 years of history, any index used in sales communications would need to be the same as the reference index. Similarly, the reference index disclosed in the simplified prospectus may be different than the index used in the MRFP, which may result in investor confusion. |

For sales communications, the requirements in Part 15, NI 81-102 are required to be followed. We disagree that the use of different indices will result in investor confusion as the purpose for using an index is different for sales communication purposes and for use in the Funds Facts and the proposed ETF Facts. |

||

|

|

|||||

|

9. |

Fundamental Changes |

One industry commenter agreed that where there is a merger, the returns of the continuing fund should be used to determine the investment risk level. |

We thank the commenter for their feedback. |

||

|

|

|||||

|

|

|

Another industry commenter asked that the instructions in the Proposed Methodology be clarified to indicate that where there is a fundamental change, the fund manager must determine if the mutual fund's past performance is relevant and if it is not relevant, a new reference index must be selected. |

The Proposed Methodology sets out that if there has been a reorganization or a transfer of assets pursuant to paragraphs 5.1(1)(f) or (g) or subparagraph 5.1(1)(h)(i) of NI 81-102, the standard deviation must be calculated using the monthly "return on investment" of the continuing mutual fund, as the case may be. If there has been a change in the fundamental investment objectives of a mutual fund pursuant to paragraph 5.1(1)(c) of NI 81-102, the standard deviation must be calculated using the monthly "return on investment" of the mutual fund starting from the date of that change. In the Proposed Methodology, where there has been a fundamental change, the past performance of a mutual fund is not used to calculate the standard deviation. |

||

|

|

|||||

|

10. |

"How risky is it?" in the Fund Facts |

A couple of investor advocates suggested that the section "How risky is it?" in the Fund Facts be changed to "How volatile is it?". |

We do not propose to make any changes to the heading "How risky is it?" in the Fund Facts. The prescribed disclosure under this heading clearly indicates: "One way to gauge risk is to look at how much a fund's return changed over time. This is called "volatility"." |

||

|

|

|||||

|

|

|

One industry association asked that the disclosure under "How risky is it?" in the Fund Facts be changed to indicate that fund managers are now following a prescribed risk classification methodology. |

Currently, the Fund Facts does not require disclosure of the risk classification methodology used by the fund manager to determine the investment risk level of a mutual fund. As all mutual funds will be required to use the Methodology upon implementation, we do not propose requiring such disclosure in the Fund Facts or the proposed ETF Facts. However, a description of the Methodology is required to be disclosed in the prospectus. |

||

|

|

|||||

|

|

|

Some investor advocates suggested that the risk scale in the Fund Facts and ETF Facts should also provide a narrative explanation of the investment risk level and its main limitations and a list of the material risks as required by the International Organization of Securities Commissions' (IOSCO) principle 1 of point of sale disclosure. |

Principle 1 of IOSCO's Principles on Point of Sale Disclosure states: "Key information should include disclosures that inform the investor of the fundamental benefits, risks, terms and costs of the product and the remuneration and conflicts associated with the intermediary through which the product is sold." The IOSCO Principles on Point of Sale Disclosure report published in February 2011 does not mandate how to meet the principles. In fact, the report states that "In some jurisdictions, a scale may be considered appropriate to identify overall risk measurement or classification of the product, rather than a list of specific product risks." |

||

|

|

|||||

|

|

|

|

As part of Stage 2 of the POS project, we tested a list of top risks with investors. The document testing revealed that a majority of investors did not understand the specific risks very clearly or at all. The investors were more likely to ask their representative to explain the specific risks of the fund or to obtain this information from the simplified prospectus, than to try to obtain information about these risks from the Fund Facts. In response to this testing and commenters' concerns, we removed the list of the top risks of the fund in the Fund Facts. The "How risky is it?" section of the Fund Facts and the proposed ETF Facts refers to the mutual fund's prospectus for more information about the risk rating and specific risks that can affect the mutual fund's returns. |

||

|

|

|

Some investor advocates also provided drafting suggestions for the disclosure under this section, such as an explanation of why the mutual fund is in a particular risk category and a statement that the investment risk level is not a measure of capital loss risk, but a measure of past changes of value. One investor advocate suggested that a narrative of the range of expected returns be given for each investment risk level. |

The Fund Facts and the proposed ETF Facts are documents that are written in plain language, are no more than two pages double-sided and are intended to provide investors with key information about mutual funds. The risk section in the Fund Facts and the proposed ETF Facts is intended to provide key information about the investment risk level of a mutual fund. Investors are also encouraged to speak to their representatives for further information about the investment risk level of a mutual fund, and, in particular, how the mutual fund may feature in their own individual risk profile. |

||

|

|

|||||

|

11. |

Amendments |

Some investor advocates commented that the investment risk level of a mutual fund should be promptly updated in the event of a significant change to the mutual fund's risk/reward profile. |

In Commentary (2) to Item 1 of Appendix F -- Investment Risk Classification Methodology, NI 81-102, we have indicated that: "Generally, a change to the mutual fund's investment risk level disclosed on the most recently filed fund facts document or ETF facts document, as applicable, would be a material change under securities legislation in accordance with Part 11 of National Instrument 81-106 Investment Fund Continuous Disclosure." |

||

|

|

|||||

|

|

|

|

In accordance with this National Instrument, when there is a material change the mutual fund must issue a press release and a material change report and must file amendments to its prospectus, annual information form and Fund Facts, as appropriate. |

||

|

|

|||||

|

|

|

Two industry commenters asked for clarification on whether or not the investment risk level of a mutual fund is required to be reviewed at the time of filing of an amendment to the Fund Facts or ETF Facts. |

Under the Methodology, a mutual fund must determine its investment risk level, at least annually. However, as stated in Commentary (1) to Item 1 of Appendix F -- Investment Risk Classification Methodology, NI 81-102: "The investment risk level may be determined more frequently than annually. Generally, the investment risk level must be determined again whenever it is no longer reasonable in the circumstances". |

||

|

|

|||||

|

12. |

Record Retention Period |

A number of industry commenters and one industry association told us they agreed that the current requirement in securities legislation to maintain records for a period of 7 years should apply to the records relating to the Proposed Methodology. |

We agree that 7 years is the appropriate record retention period. |

||

|

|

|||||

|

13. |

Drafting Comments |

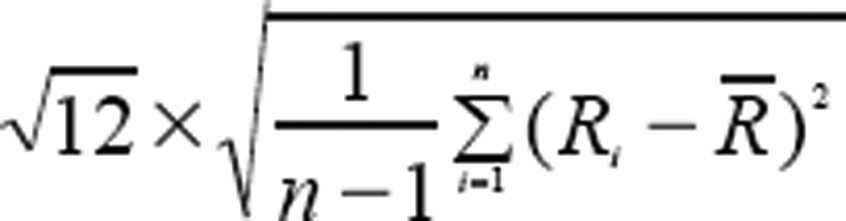

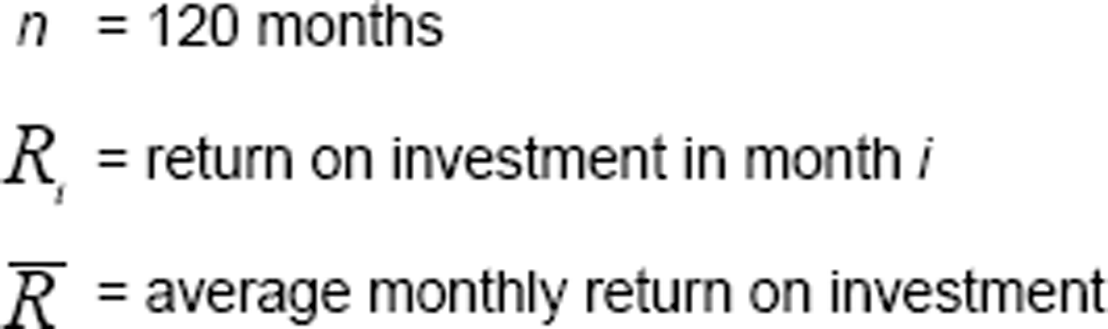

One industry commenter suggested that "annualized" be added before "standard deviation" in the Proposed Methodology as the formula annualizes standard deviation of monthly returns. |

We do not think that adding "annualized" before "standard deviation" in the Proposed Methodology is warranted as the standard deviation formula clearly annualizes standard deviation. |

||

{2} Now, the European Securities and Market Authority (ESMA).

|

Part IV -- Comments on Transition |

||

|

|

||

|

<<Issue>> |

<<Comments>> |

<<Responses>> |

|

|

||

|

Transition |

One industry commenter supported the transition to the Proposed Methodology at the time of the funds' prospectus renewal. |

We thank the commenter for their feedback. |

|

|

||

|

|

A few commenters asked for a longer transition period. One commenter requested six months between the effective date of the Proposed Methodology and a fund's prospectus renewal. Another industry commenter asked for a one year transition period. One industry association asked for at least a one year transition period to test and upgrade systems to generate new risk ratings. This commenter also noted that funds not currently using the IFIC Methodology may have changes to their risk ratings and dealers and advisors would need a separate transition period of two years. |

The CSA is providing a 9-month transition period after final publication of the Methodology. Given that the investment risk level of mutual funds will be determined by the Methodology for each filing of a Fund Facts and ETF Facts after the effective date, this means that fund managers have between 3 months and 15 months to transition, depending on their prospectus renewal date. |

|

|

||

|

|

|

As most fund managers use the IFIC Methodology to determine the investment risk levels of mutual funds, which is also based on standard deviation and the standard deviation ranges in the Proposed Methodology are consistent with the IFIC Methodology, we do not anticipate widespread changes to investment risk levels in the Fund Facts. |

|

|

||

|

|

|

For these reasons, we believe that a 9-month transition period after publication will be sufficient for all mutual funds to implement the Methodology. |

|

|

||

|

|

Two commenters asked for confirmation that the Proposed Methodology applied to the ETF Facts, once introduced, and not to the summary disclosure documents for ETFs required pursuant to exemptive relief. |

The Methodology is not applicable to the summary disclosure documents for ETFs that is required pursuant to currently granted exemptive relief. We confirm that the Methodology will only apply to the ETF Facts upon the coming into force of amendments implementing the ETF Facts. |

|

|

||

|

|

One commenter suggested that the effective date for the Proposed Methodology be a month-end date rather than a mid-month date. |

The effective date for the Proposed Methodology is September 1, 2017. |

|

Part V -- Other Comments |

||

|

|

||

|

<<Issue>> |

<<Comments>> |

<<Responses>> |

|

|

||

|

Annual Review of the Proposed Methodology |

Some industry commenters and investor advocates suggested that the CSA should conduct an annual review of the Proposed Methodology to ensure that it remains meaningful and relevant with market trends, volatility and new innovative products. One industry commenter noted that an annual review is particularly relevant in the absence of allowing fund manager discretion to lower the investment risk level of a fund. |

The CSA will monitor the effectiveness of the Methodology and its application to mutual funds on an ongoing basis. Should any material changes to the Methodology be required, they will be subject to public consultation. |

|

|

||

|

|

Another industry commenter suggested that without a mechanism to review and adjust the standard deviation ranges, the risk levels of funds will be reclassified unnecessarily, causing unnecessary disruption and confusion to investors. |

|

|

|

||

|

|

One industry association asked for confirmation that any future proposed changes to the Proposed Methodology would be subject to the CSA's public comment process. |

|

|

|

||

|

Regulatory and Product Arbitrage |

Two industry commenters encouraged the CSA to work with the insurance and banking regulators so that the Proposed Methodology would apply to competing products such as segregated funds and guaranteed investment certificates. |

We expect that the disclosure for all types of investment products will evolve over time. The scope of our work, however, is limited to investment products that are considered "securities" under securities legislation. |

|

|

||

|

|

|

We understand that the Canadian Council of Insurance Regulators (CCIR) is considering whether the Proposed Methodology would be appropriate for segregated funds and whether it should be adopted by the insurance regulators. CCIR sought specific input in this regard in a consultation paper titled Segregated Funds Working Group Issues Paper, which was published for comment in May 2016. While we meet periodically with CCIR to discuss regulatory issues that affect both mutual funds and segregated funds, to the extent that industry participants are of the view that the Methodology could be applied to segregated funds, we would encourage those commenters to make their views known directly to CCIR. |

|

|

||

|

|

|